33411 N 139th Way Scottsdale, AZ 85262

Estimated Value: $771,762 - $1,030,000

--

Bed

4

Baths

2,937

Sq Ft

$325/Sq Ft

Est. Value

About This Home

This home is located at 33411 N 139th Way, Scottsdale, AZ 85262 and is currently estimated at $954,941, approximately $325 per square foot. 33411 N 139th Way is a home located in Maricopa County with nearby schools including Desert Sun Academy, Sonoran Trails Middle School, and Cactus Shadows High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 20, 2021

Sold by

Caprola Yvonne and Caprola Nicholas B

Bought by

Caprola Yvonne and Caprola Nicholas B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$349,500

Outstanding Balance

$317,325

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$637,616

Purchase Details

Closed on

Apr 6, 2016

Sold by

Caprola Nicholas

Bought by

Caprola Yvonne

Purchase Details

Closed on

Sep 6, 2006

Sold by

Farrar Curtis W and Farrar Kimberly A

Bought by

Caprola Nicholas and Caprola Yvonne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$576,500

Interest Rate

5.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Caprola Yvonne | -- | 20 20 Title Llc | |

| Caprola Yvonne | -- | None Available | |

| Caprola Nicholas | $769,000 | The Talon Group Kierland |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Caprola Yvonne | $349,500 | |

| Previous Owner | Caprola Nicholas | $576,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,720 | $45,495 | -- | -- |

| 2024 | $1,646 | $43,328 | -- | -- |

| 2023 | $1,646 | $60,070 | $12,010 | $48,060 |

| 2022 | $1,613 | $45,570 | $9,110 | $36,460 |

| 2021 | $1,810 | $44,320 | $8,860 | $35,460 |

| 2020 | $1,784 | $40,700 | $8,140 | $32,560 |

| 2019 | $1,730 | $39,050 | $7,810 | $31,240 |

| 2018 | $1,666 | $38,960 | $7,790 | $31,170 |

| 2017 | $1,606 | $37,280 | $7,450 | $29,830 |

| 2016 | $1,597 | $36,780 | $7,350 | $29,430 |

| 2015 | $1,511 | $33,230 | $6,640 | $26,590 |

Source: Public Records

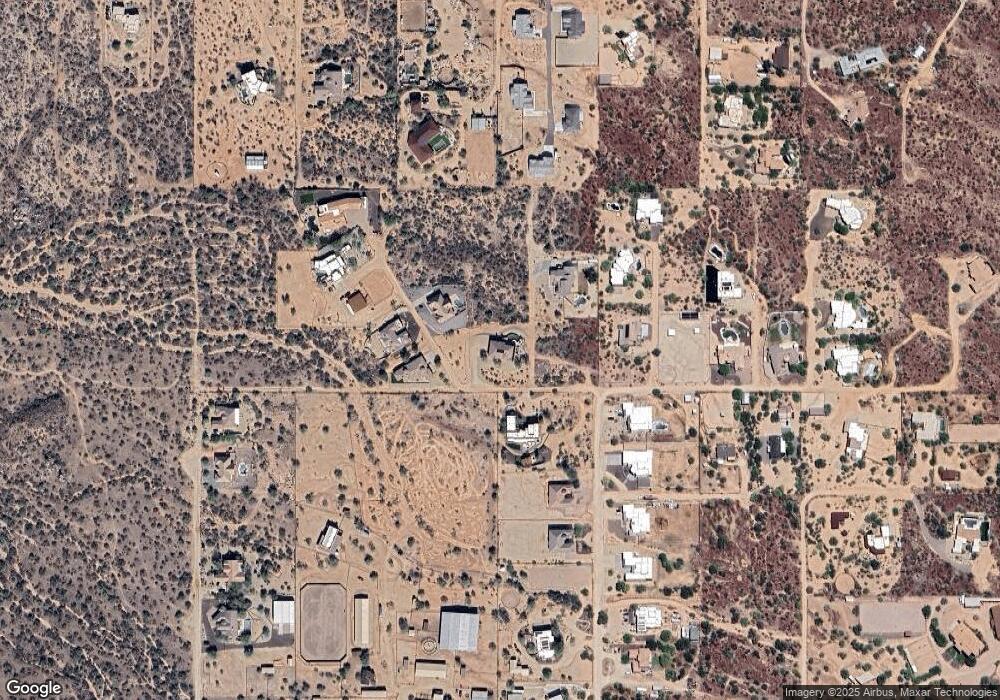

Map

Nearby Homes

- 33719 N 139th Terrace

- 14007 E Westland Rd

- 33710 N 140th Place

- 13750 aprx E Westland Rd

- 33XXX N 141st St

- 138xx E Dove Valley Rd N

- 34000 N 140th Place

- 34515 N 142nd St

- 34514 N 142nd St

- 365XX N 144th St

- 34123 N 140th Place

- 14224 E Rockview Rd

- 34309 N 140th St

- 34310 N 139th Place

- 0 N 139th Place Unit Lot 1 6819148

- 32442 N 142nd St

- 14305 E Carefree Hwy

- 14400 E Carefree Hwy Unit A/B

- 0 E Villa Cassandra Dr Unit 6926409

- 14215 E Calle de Las Estrellas Dr

- 33425 N 139th Way

- 13935 Smokehouse Trail

- 33412 N 139th Place

- 33507 N 139th Terrace

- 33428 N 139th Place Unit 2

- 33428 N 139th Place

- 139xx N 140th Place

- 139xx N 140th Place

- 334xx N 140th Place

- 334xx N 140th Place

- 0 N 140th Place Unit 1 2967982

- 0 N 140th Place Unit 6199596

- 33416 N 140th Place

- 33416 N 140th Place

- 0 E 139th Way Unit 1 2928780

- 33220 N 140th St

- 33420 N 140th St

- 33325 N 140th St

- 3351x N 139 Place Unit 219-36-018N

- 0 E Red Range Way