Estimated Value: $140,000 - $160,000

3

Beds

1

Bath

816

Sq Ft

$185/Sq Ft

Est. Value

About This Home

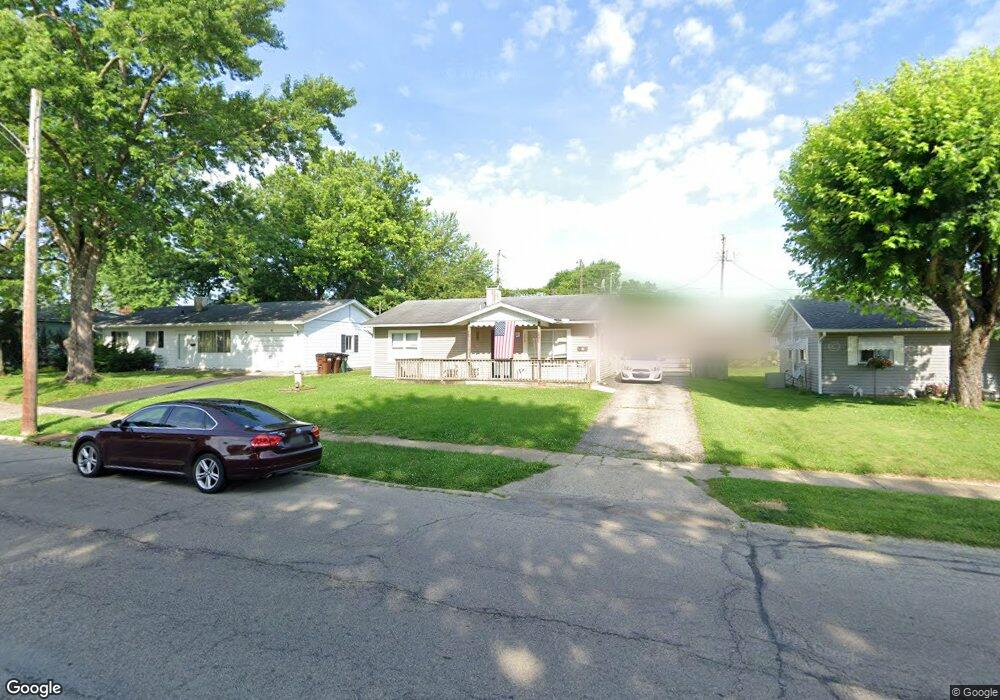

This home is located at 338 Sheelin Rd, Xenia, OH 45385 and is currently estimated at $150,612, approximately $184 per square foot. 338 Sheelin Rd is a home located in Greene County with nearby schools including Xenia High School, Summit Academy Community School for Alternative Learners - Xenia, and Legacy Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 7, 2018

Sold by

Estate Of Deborah L C Jordan

Bought by

Jordan Dennis K

Current Estimated Value

Purchase Details

Closed on

Aug 15, 2016

Sold by

Scottie E Hastings

Bought by

Jordan Deborah and Jordan Dennis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$34,500

Outstanding Balance

$27,500

Interest Rate

3.45%

Estimated Equity

$123,112

Purchase Details

Closed on

Jul 1, 2016

Bought by

Jordan Deborah L C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$34,500

Outstanding Balance

$27,500

Interest Rate

3.45%

Estimated Equity

$123,112

Purchase Details

Closed on

Nov 9, 2007

Sold by

Campbell Thomas Edward

Bought by

Jordan Deborah L C and Hastings Scottie Lee

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jordan Dennis K | -- | None Available | |

| Jordan Deborah | -- | -- | |

| Jordan Deborah L C | -- | -- | |

| Jordan Deborah L C | -- | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jordan Deborah | $34,500 | |

| Closed | Jordan Deborah | -- | |

| Closed | Jordan Deborah | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,527 | $35,680 | $9,020 | $26,660 |

| 2023 | $1,527 | $35,680 | $9,020 | $26,660 |

| 2022 | $1,260 | $25,110 | $6,440 | $18,670 |

| 2021 | $1,277 | $25,110 | $6,440 | $18,670 |

| 2020 | $1,223 | $25,110 | $6,440 | $18,670 |

| 2019 | $1,147 | $22,170 | $4,510 | $17,660 |

| 2018 | $1,152 | $22,170 | $4,510 | $17,660 |

| 2017 | $1,103 | $22,170 | $4,510 | $17,660 |

| 2016 | $1,104 | $20,850 | $4,510 | $16,340 |

| 2015 | $553 | $20,850 | $4,510 | $16,340 |

| 2014 | $1,060 | $20,850 | $4,510 | $16,340 |

Source: Public Records

Map

Nearby Homes

- 343 Sheelin Rd

- 1351 Omard Dr

- 912 Omard Dr

- 883 Omard Dr

- 1233 June Dr

- 1283 June Dr

- 1223 June Dr

- 509 Antrim Rd

- 1391 June Dr

- 1342 Kylemore Dr

- 613 N West St

- 121 S Progress Dr

- 1144 Rockwell Dr

- 305-325 Bellbrook Ave

- 137 Pleasant St

- 516 N King St

- 0 W Church St

- 659 N King St

- 878 N Detroit St

- 902 N Detroit St

- 350 Sheelin Rd

- 326 Sheelin Rd

- 1102 Richard Dr

- 1114 Richard Dr

- 364 Sheelin Rd

- 314 Sheelin Rd

- 1090 Richard Dr

- 1130 Richard Dr

- 376 Sheelin Rd

- 1074 Richard Dr

- 363 Sheelin Rd

- 1158 Stewart Ave

- 388 Sheelin Rd

- 1062 Richard Dr

- 375 Sheelin Rd

- 1157 Stewart Ave

- 1115 E Richard Dr

- 1089 Richard Dr

- 871 Dayton Ave

- 1146 Stewart Ave