34 Stuart St Dalton, OH 44618

Estimated Value: $197,000 - $228,000

2

Beds

1

Bath

1,238

Sq Ft

$176/Sq Ft

Est. Value

About This Home

This home is located at 34 Stuart St, Dalton, OH 44618 and is currently estimated at $217,628, approximately $175 per square foot. 34 Stuart St is a home located in Wayne County with nearby schools including Dalton Elementary School, Dalton Middle School, and Dalton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 25, 2004

Sold by

Mcdonald Kevin P and Mcdonald Jean M

Bought by

Schmidt Pamela J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,600

Outstanding Balance

$49,434

Interest Rate

5.85%

Mortgage Type

Unknown

Estimated Equity

$168,194

Purchase Details

Closed on

Jul 12, 2002

Sold by

Mack Dev Co

Bought by

Mcdonald Kevin P and Mcdonald Jean M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,900

Interest Rate

6.82%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schmidt Pamela J | $123,500 | Midland Title | |

| Mcdonald Kevin P | $104,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schmidt Pamela J | $98,600 | |

| Previous Owner | Mcdonald Kevin P | $83,900 | |

| Closed | Schmidt Pamela J | $98,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,824 | $62,480 | $12,040 | $50,440 |

| 2023 | $2,198 | $62,480 | $12,040 | $50,440 |

| 2022 | $1,951 | $48,060 | $9,260 | $38,800 |

| 2021 | $1,971 | $48,060 | $9,260 | $38,800 |

| 2020 | $1,999 | $48,060 | $9,260 | $38,800 |

| 2019 | $1,785 | $43,840 | $9,240 | $34,600 |

| 2018 | $1,795 | $43,840 | $9,240 | $34,600 |

| 2017 | $1,770 | $43,840 | $9,240 | $34,600 |

| 2016 | $1,677 | $42,150 | $8,880 | $33,270 |

| 2015 | $1,643 | $42,150 | $8,880 | $33,270 |

| 2014 | $1,652 | $42,150 | $8,880 | $33,270 |

| 2013 | $1,648 | $41,070 | $9,790 | $31,280 |

Source: Public Records

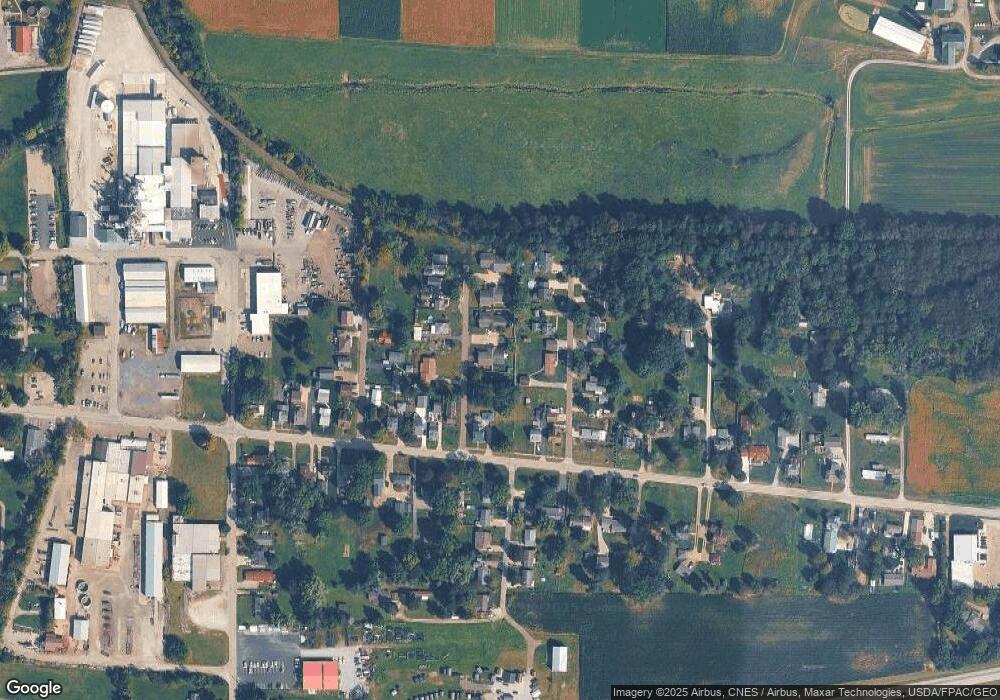

Map

Nearby Homes

- 206 E Main St

- 0 Dalton Fox Lake Rd

- 120 N Church St

- 241 W Main St

- 223 Tanglewood Dr

- 504 Burnett Ave

- 233 Tanglewood Dr

- 209 Greenbriar Ln

- 15288 Old Lincoln Way

- 2662 Mount Eaton Rd

- 890 Greenside Ave SW

- 0 Barrs St SW Unit 5184701

- 14716 Lawmont St

- 1173 Manchester Ave SW

- 14361 Stanwood St SW

- 704 Homestead Pointe Dr

- Eden Cay w/ Basement Plan at Sippo Reserves

- Grand Cayman w/ Basement Plan at Sippo Reserves

- Grand Bahama w/ Basement Plan at Sippo Reserves

- Aruba Bay w/ Basement Plan at Sippo Reserves