35 Ancient Oaks Ln Newnan, GA 30263

Estimated Value: $241,000 - $323,000

3

Beds

2

Baths

1,123

Sq Ft

$239/Sq Ft

Est. Value

About This Home

This home is located at 35 Ancient Oaks Ln, Newnan, GA 30263 and is currently estimated at $268,707, approximately $239 per square foot. 35 Ancient Oaks Ln is a home located in Coweta County with nearby schools including Western Elementary School, Evans Middle School, and Newnan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 29, 2017

Sold by

Smith Michael

Bought by

Piney Trails Grp Lllp

Current Estimated Value

Purchase Details

Closed on

Oct 30, 2013

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Smith Michael and Devereaux Danielle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,877

Interest Rate

4.23%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 7, 2013

Sold by

Cenlar Fsb

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Dec 27, 1994

Bought by

Coggin Joseph G

Purchase Details

Closed on

Jul 26, 1994

Bought by

Coggin Joseph G and Coggin Ev

Purchase Details

Closed on

Nov 30, 1984

Bought by

Ancient Oak Farm Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Piney Trails Grp Lllp | $140,000 | -- | |

| Smith Michael | -- | -- | |

| Federal Home Loan Mortgage Corporation | $90,950 | -- | |

| Cenlar Fsb | $90,950 | -- | |

| Coggin Joseph G | $12,000 | -- | |

| Coggin Joseph G | $12,000 | -- | |

| Ancient Oak Farm Inc | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Smith Michael | $118,877 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,791 | $75,821 | $17,600 | $58,221 |

| 2024 | $1,768 | $76,173 | $17,600 | $58,573 |

| 2023 | $1,768 | $64,809 | $17,600 | $47,209 |

| 2022 | $1,527 | $61,994 | $17,600 | $44,394 |

| 2021 | $1,566 | $59,487 | $17,600 | $41,887 |

| 2020 | $1,577 | $59,487 | $17,600 | $41,887 |

| 2019 | $1,526 | $52,124 | $9,726 | $42,398 |

| 2018 | $1,528 | $52,124 | $9,726 | $42,398 |

| 2017 | $1,216 | $46,274 | $9,726 | $36,548 |

| 2016 | $1,204 | $46,274 | $9,726 | $36,548 |

| 2015 | $1,186 | $46,274 | $9,726 | $36,548 |

| 2014 | $1,179 | $46,274 | $9,726 | $36,548 |

Source: Public Records

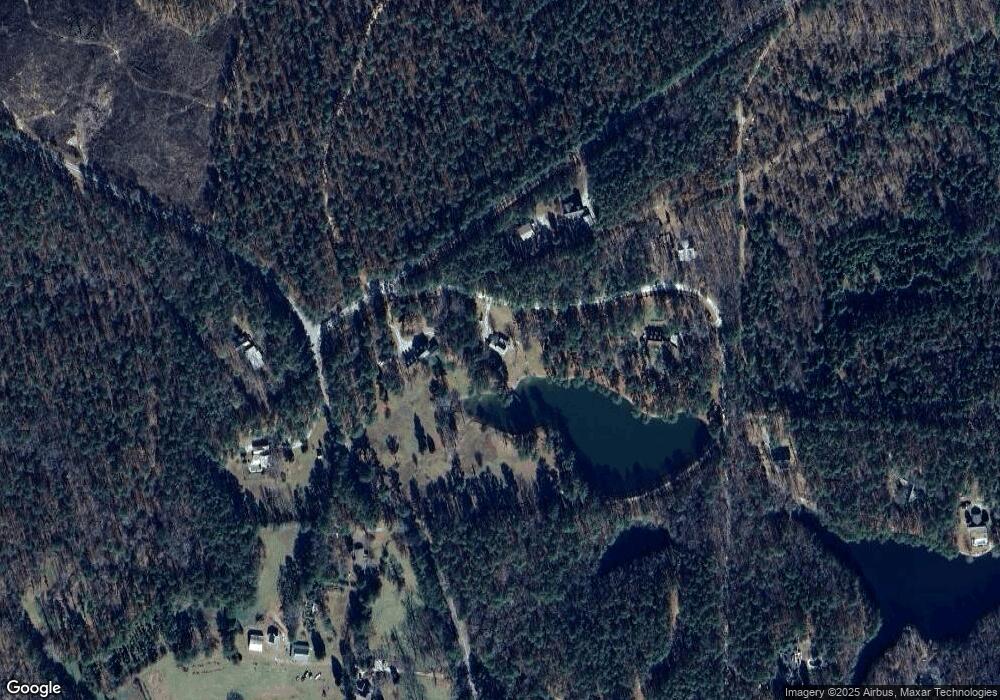

Map

Nearby Homes

- 260 Ancient Oak Ln

- 927 Boy Scout Rd

- 248 Coot White Rd

- 323 Newman Rd

- 4230 Joe Stephens Rd

- 0 Newman Rd Unit 10559645

- 2265 Mount Carmel Rd

- 731 Summers McKoy Rd

- 0 Mount Carmel Rd Unit 10498073

- 0 Margarita Trail Unit 10555337

- 0 Margarita Trail Unit 7607851

- 450 Mckoy Rd

- 92 Twelve Springs Dr

- 134 Rustica Dr

- 4621 Highway 34 W

- 4621 Hwy 34 W

- 97 Welcome Wood Dr

- 0 Thomas Powers Rd Unit 10569332

- 0 Thomas Powers Rd Unit 24228819

- 57 Scout Way

- 35 Ancient Oaks Ln Unit 4

- 35 Ancient Oak Ln Unit 4

- 35 Ancient Oak Ln

- 11 Ancient Oak Ln

- 419 Hewlette South Rd

- 3738 Mount Carmel Rd

- 102 Ancient Oaks Ln

- 102 Ancient Oak Ln

- 0 Bud Davis Rd Unit 8418721

- 0 Bud Davis Rd Unit 8295966

- 0 Bud Davis Rd Unit 3053762

- 0 Bud Davis Rd Unit 3055315

- 0 Bud Davis Rd Unit 3271404

- 0 Bud Davis Rd Unit 7136801

- 0 Bud Davis Rd Unit 7235220

- 0 Bud Davis Rd Unit 7334017

- 0 Bud Davis Rd Unit TRACT16 7376027

- 0 Bud Davis Rd Unit 7420835

- 0 Bud Davis Rd Unit 16 7483377

- 0 Bud Davis Rd Unit 7577400