3366 Us Highway 22 Branchburg, NJ 08876

Branchburg Township NeighborhoodEstimated payment $6,058/month

Highlights

- 6.7 Acre Lot

- Level Lot

- 4-minute walk to Brandywine Park

- Stony Brook School Rated A-

About This Lot

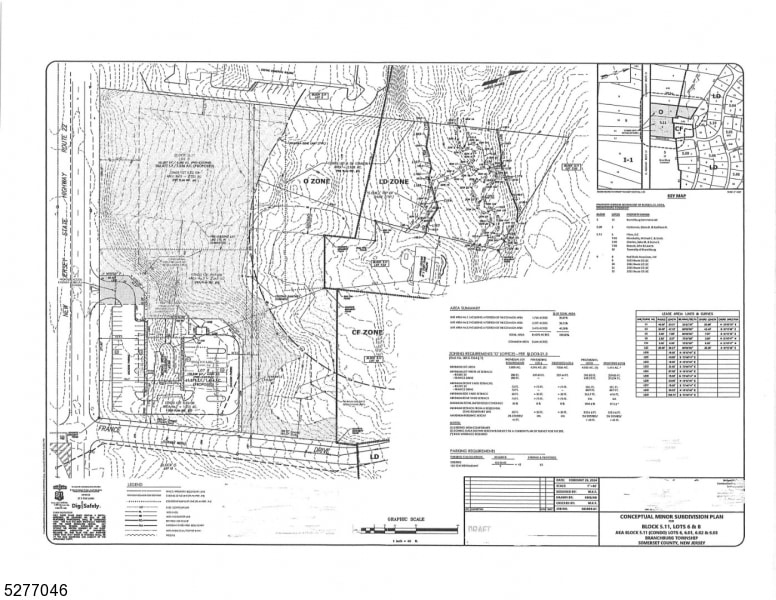

UNBELIEVABLE: 6.70 ACRES ON RT 22 WEST LOCATED IN THE O/LD ZONE (OFFICE ZONE AND LOW DENSITY RESIDENTIAL) IN BRANCHBURG, A PRESTIGIOUS SOMERSET COUNTY LOCATION, PERMITTED USES PROFESSIONAL OFFICES, MEDICAL OFFICES, CHILD CARE, THE SITE IS SERVICED BY ALL PUBLIC UTILITIES INCLUDING WATER, SEWER, ELECTRIC & GAS, EXCELLENT DEMOGRAPHICS, 34,000 CARS A DAY PASS THIS SITE LOT # 6.02 & 6.03

Listing Agent

TIM DELUCCIA

BHHS FOX & ROACH Brokerage Phone: 908-938-6405 Listed on: 02/28/2025

Property Details

Property Type

- Land

Est. Annual Taxes

- $25,526

Lot Details

- 6.7 Acre Lot

- Level Lot

- 2 Lots in the community

Listing and Financial Details

- Assessor Parcel Number 2705-00005-0011-00006-0002-CONDO

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $25,527 | $1,415,000 | $619,500 | $795,500 |

| 2024 | $25,527 | $1,415,000 | $619,500 | $795,500 |

| 2023 | $25,259 | $1,350,000 | $619,500 | $730,500 |

| 2022 | $25,400 | $1,290,000 | $619,500 | $670,500 |

| 2021 | $27,334 | $1,293,000 | $619,500 | $673,500 |

| 2020 | $27,709 | $1,293,000 | $619,500 | $673,500 |

| 2019 | $27,584 | $1,280,000 | $352,700 | $927,300 |

| 2018 | $28,093 | $1,300,000 | $352,700 | $947,300 |

| 2017 | $28,288 | $1,300,000 | $352,700 | $947,300 |

| 2016 | $25,733 | $1,175,000 | $352,700 | $822,300 |

| 2015 | $25,686 | $1,175,000 | $352,700 | $822,300 |

| 2014 | $25,920 | $1,200,000 | $352,700 | $847,300 |

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 02/28/2025 02/28/25 | For Sale | $749,700 | -- | -- |

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Deed | $1,350,000 | None Listed On Document | |

| Deed | $1,350,000 | None Listed On Document | |

| Deed | -- | -- |

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Open | $1,060,000 | Construction | |

| Closed | $1,060,000 | Construction |

Source: Garden State MLS

MLS Number: 3948310

APN: 05-00005-11-00006-01-CONDO

- 40 France Dr

- 508 Keenland Ct

- 305 Saratoga Ct

- 248 Carol Jean Way

- 420 Azalea Terrace

- 615 Magnolia Ln

- 818 Magnolia Ln

- 1135 State Route 28

- 34 Iroquois Trail

- 33 Iroquois Trail

- 1114 State Route 28

- 16 Iroquois Trail

- 215 Readington Rd

- 212 County Line Rd

- 21 Cheyenne Trail

- 23 Buffalo Hollow Rd

- 10 Clark Ln

- 5 Walnut Dr

- 41 Sanderson Ct

- 61 Waugh Ct

- 3400 Us Highway 22

- 3301 Us Highway 22

- 3260 U S 22

- 1007 Magnolia Ln Ondo

- 502 Dunn Cir

- 608 Dunn Cir

- 3509 French Dr Unit 9

- 3607 Riddle Ct

- 332 Rolling Knolls Way

- 604 Brokaw Ct

- 4703 Patterson St Unit 47

- 69 Cedar Grove Rd

- 1306 Doolittle Dr

- 1101 Doolittle Dr

- 1713 Breckenridge Dr

- 1902 Bayley Ct

- 2106 Doolittle Dr

- 3705 Pinhorn Dr Unit E

- 604 Bayley Ct Unit 6D

- 4202 Winder Dr