335 Morgan Ln Gahanna, OH 43230

Estimated Value: $228,000 - $432,000

--

Bed

--

Bath

--

Sq Ft

0.41

Acres

About This Home

This home is located at 335 Morgan Ln, Gahanna, OH 43230 and is currently estimated at $303,333. 335 Morgan Ln is a home located in Franklin County with nearby schools including Chapelfield Elementary School, Gahanna West Middle School, and Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 17, 2024

Sold by

Jeffrey W Henderson Revocable Trust and Lynn M Henderson Revocable Trust

Bought by

Sanfilippo Jennifer Lynn and Sanfilippo Joseph Lee

Current Estimated Value

Purchase Details

Closed on

Apr 1, 2024

Sold by

Jeffrey W Henderson Revocable Trust and Lynn M Henderson Revocable Trust

Bought by

Sanfilippo Jennifer Lynn and Sanfilippo Joseph Lee

Purchase Details

Closed on

Apr 13, 2018

Sold by

Henderson Lynn

Bought by

Henderson Jeffrey W and Henderson Lynn M

Purchase Details

Closed on

Dec 24, 2009

Sold by

Dooley Susan Warner

Bought by

Dooley James E

Purchase Details

Closed on

Jun 15, 2007

Sold by

Ramos Francis C

Bought by

Henderson Lynn

Purchase Details

Closed on

Apr 28, 2005

Sold by

Halterman Richard D

Bought by

Ramos Francis C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$109,250

Interest Rate

6.12%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Oct 20, 2000

Sold by

Ridenour Road Development Co

Bought by

Halterman Richard D and Richard D Halterman Revocable

Purchase Details

Closed on

Jan 3, 1994

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sanfilippo Jennifer Lynn | $250,000 | Stewart Title | |

| Lynn M Henderson Revocable Trust | -- | Stewart Title | |

| Sanfilippo Jennifer Lynn | $250,000 | Stewart Title | |

| Lynn M Henderson Revocable Trust | -- | Stewart Title | |

| Henderson Jeffrey W | -- | None Available | |

| Dooley James E | -- | Huntington | |

| Henderson Lynn | $138,500 | Stewart Tit | |

| Ramos Francis C | $115,000 | Lawyers Tit | |

| Halterman Richard D | $115,000 | Allodial Title Company | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ramos Francis C | $109,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,735 | $45,500 | $45,500 | -- |

| 2023 | $2,701 | $45,500 | $45,500 | $0 |

| 2022 | $3,521 | $46,200 | $46,200 | $0 |

| 2021 | $3,408 | $46,200 | $46,200 | $0 |

| 2020 | $6,147 | $84,000 | $84,000 | $0 |

| 2019 | $5,150 | $70,000 | $70,000 | $0 |

| 2018 | $2,557 | $70,000 | $70,000 | $0 |

| 2017 | $4,738 | $70,000 | $70,000 | $0 |

| 2016 | $2,383 | $32,060 | $32,060 | $0 |

| 2015 | $1,193 | $32,060 | $32,060 | $0 |

| 2014 | $2,367 | $32,060 | $32,060 | $0 |

| 2013 | $1,407 | $38,360 | $38,360 | $0 |

Source: Public Records

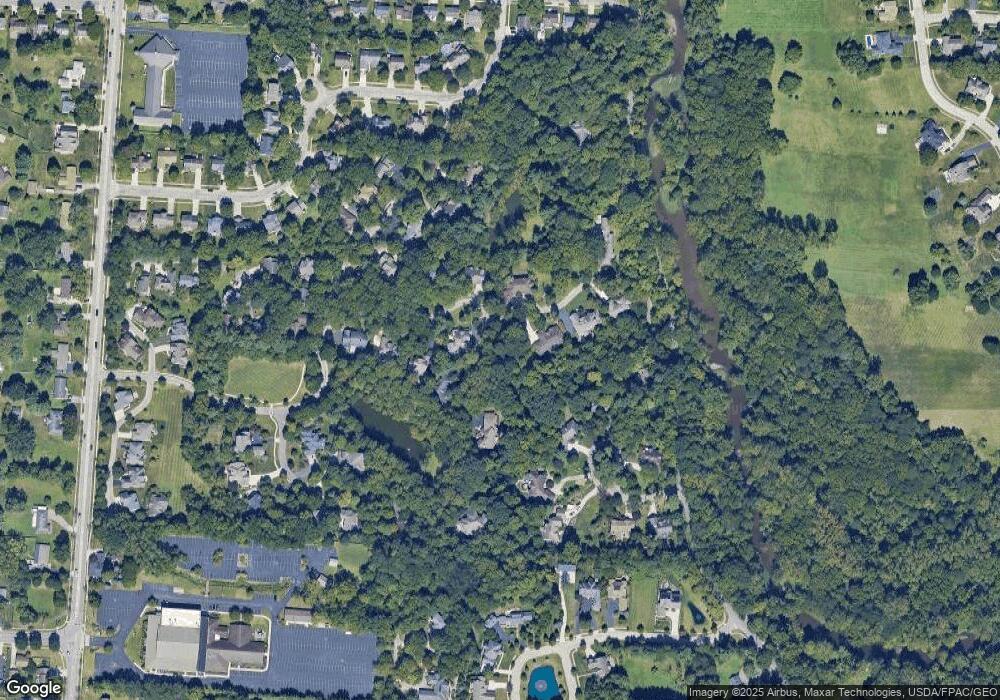

Map

Nearby Homes

- 642 Ridenour Rd

- 108 Walcreek Dr W

- 111 Nob Hill Dr N

- 536 Springwood Lake Dr

- 211 Crossing Creek N

- 402 Bluestem Ave

- 459 Bluestem Ave

- 638 Thistle Ave

- 388 Elkwood Place

- 295 Imperial Dr

- 302 Zander Ln Unit 302

- 3877 Hines Rd

- 249 Regents Rd

- 3118 Berkley Pointe Dr

- 209 Imperial Dr

- 3150 Berkley Pointe Dr

- 365 Sycamore Woods Ln Unit 365

- 3544 Halpern St

- 0 Wendler Blvd

- 206 Lintner St

- 335 Morgan Ln Unit Lot 4

- 341 Morgan Ln

- 25 Morgan Ln

- 20 Morgan Ln

- 27 Morgan Ln

- 0 Morgan Ln Unit 2332951

- 0 Morgan Ln Unit 3973

- 0 Morgan Ln Unit 17 9702219

- 0 Morgan Ln Unit 24 9702212

- 2 Morgan Ln

- 330 Morgan Ln

- 329 Morgan Ln

- 355 Morgan Ln

- 358 Morgan Ln

- 325 Morgan Ln

- 351 Morgan Ln

- 361 Morgan Ln

- 319 Morgan Ln

- 347 Morgan Ln