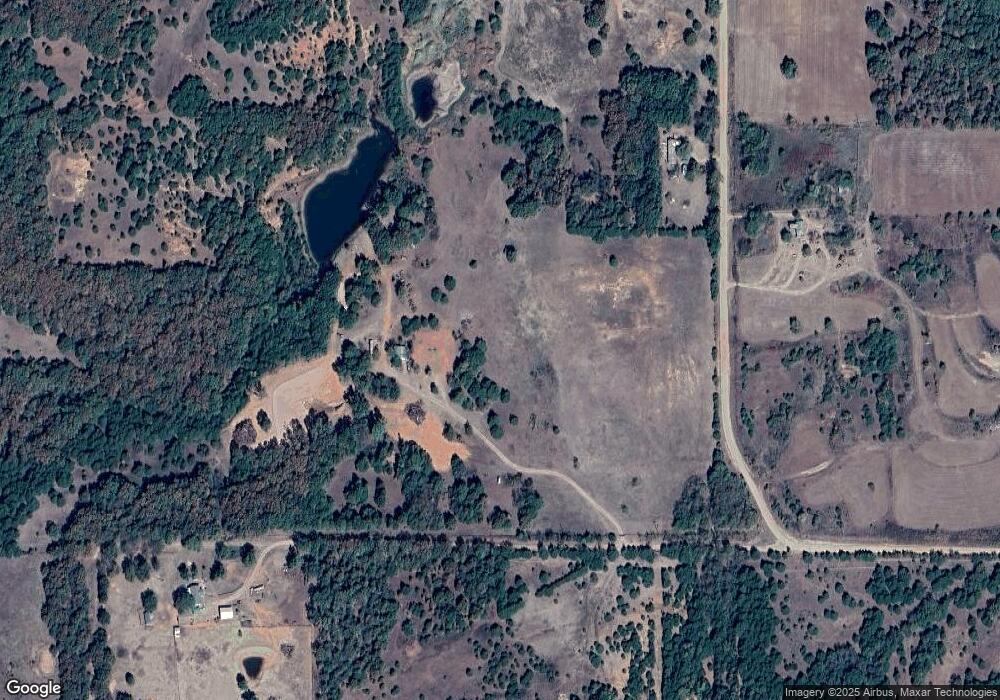

347905 E 840 Rd Stroud, OK 74079

Estimated Value: $591,000

3

Beds

1

Bath

1,760

Sq Ft

$336/Sq Ft

Est. Value

About This Home

This home is located at 347905 E 840 Rd, Stroud, OK 74079 and is currently estimated at $591,000, approximately $335 per square foot. 347905 E 840 Rd is a home located in Lincoln County with nearby schools including Parkview Elementary School, Stroud Middle School, and Stroud High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 3, 2025

Sold by

Jenkins Melissa Gay

Bought by

Jenkins Melissa Gay and Goodmon Melissa Gay

Current Estimated Value

Purchase Details

Closed on

May 12, 2024

Sold by

Tucker Crysta Dawn and Tucker Tyler

Bought by

Goodmon Melissa

Purchase Details

Closed on

May 9, 2024

Sold by

Charkowski Stephanie Danielle and Charkowski Christop

Bought by

Goodmon Melissa

Purchase Details

Closed on

May 8, 2024

Sold by

Goodmon Anthony Paul and Goodmon Chassary

Bought by

Goodmon Melissa

Purchase Details

Closed on

Mar 7, 2022

Sold by

Todd Bishop Jeffrey

Bought by

Effectuate Llc

Purchase Details

Closed on

Mar 26, 2001

Sold by

Goodman Robert L and Paul Go

Bought by

Whom It May Concern

Purchase Details

Closed on

Jul 2, 1984

Sold by

Goodman Robert and Goodman Paul

Bought by

Goodman Paul and Goodman Imogene

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jenkins Melissa Gay | -- | None Listed On Document | |

| Goodmon Melissa | -- | None Listed On Document | |

| Goodmon Melissa | -- | None Listed On Document | |

| Goodmon Melissa | -- | None Listed On Document | |

| Goodmon Melissa | -- | None Listed On Document | |

| Goodmon Melissa | -- | None Listed On Document | |

| Goodmon Melissa | -- | None Listed On Document | |

| Effectuate Llc | -- | None Listed On Document | |

| Whom It May Concern | -- | -- | |

| Goodman Paul | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $279 | $3,117 | $451 | $2,666 |

| 2024 | $213 | $2,492 | $451 | $2,041 |

| 2023 | $213 | $2,492 | $451 | $2,041 |

| 2022 | $213 | $2,517 | $451 | $2,066 |

| 2021 | $215 | $2,517 | $451 | $2,066 |

| 2020 | $327 | $4,869 | $452 | $4,417 |

| 2019 | $333 | $4,869 | $452 | $4,417 |

| 2018 | $330 | $4,869 | $452 | $4,417 |

| 2017 | $340 | $4,869 | $452 | $4,417 |

| 2016 | $312 | $4,869 | $452 | $4,417 |

| 2015 | $321 | $4,869 | $452 | $4,417 |

| 2014 | $297 | $4,869 | $452 | $4,417 |

Source: Public Records

Map

Nearby Homes

- 349076 E 840 Rd

- 0 E Rd

- 349412 E 840 Rd

- 830809 S 3500 Rd

- 840151 S 3450 Rd

- 820895 S 3510 Rd

- 344565 E 840 Rd

- 820895 S County Road 3510

- 0 E 860 Rd

- 344586 E 860 Rd

- 870756 S 3460 Rd

- 0 E 800 Rd Unit 2531968

- 0 E 800 Rd Unit 1202358

- 0 E 800 Rd Unit 1202357

- 760707 S County Road 3520 Rd

- 760243 S County Road 3520 Rd

- 00 E 810 Rd

- 343507-343805 E 810 Rd

- 0 N 3500 Rd

- 0 S 3503 Rd