3425 Howell Ct Abingdon, MD 21009

Estimated Value: $238,044 - $308,000

Studio

2

Baths

1,240

Sq Ft

$221/Sq Ft

Est. Value

About This Home

This home is located at 3425 Howell Ct, Abingdon, MD 21009 and is currently estimated at $273,511, approximately $220 per square foot. 3425 Howell Ct is a home located in Harford County with nearby schools including Abingdon Elementary School, Edgewood Middle School, and Edgewood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 28, 2015

Sold by

Dausch William C

Bought by

Dausch William C and Zhu Yanmei

Current Estimated Value

Purchase Details

Closed on

Dec 8, 1993

Sold by

Shinsky T E

Bought by

Dausch William C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,900

Interest Rate

6.78%

Purchase Details

Closed on

May 18, 1989

Sold by

Matson Homes Inc

Bought by

Shinsky Thomas E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,413

Interest Rate

10.93%

Purchase Details

Closed on

Jan 20, 1989

Sold by

Constant Friendship Inc

Bought by

Matson Homes Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dausch William C | -- | Attorney | |

| Dausch William C | $89,900 | -- | |

| Shinsky Thomas E | $84,200 | -- | |

| Matson Homes Inc | $19,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Dausch William C | $89,900 | |

| Previous Owner | Shinsky Thomas E | $86,413 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,031 | $198,067 | $0 | $0 |

| 2024 | $2,031 | $186,333 | $0 | $0 |

| 2023 | $1,859 | $174,600 | $58,000 | $116,600 |

| 2022 | $1,859 | $170,567 | $0 | $0 |

| 2021 | $1,042 | $166,533 | $0 | $0 |

| 2020 | $1,875 | $162,500 | $58,000 | $104,500 |

| 2019 | $1,851 | $160,400 | $0 | $0 |

| 2018 | $1,810 | $158,300 | $0 | $0 |

| 2017 | $1,786 | $156,200 | $0 | $0 |

| 2016 | -- | $155,300 | $0 | $0 |

| 2015 | $1,944 | $154,400 | $0 | $0 |

| 2014 | $1,944 | $153,500 | $0 | $0 |

Source: Public Records

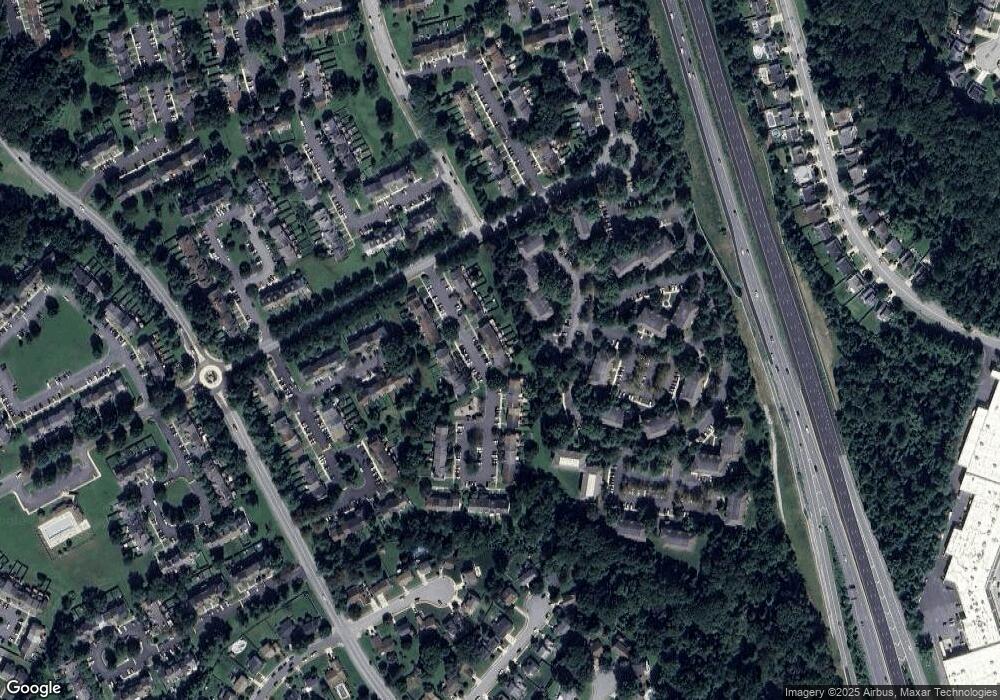

Map

Nearby Homes

- 3402 Tulleys Pointe Ct Unit 1A

- 205 Star Pointe Ct Unit 1D

- 203 Star Pointe Ct Unit 2C

- 201 Star Pointe Ct Unit 1A

- 201 Windmille Pointe Ct Unit 2C

- 203 Crosse Pointe 1d Ct Unit 1D

- 3455 Howell Ct

- 3510 Thomas Pointe Ct Unit 2A

- 3336 Garrison Cir

- 3303 Trellis Ln

- 618 Milford Ct

- 236 Lodgecliff Ct

- 322 Delmar Ct

- 3101 Cardinal Way Unit D

- 3109 Eden Dr

- 463 Crisfield Dr

- 104 Singer Rd

- 425 Foreland Garth

- 455 Deer Hill Cir

- 352 Foreland Garth

Your Personal Tour Guide

Ask me questions while you tour the home.