3410 Parkside Dr Pearland, TX 77584

Estimated Value: $621,000 - $718,000

4

Beds

4

Baths

3,630

Sq Ft

$183/Sq Ft

Est. Value

About This Home

This home is located at 3410 Parkside Dr, Pearland, TX 77584 and is currently estimated at $665,134, approximately $183 per square foot. 3410 Parkside Dr is a home located in Brazoria County with nearby schools including Magnolia Elementary School, Sam Jamison Middle School, and Pearland Junior High School South.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2001

Sold by

David Powers Homes Wo Ltd

Bought by

Ralph Gregory P and Ralph Simone R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$257,750

Outstanding Balance

$94,675

Interest Rate

6.81%

Estimated Equity

$570,459

Purchase Details

Closed on

Oct 23, 2000

Sold by

Kirby Run Associates Lp

Bought by

David Powers Homes W O Ltd

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,713

Interest Rate

7.87%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ralph Gregory P | -- | Stewart Title | |

| David Powers Homes W O Ltd | -- | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ralph Gregory P | $257,750 | |

| Previous Owner | David Powers Homes W O Ltd | $235,713 | |

| Closed | Ralph Gregory P | $32,222 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,159 | $647,865 | $64,450 | $615,550 |

| 2023 | $11,159 | $535,425 | $64,450 | $585,550 |

| 2022 | $11,709 | $486,750 | $64,450 | $504,510 |

| 2021 | $11,401 | $442,500 | $56,720 | $385,780 |

| 2020 | $12,252 | $454,120 | $51,560 | $402,560 |

| 2019 | $11,310 | $419,110 | $51,560 | $367,550 |

| 2018 | $11,261 | $419,110 | $51,560 | $367,550 |

| 2017 | $11,162 | $413,370 | $51,560 | $361,810 |

| 2016 | $10,893 | $403,410 | $51,560 | $351,850 |

| 2014 | $9,243 | $380,330 | $51,560 | $328,770 |

Source: Public Records

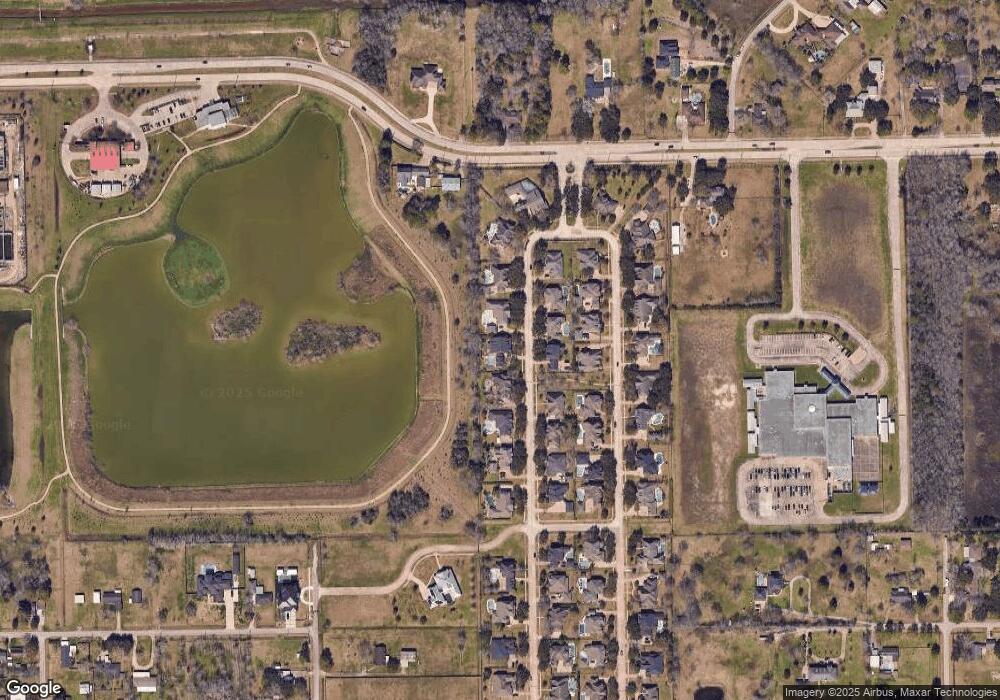

Map

Nearby Homes

- 3602 Lindhaven Dr

- 3730 Aubrell Rd

- 5301 Ryan Acres Dr

- 3115 Centennial Village Dr

- 3834 Aubrell Rd

- 5205 Spring Branch Dr

- 3911 Spring Garden Dr

- 3237 Harkey Rd

- 6112 Tomorrow Cir

- 3149 Harkey Rd

- 4806 Chaperel Dr

- 4967 Millican Dr

- 00 Hatfield Rd

- 5109 Playa Dr

- 3510 Dorsey Ln

- 3307 Norma Ln

- 3910 Greenwood Dr

- 3902 Basil Ct

- 6301 Larrycrest Dr

- 5705 Woodville Ln

- 3412 Parkside Dr

- 3408 Parkside Dr

- 3411 Parkside Dr

- 3409 Parkside Dr

- 3502 Parkside Dr

- 3406 Parkside Dr

- 3413 Parkside Dr

- 3407 Parkside Dr

- 3410 Lindhaven Dr

- 3408 Lindhaven Dr

- 3501 Parkside Dr

- 3414 Lindhaven Dr

- 3405 Parkside Dr

- 3406 Lindhaven Dr

- 3404 Parkside Dr

- 3504 Parkside Dr

- 3502 Lindhaven Dr

- 3503 Parkside Dr

- 3404 Lindhaven Dr

- 3506 Parkside Dr