34 Leo St Unit A Staten Island, NY 10314

Graniteville NeighborhoodEstimated Value: $491,485 - $548,000

3

Beds

2

Baths

1,180

Sq Ft

$449/Sq Ft

Est. Value

About This Home

This home is located at 34 Leo St Unit A, Staten Island, NY 10314 and is currently estimated at $530,371, approximately $449 per square foot. 34 Leo St Unit A is a home located in Richmond County with nearby schools including P.S. 22 Graniteville, I.S. 51 Edwin Markham, and Port Richmond High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 1, 2018

Sold by

Kenny Regina and Calicchio Lisa

Bought by

Gniewkowski Lisa A and Evans Michel J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,000

Outstanding Balance

$289,524

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$240,847

Purchase Details

Closed on

Jul 20, 2004

Sold by

Kennedy Toniann and Hernandez Toni

Bought by

Kenny Regina and Calicchio Lisa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$263,650

Interest Rate

6.37%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Mar 6, 1998

Sold by

Fischette Craig M and Fischette Virginia R

Bought by

Hernandez Toni

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,700

Interest Rate

6.96%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gniewkowski Lisa A | $415,000 | Chicago Title Insurance Comp | |

| Kenny Regina | $263,679 | None Available | |

| Hernandez Toni | $109,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gniewkowski Lisa A | $332,000 | |

| Previous Owner | Kenny Regina | $263,650 | |

| Previous Owner | Hernandez Toni | $105,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,754 | $32,315 | $1,232 | $31,083 |

| 2024 | $3,766 | $26,377 | $1,472 | $24,905 |

| 2023 | $3,631 | $19,278 | $1,517 | $17,761 |

| 2022 | $3,344 | $21,844 | $1,933 | $19,911 |

| 2021 | $3,308 | $19,992 | $1,933 | $18,059 |

| 2020 | $3,336 | $19,882 | $1,933 | $17,949 |

| 2019 | $3,198 | $17,587 | $1,933 | $15,654 |

| 2018 | $2,977 | $16,065 | $1,818 | $14,247 |

| 2017 | $2,790 | $15,157 | $1,863 | $13,294 |

| 2016 | $2,549 | $14,300 | $1,811 | $12,489 |

| 2015 | $2,372 | $14,300 | $1,667 | $12,633 |

| 2014 | $2,372 | $13,951 | $1,934 | $12,017 |

Source: Public Records

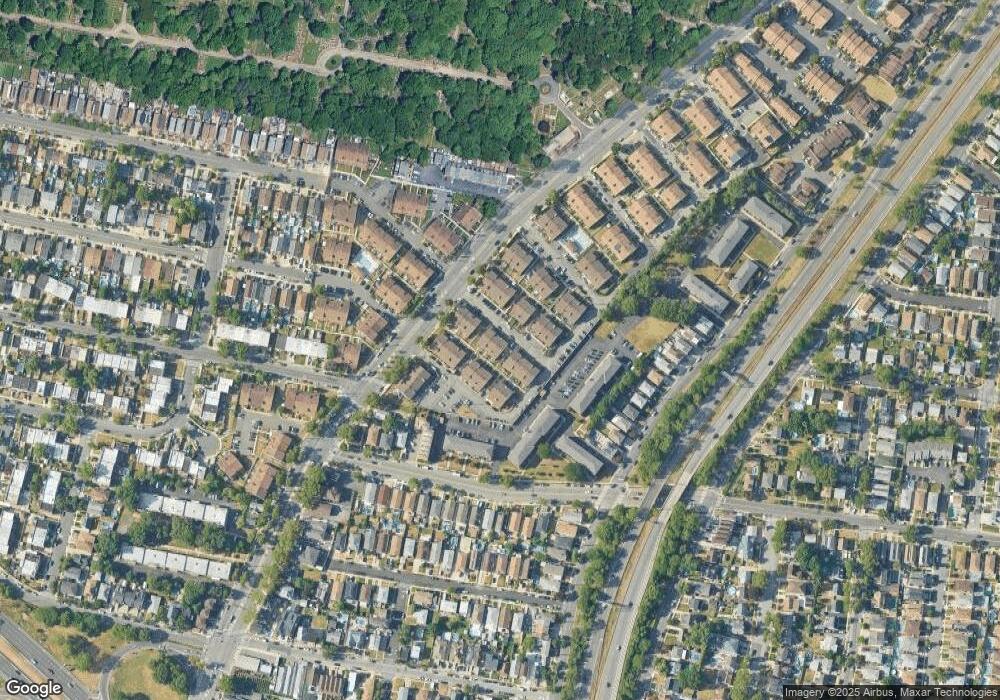

Map

Nearby Homes

- 17 Leo St Unit A

- 418 Willow Rd W

- 12 Regis Dr Unit 79

- 34 Regis Dr

- 33 Marc St

- 581 W Caswell Ave

- 17 B Yafa Ct Unit A

- 95 Regis Dr

- 62 Comstock Ave

- 444- 2 Caswell Ave

- 187 Willow Rd E

- 124 Woodbine Ave

- 70 Lyon Place

- 61 Comstock Ave

- 443 Willow Rd E

- 443 Willow Rd E Unit 1

- 15 Lambert St

- 252 Willow Rd W Unit 4a

- 151 Regis Dr

- 42 Vedder Ave Unit 2

- 34 Leo St Unit 36

- 34A Leo St Unit 35

- 35 Armond St Unit 21

- 30 Leo St

- 30 Leo St Unit 40

- 36A Leo St Unit 33

- 33 Armand St

- 38A Leo St

- 38A Leo St Unit 31

- 35 Armond St Unit 22

- 33 Armond St Unit 19

- 31 Armond St

- 31 Armond St

- 31 Armond St Unit 17

- 31 Armond St Unit 18

- 38 Leo St Unit 32

- 38 Leo St Unit A

- 28A Melissa St

- 32 Melissa St Unit 72

- 39A Leo St