3430 I St NE Unit J301 Auburn, WA 98002

North Auburn NeighborhoodEstimated Value: $224,000 - $281,000

2

Beds

2

Baths

858

Sq Ft

$308/Sq Ft

Est. Value

About This Home

This home is located at 3430 I St NE Unit J301, Auburn, WA 98002 and is currently estimated at $263,951, approximately $307 per square foot. 3430 I St NE Unit J301 is a home located in King County with nearby schools including Evergreen Heights Elementary School, Cascade Middle School, and Auburn High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 2, 2014

Sold by

Riggins John D and Riggins Maria E

Bought by

Martin Jonathan D and Wang Rui

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Outstanding Balance

$38,257

Interest Rate

3.89%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$225,694

Purchase Details

Closed on

Dec 14, 1994

Sold by

Stephens Herbert S and Stephens Debi L

Bought by

Riggins John D and Riggins Maria E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,750

Interest Rate

7.87%

Purchase Details

Closed on

Mar 10, 1993

Sold by

Stephens C Herbert

Bought by

Stephens Herbert S

Purchase Details

Closed on

Jan 3, 1992

Sold by

Stephens Herbert S

Bought by

Stephens Herbert S and Stephens Herbert C

Purchase Details

Closed on

Aug 6, 1982

Sold by

Barrett William and Barrett Sally

Bought by

S & A Construction Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Martin Jonathan D | $64,000 | First American | |

| Riggins John D | $41,000 | Stewart Title Company | |

| Stephens Herbert S | -- | -- | |

| Stephens Herbert S | -- | -- | |

| S & A Construction Inc | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Martin Jonathan D | $50,000 | |

| Previous Owner | Riggins John D | $30,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,953 | $242,000 | $23,600 | $218,400 |

| 2023 | $3,147 | $249,000 | $23,600 | $225,400 |

| 2022 | $2,595 | $223,000 | $14,200 | $208,800 |

| 2021 | $2,387 | $189,000 | $9,400 | $179,600 |

| 2020 | $2,135 | $164,000 | $9,400 | $154,600 |

| 2018 | $1,727 | $125,000 | $7,500 | $117,500 |

| 2017 | $1,446 | $103,000 | $7,500 | $95,500 |

| 2016 | $1,112 | $85,000 | $7,500 | $77,500 |

| 2015 | $1,009 | $67,000 | $7,500 | $59,500 |

| 2014 | -- | $58,000 | $7,500 | $50,500 |

| 2013 | -- | $45,000 | $7,500 | $37,500 |

Source: Public Records

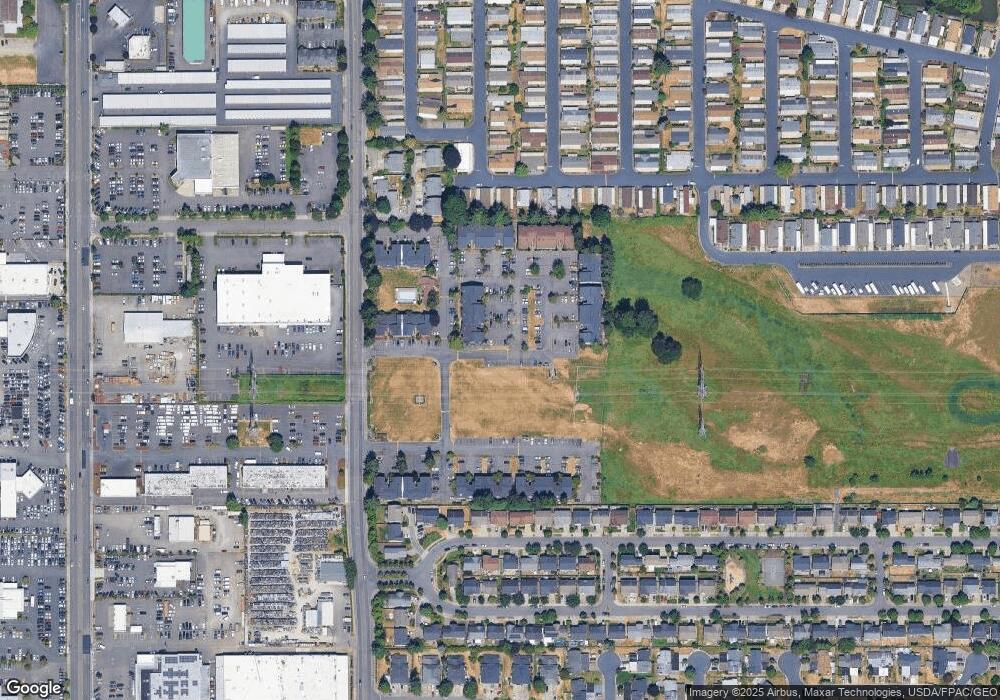

Map

Nearby Homes

- 3430 I St NE Unit J101

- 3402 I St NE Unit H202

- 1162 32nd Place NE

- 3611 I St NE Unit 237

- 3611 I St NE Unit 301

- 3611 I St NE Unit 76

- 3611 I St NE Unit 424

- 3611 I St NE Unit 162

- 3601 I St NE

- 919 30th St NE

- 4217 L Place NE

- 30598 100th Ave SE

- 2205 M St NE Unit A-B

- 10320 SE 304th Place

- 1913 M St NE Unit 1913

- 28202 85th Ave S

- 29022 108th Ave SE

- 10816 SE 292nd St

- 322 XX 108th Place SE

- 1610 M St NE

- 3302 I St NE Unit A204

- 3302 I St NE Unit B301

- 3302 I St NE Unit B204

- 3302 I St NE Unit A101

- 3302 I St NE Unit A202

- 3302 I St NE Unit A-104

- 3430 I St NE Unit J-104

- 3430 I St NE Unit J203

- 3430 I St NE Unit L103

- 3430 I St NE Unit N-203

- 3302 I St NE Unit B101

- 3430 I St NE Unit K301

- 3302 I St NE Unit A304

- 3302 I St NE Unit A103

- 3302 I St NE Unit B-203

- 3302 I St NE Unit A203

- 3302 I St NE Unit B104

- 3302 I St NE Unit A102