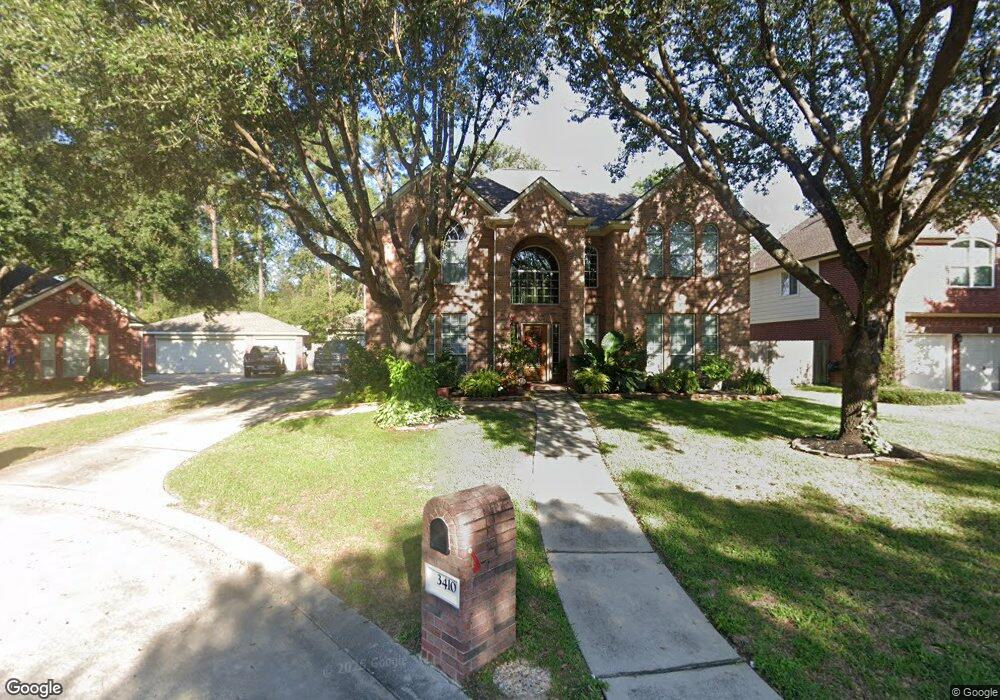

3410 Hackberry Ct Spring, TX 77388

Estimated Value: $417,813 - $452,000

4

Beds

4

Baths

3,442

Sq Ft

$126/Sq Ft

Est. Value

About This Home

This home is located at 3410 Hackberry Ct, Spring, TX 77388 and is currently estimated at $434,953, approximately $126 per square foot. 3410 Hackberry Ct is a home located in Harris County with nearby schools including Haude Elementary School, Strack Intermediate School, and Klein Collins High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 18, 2012

Sold by

Fannie Mae

Bought by

Frances Phillip A and Frances Paula F

Current Estimated Value

Purchase Details

Closed on

Dec 6, 2011

Sold by

Paschal Rebecca and Paschal Kirk

Bought by

Federal National Mortgage Association and Fannie Mae

Purchase Details

Closed on

Jun 27, 2007

Sold by

Newmark Homes Lp

Bought by

Gracepoint Builders Lp

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$640,486

Interest Rate

6.19%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Oct 1, 2002

Sold by

J Patrick Homes Ltd

Bought by

Paschal Rebecca

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$209,600

Interest Rate

6.26%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Frances Phillip A | -- | None Available | |

| Federal National Mortgage Association | $212,559 | None Available | |

| Gracepoint Builders Lp | -- | Chicago Title | |

| Paschal Rebecca | -- | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gracepoint Builders Lp | $640,486 | |

| Previous Owner | Paschal Rebecca | $209,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,963 | $393,101 | $60,968 | $332,133 |

| 2024 | $6,963 | $396,230 | $60,968 | $335,262 |

| 2023 | $6,963 | $405,901 | $60,968 | $344,933 |

| 2022 | $7,170 | $423,706 | $60,968 | $362,738 |

| 2021 | $7,006 | $287,000 | $43,729 | $243,271 |

| 2020 | $6,805 | $230,000 | $43,729 | $186,271 |

| 2019 | $7,096 | $230,000 | $43,729 | $186,271 |

| 2018 | $2,071 | $230,000 | $43,729 | $186,271 |

| 2017 | $14,296 | $230,000 | $43,729 | $186,271 |

| 2016 | $7,521 | $242,000 | $43,729 | $198,271 |

| 2015 | $4,239 | $275,878 | $43,729 | $232,149 |

| 2014 | $4,239 | $224,427 | $43,729 | $180,698 |

Source: Public Records

Map

Nearby Homes

- 3406 Stone Ivory Ct

- 20614 Cypresswood Meadows Dr

- 20403 Sagecombe Ct

- 3510 Ash Glen Dr

- 2518 Liguria Ln

- 2615 Liguria Ln

- 2615 Piemonte Avenue Cir

- 2607 Piemonte Avenue Cir

- 2603 Piemonte Ct Ave

- 20206 Treetop Ln

- 20011 Rosswood Ln

- 20806 Deauville Dr

- 3610 Walnut Forest Ln

- 3618 Walnut Forest Ln

- 0 Kuykendahl Rd Unit 50148573

- 20818 Meadowhill Dr

- 20831 Deauville Dr

- 20903 Manon Ln

- 2915 Sandleigh Dr

- 20538 Bonds Creek Ln

- 3406 Hackberry Ct

- 3414 Hackberry Ct

- 3402 Hackberry Ct

- 3418 Hackberry Ct

- 3411 Hackberry Ct

- 20517 Falvel Rd

- 3407 Hackberry Ct

- 3415 Hackberry Ct

- 20434 Long Cypress Dr

- 20518 Treetop Ln

- 20430 Long Cypress Dr

- 20514 Treetop Ln

- 20520 Falvel Rd

- 20519 Falvel Rd

- 20510 Treetop Ln

- 20426 Long Cypress Dr

- 20522 Treetop Ln

- 3410 Stone Ivory Ct

- 3402 Stone Ivory Ct

- 3414 Stone Ivory Ct