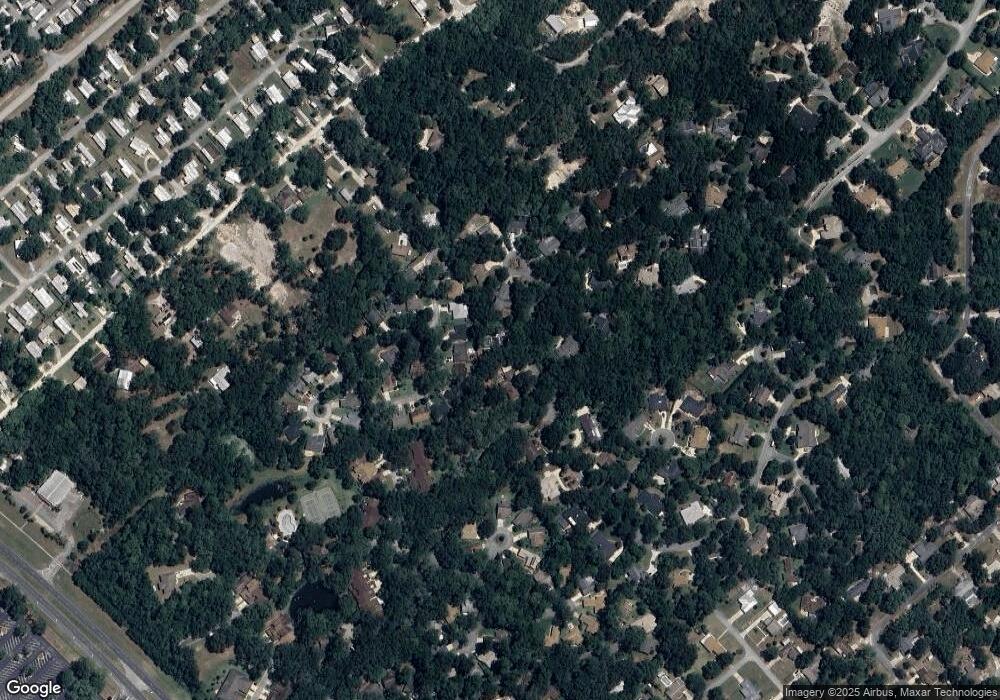

336 Crooked Tree Trail Unit 4 Deland, FL 32724

North DeLand NeighborhoodEstimated Value: $348,000 - $487,000

3

Beds

3

Baths

2,801

Sq Ft

$144/Sq Ft

Est. Value

About This Home

This home is located at 336 Crooked Tree Trail Unit 4, Deland, FL 32724 and is currently estimated at $401,950, approximately $143 per square foot. 336 Crooked Tree Trail Unit 4 is a home located in Volusia County with nearby schools including George W. Marks Elementary School, Deland High School, and Deland Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 26, 2013

Sold by

Schultheis Alicia and Schultheis John M

Bought by

Marrero Juan C and Cuprill Mercedes M

Current Estimated Value

Purchase Details

Closed on

Dec 13, 2001

Sold by

Lacey Mary Jo

Bought by

Schultheis Alicia S and Schultheis John M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,500

Interest Rate

6.5%

Purchase Details

Closed on

Feb 2, 1998

Sold by

Lacey Pauline M and Lacey Edward T

Bought by

Lacey Mary Jo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

7.01%

Purchase Details

Closed on

Mar 15, 1992

Bought by

Marrero Juan C

Purchase Details

Closed on

Jan 15, 1990

Bought by

Marrero Juan C

Purchase Details

Closed on

Jan 15, 1989

Bought by

Marrero Juan C

Purchase Details

Closed on

Jan 15, 1983

Bought by

Marrero Juan C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Marrero Juan C | $170,000 | Volusia Title Services | |

| Schultheis Alicia S | $146,200 | -- | |

| Lacey Mary Jo | $105,000 | -- | |

| Marrero Juan C | $108,000 | -- | |

| Marrero Juan C | $95,000 | -- | |

| Marrero Juan C | $115,000 | -- | |

| Marrero Juan C | $16,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Schultheis Alicia S | $131,500 | |

| Previous Owner | Lacey Mary Jo | $90,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,955 | $301,209 | $65,000 | $236,209 |

| 2024 | $4,955 | $278,988 | $60,000 | $218,988 |

| 2023 | $4,955 | $281,882 | $50,000 | $231,882 |

| 2022 | $4,580 | $251,441 | $50,000 | $201,441 |

| 2021 | $4,328 | $200,902 | $31,850 | $169,052 |

| 2020 | $4,012 | $184,602 | $24,500 | $160,102 |

| 2019 | $4,158 | $182,087 | $17,640 | $164,447 |

| 2018 | $3,919 | $169,952 | $16,415 | $153,537 |

| 2017 | $3,650 | $147,665 | $16,415 | $131,250 |

| 2016 | $3,549 | $146,709 | $0 | $0 |

| 2015 | $3,389 | $135,632 | $0 | $0 |

| 2014 | $3,722 | $150,687 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 66 Elmwood Trail

- 3516 Jerathan Dr

- 287 Crooked Tree Trail Unit 4

- 63 Fernwood Trail

- 238 Crooked Tree Trail

- 55 Wildwood Trail

- 256 Crooked Tree Trail

- 29 Ramblewood Trail

- 920 Shady Branch Trail

- 160 Cutbank Trail

- 219 Brevity Ln

- 337 Spring Lake Dr Unit 210

- 4111 Woodland Cir

- 680 Old Treeline Trail

- 906 Village Green Rd Unit 4

- 105 Live Oak Dr Unit 245

- 112 Live Oak Dr

- 369 Spring Lake Dr

- 130 Oakleaf Cir

- 165 Cypress Point N

- 431 Secluded Oaks Trail

- 437 Secluded Oaks Trail

- 332 Crooked Tree Trail

- 340 Crooked Tree Trail Unit 4

- 425 Secluded Oaks Trail

- 443 Secluded Oaks Trail

- 3356 Circle Oaks Trail Unit 4

- 419 Secluded Oaks Trail

- 449 Secluded Oaks Trail

- 3374 Whispering Pine Trail Unit 4

- 430 Secluded Oaks Trail

- 416 Secluded Oaks Trail

- 279 Silver Branch Trail

- 413 Secluded Oaks Trail

- 3349 Circle Oaks Trail

- 450 Secluded Oaks Trail Unit 10

- 320 Crooked Tree Trail Unit 4

- 3378 Whispering Pine Trail

- 273 Silver Branch Trail

- 260 Silver Branch Trail