Estimated Value: $428,000 - $461,000

2

Beds

2

Baths

1,303

Sq Ft

$339/Sq Ft

Est. Value

About This Home

This home is located at 336 N 1030 E Unit T1, Lehi, UT 84043 and is currently estimated at $441,869, approximately $339 per square foot. 336 N 1030 E Unit T1 is a home located in Utah County with nearby schools including Sego Lily Elementary School, Lehi Junior High School, and Skyridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 26, 2012

Sold by

Reverse Mortgage Solutions Inc

Bought by

Federal National Mortgage Association

Current Estimated Value

Purchase Details

Closed on

Mar 7, 2012

Sold by

Kleinsmith Phillip M

Bought by

Reverse Mortgage Solution Inc

Purchase Details

Closed on

Sep 25, 2008

Sold by

Cloud Beverly Anne and Cloud Beverly Ann

Bought by

Cloud Beverly Anne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$330,000

Interest Rate

3.44%

Mortgage Type

Reverse Mortgage Home Equity Conversion Mortgage

Purchase Details

Closed on

Mar 30, 2006

Sold by

Leisure Villas Inc

Bought by

Cloud Beverly Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

6.25%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Federal National Mortgage Association | -- | Highland Title | |

| Reverse Mortgage Solution Inc | -- | None Available | |

| Cloud Beverly Anne | -- | Backman Fptp | |

| Cloud Beverly Ann | -- | Merrill Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cloud Beverly Anne | $330,000 | |

| Previous Owner | Cloud Beverly Ann | $140,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,894 | $225,170 | $60,200 | $349,200 |

| 2024 | $1,894 | $221,650 | $0 | $0 |

| 2023 | $1,627 | $206,745 | $0 | $0 |

| 2022 | $1,765 | $217,415 | $0 | $0 |

| 2021 | $1,596 | $297,200 | $44,600 | $252,600 |

| 2020 | $1,531 | $281,900 | $42,300 | $239,600 |

| 2019 | $1,249 | $239,100 | $35,900 | $203,200 |

| 2018 | $1,134 | $205,100 | $30,800 | $174,300 |

| 2017 | $1,173 | $112,805 | $0 | $0 |

| 2016 | $1,153 | $102,850 | $0 | $0 |

| 2015 | $1,214 | $102,850 | $0 | $0 |

| 2014 | $1,221 | $102,850 | $0 | $0 |

Source: Public Records

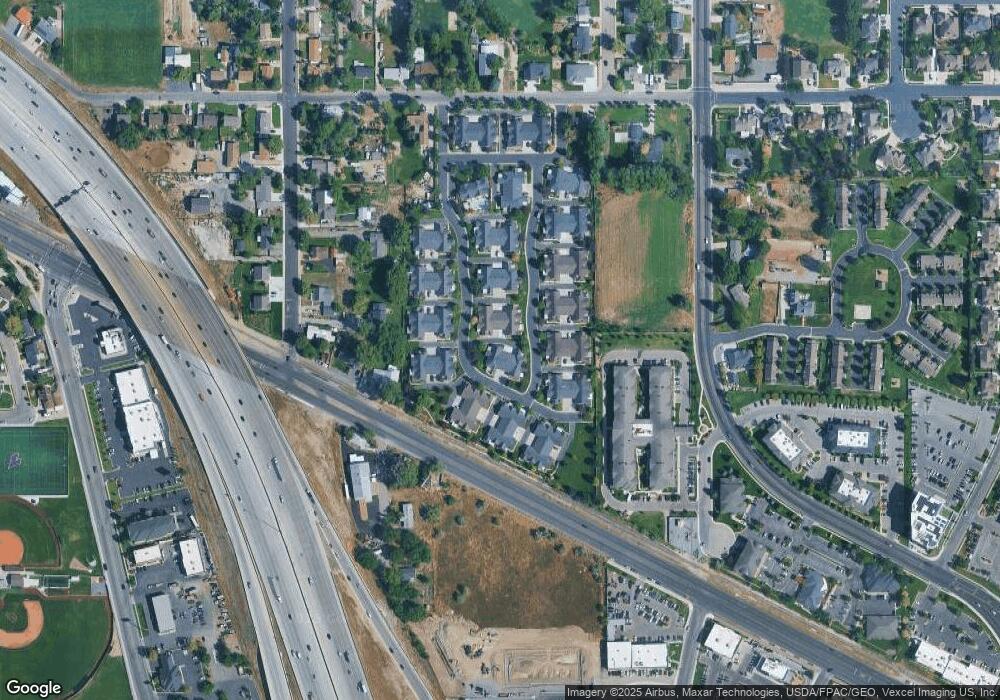

Map

Nearby Homes

- 1036 E 310 N Unit K1

- 458 N 1100 E Unit 3

- 328 N 1270 E

- 595 N 1200 E

- 418 N 1322 E

- 735 N 1000 E

- 807 N Somerset Alley

- 1175 E 900 N

- 901 N Lakota Rd

- 428 E 500 N

- 893 N 1580 E

- 705 N 400 E

- 822 N 860 W Unit 317

- 822 W 800 St N Unit LOT319

- 962 N 780 St W Unit 508

- 974 N 780 St W Unit 509

- 916 N 780 St W Unit 501

- 3935 W 1000 N Unit 438

- 3983 W 1000 N Unit 442

- 4007 W 1000 N

- 336 N 1030 E Unit T-3

- 336 N 1030 E Unit 2

- 336 N 1030 E Unit T4

- 344 N 1100 E Unit G1

- 344 N 1100 E Unit G3

- 344 N 1100 E Unit 2

- 344 N 1100 E Unit G4

- 344 N 1100 E

- 344 N 1100 E Unit 1

- 344 N 1100 E Unit 3

- 366 N 1030 East S Bldg Unit S-2

- 1066 E 310 N Unit J4

- 1066 E 310 N Unit J1

- 1066 E 310 N Unit J3

- 1066 E 310 N Unit J2

- 1066 E 310 N Unit 3

- 1066 E 310 N Unit J

- 1036 E 310 N Unit K4

- 314 N 1100 E

- 314 N 1100 E Unit H3