3421 New Hope Rd Dacula, GA 30019

Estimated Value: $512,000 - $802,000

3

Beds

2

Baths

2,169

Sq Ft

$314/Sq Ft

Est. Value

About This Home

This home is located at 3421 New Hope Rd, Dacula, GA 30019 and is currently estimated at $681,811, approximately $314 per square foot. 3421 New Hope Rd is a home located in Gwinnett County with nearby schools including Harbins Elementary School, McConnell Middle School, and Archer High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 28, 2008

Sold by

Turner Robert A and Turner Rebecca A

Bought by

Shepherd Jessie T and Shepherd Linda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$308,800

Outstanding Balance

$193,408

Interest Rate

5.84%

Mortgage Type

New Conventional

Estimated Equity

$488,403

Purchase Details

Closed on

Mar 14, 2003

Sold by

Enix James L

Bought by

Turner Rebecca

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,500

Interest Rate

5.74%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shepherd Jessie T | $386,000 | -- | |

| Turner Rebecca | $100,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Shepherd Jessie T | $308,800 | |

| Previous Owner | Turner Rebecca | $103,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,777 | $210,280 | $92,000 | $118,280 |

| 2024 | $6,920 | $210,280 | $92,000 | $118,280 |

| 2023 | $6,920 | $210,280 | $92,000 | $118,280 |

| 2022 | $5,476 | $142,440 | $55,200 | $87,240 |

| 2021 | $5,558 | $142,440 | $55,200 | $87,240 |

| 2020 | $5,591 | $142,440 | $55,200 | $87,240 |

| 2019 | $4,396 | $118,000 | $39,200 | $78,800 |

| 2018 | $4,402 | $118,000 | $39,200 | $78,800 |

| 2016 | $4,418 | $118,000 | $39,200 | $78,800 |

| 2015 | $3,847 | $99,280 | $39,200 | $60,080 |

| 2014 | -- | $78,720 | $25,200 | $53,520 |

Source: Public Records

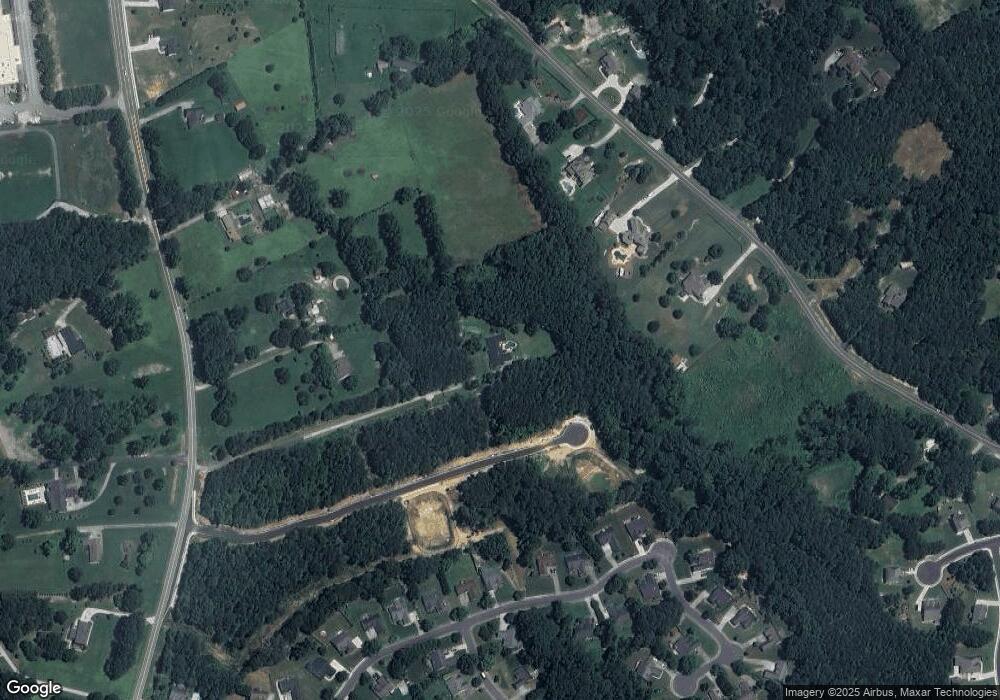

Map

Nearby Homes

- 2145 Jones Phillips Rd

- 2085 Jones Phillips Rd

- 2290 Taylor Pointe Way

- 2630 Track Way

- 2549 Maggie Woods Ct

- 3308 Alcovy Club Ct

- 3288 Alcovy Club Ct

- 2905 Cammie Wages Rd

- 2602 Alcovy Club Dr

- 2512 Alcovy Club Dr

- 2003 Greeson Rd

- 3191 Morris Hills Dr

- 3176 Morris Hills Dr

- 2102 Cayman Ct

- 2132 Cayman Ct

- 3090 Newell Dr

- 2031 Jones Phillips Rd

- 2021 Jones Phillips Rd

- 3465 New Hope Rd

- 2135 Jones Phillips Rd

- 2155 Jones Phillips Rd

- 2840 Jay Oak Dr

- 2820 Jay Oak Dr

- 2810 Jay Oak Dr

- 3475 New Hope Rd

- 2830 Jay Oak Dr

- 2850 Jay Oak Dr

- 2800 Jay Oak Dr

- 2790 Jay Oak Dr

- 2125 Jones Phillips Rd

- 2780 Jay Oak Dr

- 2815 Jay Oak Dr

- 2165 Jones Phillips Rd

- 2865 Jay Oak Dr

- 2260 Taylor Pointe Way

- 2860 Jay Oak Dr

- 2770 Jay Oak Dr

- 3485 New Hope Rd