335 S 190 W American Fork, UT 84003

Estimated Value: $527,000 - $605,000

2

Beds

3

Baths

1,000

Sq Ft

$564/Sq Ft

Est. Value

About This Home

Beautiful Basement Apartment

Available November 1, 2024

Highlights:

• New Home - 2022

• Great Neighborhood/Neighbors

• Gig-Speed Internet Included

• Smart Appliances

• Private Laundry

• Storage Room

• Pantry

• Private Entrance

• Smoke and Pet Free

• 2 Off-Street Parking Spaces

• 3 min to I-15, Front Runner, and the city center

• Minimum one-year lease

Rent: $1,350

Utilities: $150

One-Time Deposit: $1,350

Message Matthew to schedule a virtual or in-person tour and to apply.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 17, 2021

Sold by

Colaizzi John and Mason Julane

Bought by

Mower Matthew David and Groll Mower Laryssa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,000

Outstanding Balance

$301,891

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$262,102

Purchase Details

Closed on

Aug 12, 2019

Sold by

Af 12 Roost Llc

Bought by

Af 12 Roost Llc

Purchase Details

Closed on

Aug 2, 2019

Sold by

Af 12 Roost Llc

Bought by

Af 12 Roost Llc

Purchase Details

Closed on

Jul 25, 2018

Sold by

Roberts Mfg Inc

Bought by

Af 12 Roost Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mower Matthew David | -- | Highland Title | |

| Af 12 Roost Llc | -- | Accommodation | |

| Af 12 Roost Llc | -- | Accommodation | |

| Af 12 Roost Llc | -- | Backman Title Services Ltd |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mower Matthew David | $332,000 |

Source: Public Records

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 11/01/2024 11/01/24 | For Rent | $1,450 | 0.0% | -- |

| 10/08/2024 10/08/24 | Off Market | $1,450 | -- | -- |

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,467 | $299,805 | $195,500 | $349,600 |

| 2024 | $2,467 | $274,065 | $0 | $0 |

| 2023 | $2,355 | $277,365 | $0 | $0 |

| 2022 | $2,218 | $257,895 | $0 | $0 |

| 2021 | $1,311 | $130,900 | $130,900 | $0 |

| 2020 | $1,207 | $116,900 | $116,900 | $0 |

| 2019 | $1,070 | $107,200 | $107,200 | $0 |

| 2018 | $1,017 | $97,400 | $97,400 | $0 |

| 2017 | $829 | $77,900 | $0 | $0 |

Source: Public Records

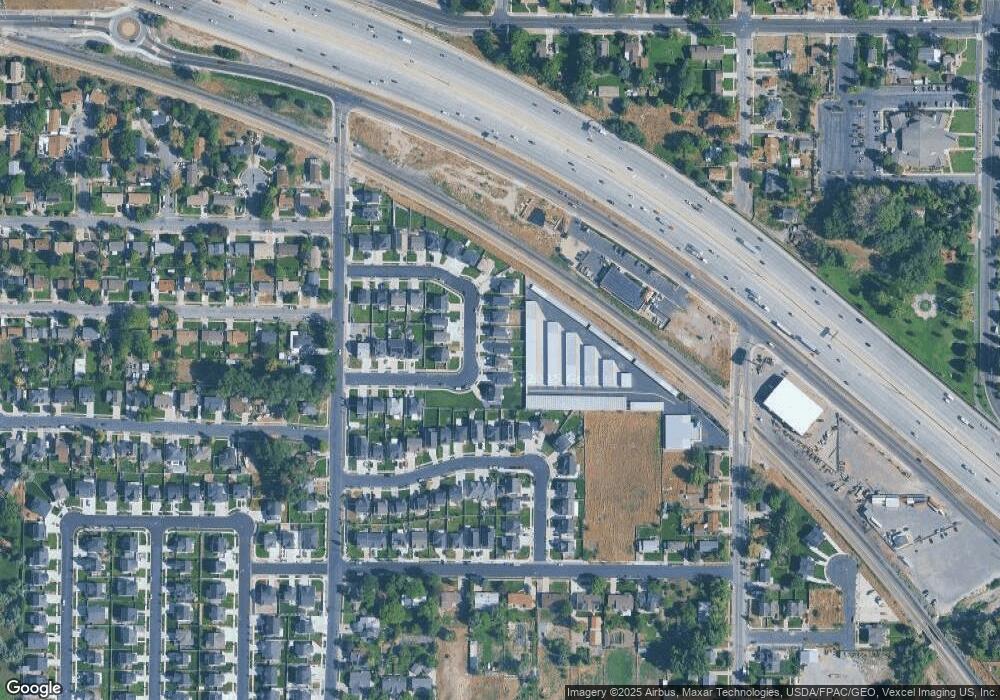

Map

Nearby Homes

- 368 S Storrs Ct Unit 107

- 429 S Storrs Ave

- 316 W 390 S

- 271 S Barratt Cir

- 365 W 370 S

- 424 S 340 W

- 382 W 330 S

- 391 W 370 S

- 412 S 390 W

- 195 S Center St

- 65 E 400 S Unit 8

- 351 Washington Ave

- 82 S Lincoln Ave

- 55 Roosevelt Ave

- 217 W Main St

- 326 S 650 W

- 528 S 260 E

- 415 S 680 W Unit 45

- 129 W Pacific Dr

- 336 S 300 E

- 335 S 190 W Unit Basement

- 335 S 190 W Unit 5A

- 335 S 190 W

- 341 S 190 W Unit 5B

- 341 S 190 W

- 327 S 190 W Unit 4B

- 327 S 190 W

- 321 S 190 W Unit 4A

- 321 S 190 W

- 349 S 190 W Unit 6A

- 349 S 190 W

- 317 S 190 W Unit 3B

- 317 S 190 W

- 355 S 190 W Unit 6B

- 355 S 190 W

- 332 S 190 W Unit 7B

- 338 S 190 W Unit 7A

- 311 S 190 W Unit 3A

- 311 S 190 W

- 324 S 190 W Unit 8A