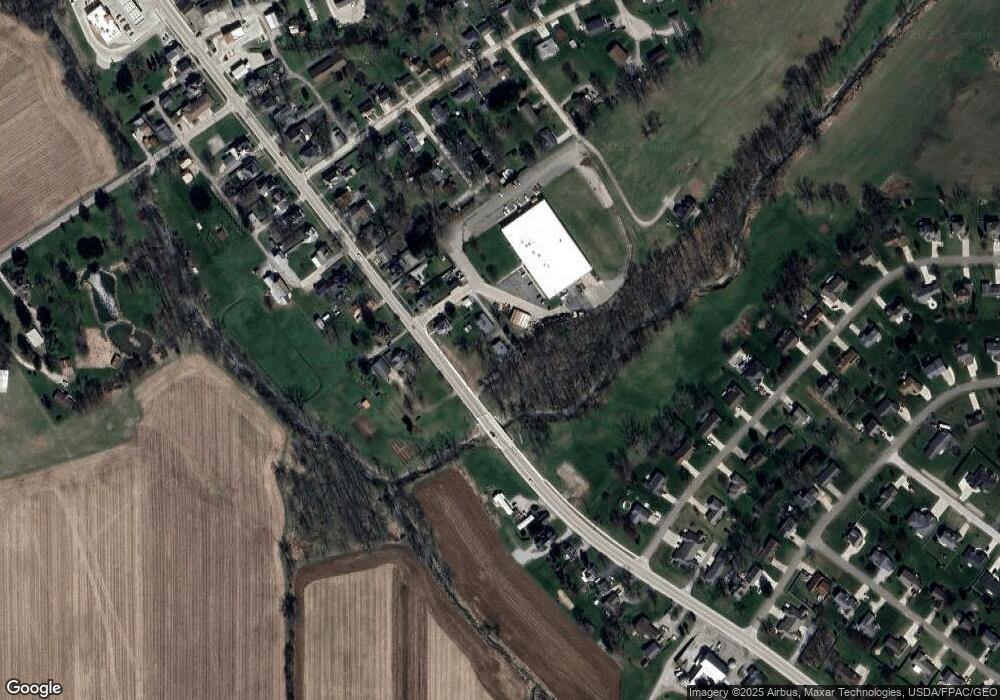

351 E Main St Apple Creek, OH 44606

Estimated Value: $189,086 - $260,000

2

Beds

2

Baths

1,150

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 351 E Main St, Apple Creek, OH 44606 and is currently estimated at $209,772, approximately $182 per square foot. 351 E Main St is a home located in Wayne County with nearby schools including Waynedale High School, Geis Acres School, and IRON WOOD.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 26, 2024

Sold by

Schreiner Jeffery L

Bought by

Schreiner Elliott and Schreiner Aleta

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,000

Outstanding Balance

$142,526

Interest Rate

6.49%

Mortgage Type

New Conventional

Estimated Equity

$67,246

Purchase Details

Closed on

Sep 22, 2024

Sold by

Granger Adam and Granger Angela

Bought by

Schreiner Jeffery L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,000

Outstanding Balance

$142,526

Interest Rate

6.49%

Mortgage Type

New Conventional

Estimated Equity

$67,246

Purchase Details

Closed on

Dec 8, 2009

Sold by

Schreiner Jeffery L and Schreiner Diane

Bought by

Granger Adam and Granger Angela

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,000

Interest Rate

5.11%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Aug 7, 1992

Sold by

Saurer Temple M

Bought by

Schreiner Jeffrey L and Schreiner Pat

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schreiner Elliott | $180,000 | Wayne County Title | |

| Schreiner Elliott | $180,000 | Wayne County Title | |

| Schreiner Jeffery L | -- | None Listed On Document | |

| Schreiner Jeffery L | -- | None Listed On Document | |

| Granger Adam | $109,000 | None Available | |

| Schreiner Jeffrey L | $52,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schreiner Elliott | $144,000 | |

| Closed | Schreiner Elliott | $144,000 | |

| Previous Owner | Granger Adam | $106,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,772 | $47,340 | $19,890 | $27,450 |

| 2023 | $1,772 | $47,340 | $19,890 | $27,450 |

| 2022 | $1,293 | $31,350 | $13,170 | $18,180 |

| 2021 | $1,296 | $31,350 | $13,170 | $18,180 |

| 2020 | $1,310 | $31,350 | $13,170 | $18,180 |

| 2019 | $1,214 | $28,350 | $11,290 | $17,060 |

| 2018 | $1,262 | $28,350 | $11,290 | $17,060 |

| 2017 | $1,225 | $28,350 | $11,290 | $17,060 |

| 2016 | $1,311 | $27,540 | $11,290 | $16,250 |

| 2015 | $1,173 | $27,540 | $11,290 | $16,250 |

| 2014 | $1,180 | $27,540 | $11,290 | $16,250 |

| 2013 | $1,290 | $28,840 | $14,220 | $14,620 |

Source: Public Records

Map

Nearby Homes

- 0 E Main St

- 24 Shannon Dr

- 30 Grange St

- 4622 S Apple Creek Rd

- 250 Church St

- 9554 Dover Rd

- 7445 Ely Rd

- 1993 Barnard Rd

- 3433 Fredericksburg Rd

- 4554 E Moreland Rd

- 5277 Secrest Rd

- 8276 Harrison Rd

- 24 Silver Pond Dr

- 9675 Harrison Rd

- 0 Nonpariel Rd

- 10624 Harrison Rd

- 2477 Pleasant Ridge Rd

- 660 Millborne Rd

- 3306 Sylvan Rd

- 4552 E Lincoln Way