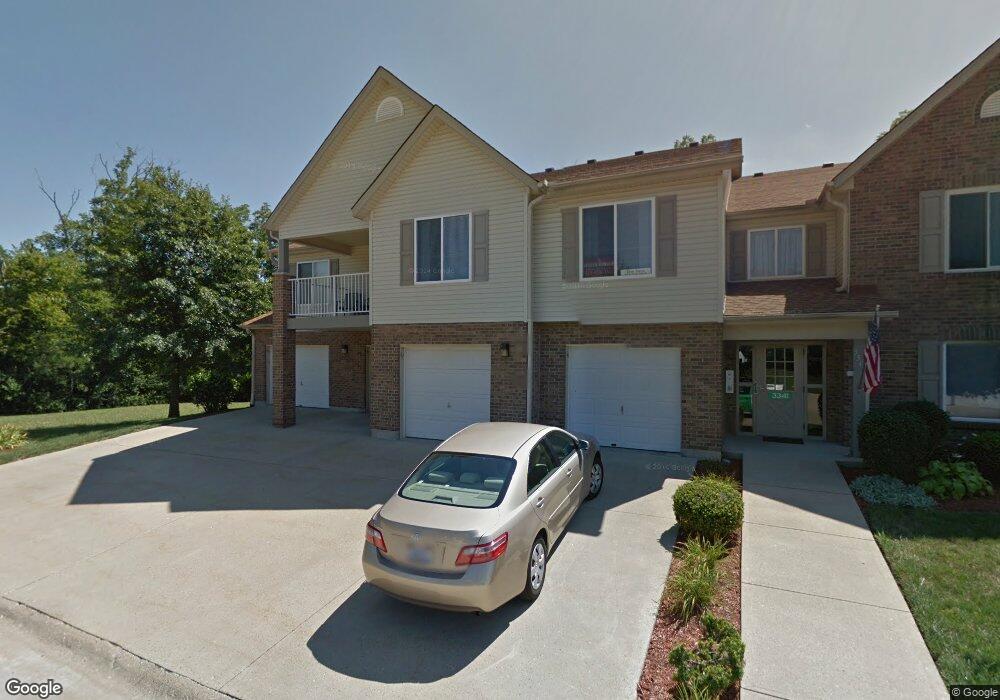

3341 Lindsay Ln Unit 68 Cincinnati, OH 45251

Estimated Value: $150,750 - $191,000

2

Beds

2

Baths

1,204

Sq Ft

$137/Sq Ft

Est. Value

About This Home

This home is located at 3341 Lindsay Ln Unit 68, Cincinnati, OH 45251 and is currently estimated at $164,688, approximately $136 per square foot. 3341 Lindsay Ln Unit 68 is a home located in Hamilton County with nearby schools including Taylor Elementary School, Pleasant Run Elementary School, and Pleasant Run Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 12, 2023

Sold by

Ebert Noel and Ebert Barbara J

Bought by

Polk James A and Polk Beth N

Current Estimated Value

Purchase Details

Closed on

Apr 12, 2003

Sold by

Weingartner Julia L

Bought by

Ebert Noel and Ebert Barbara J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$11,000

Interest Rate

5.71%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Feb 23, 2000

Sold by

Weingartner Julia L

Bought by

Ebert Noel and Ebert Barbara J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$94,000

Interest Rate

7%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Nov 10, 1997

Sold by

Hilsinger Building And Development Corp

Bought by

Weingartner Julia L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,600

Interest Rate

7.43%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Polk James A | $46,350 | None Listed On Document | |

| Polk James A | $46,350 | None Listed On Document | |

| Ebert Noel | $110,000 | -- | |

| Ebert Noel | $94,000 | -- | |

| Weingartner Julia L | $94,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ebert Noel | $11,000 | |

| Previous Owner | Ebert Noel | $88,000 | |

| Previous Owner | Ebert Noel | $94,000 | |

| Previous Owner | Weingartner Julia L | $84,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,409 | $42,903 | $6,650 | $36,253 |

| 2023 | $1,812 | $42,903 | $6,650 | $36,253 |

| 2022 | $1,562 | $32,446 | $3,770 | $28,676 |

| 2021 | $1,541 | $32,446 | $3,770 | $28,676 |

| 2020 | $1,567 | $32,446 | $3,770 | $28,676 |

| 2019 | $1,008 | $22,964 | $3,168 | $19,796 |

| 2018 | $905 | $22,964 | $3,168 | $19,796 |

| 2017 | $853 | $22,964 | $3,168 | $19,796 |

| 2016 | $809 | $22,187 | $3,623 | $18,564 |

| 2015 | $823 | $22,187 | $3,623 | $18,564 |

| 2014 | $825 | $22,187 | $3,623 | $18,564 |

| 2013 | $1,368 | $32,155 | $5,250 | $26,905 |

Source: Public Records

Map

Nearby Homes

- 3151 Birchway Dr Unit 3151

- 9446 Haddington Ct

- 9558 Woodstate Dr Unit 13E

- 9568 Woodstate Dr

- 3464 Sunbury Ln

- 3364 Amberway Ct Unit 45

- 3246 Ainsworth Dr

- 3275 Deshler Dr

- 3463 Amberway Ct

- 3258 Lillwood Ln

- 3276 Deshler Dr

- 3351 Deshler Dr

- 9717 Loralinda Dr

- 3374 Deshler Dr

- 9302 Loralinda Dr

- 3205 Donnybrook Ln

- 3013 Niagara St

- 9828 Loralinda Dr

- 9126 Round Top Rd

- 2908 Libra Ln

- 3341 Lindsay Ln

- 3341 Lindsay Ln

- 3341 Lindsay Ln

- 3341 Lindsay Ln

- 3341 Lindsay Ln

- 3341 Lindsay Ln Unit 67

- 3341 Lindsay Ln Unit 64

- 3341 Lindsay Ln Unit 63

- 3341 Lindsay Ln Unit 65

- 3341 Lindsay Ln Unit 66

- 3345 Lindsay Ln Unit 57

- 3345 Lindsay Ln Unit 60

- 3345 Lindsay Ln

- 3345 Lindsay Ln

- 3345 Lindsay Ln

- 3345 Lindsay Ln

- 3345 Lindsay Ln

- 3345 Lindsay Ln Unit 61

- 3345 Lindsay Ln Unit 59

- 3345 Lindsay Ln Unit 58