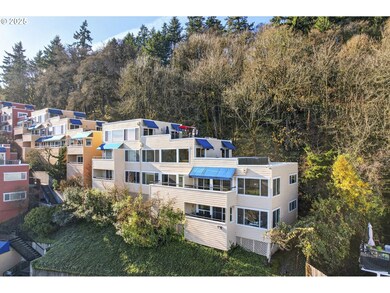

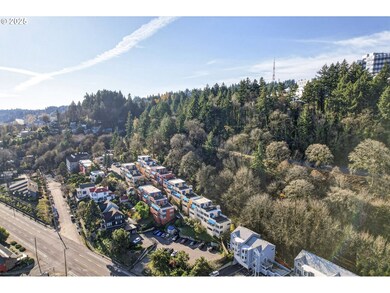

3515 SW Barbur Blvd Unit R2 Portland, OR 97239

Council Crest NeighborhoodEstimated payment $2,650/month

Highlights

- River View

- Built-In Refrigerator

- Deck

- Ainsworth Elementary School Rated A-

- Bluff on Lot

- Contemporary Architecture

About This Home

Live your best Portland life in this cozy condo nestled in a wooded hillside with breathtaking views of downtown, Southeast Portland, the Cascade mountain range, and the Willamette river! Watch the sunrise from your living room and then step outside your door to explore all of the outdoor amenities that the Homestead/Lair Hill area offers. Discover old growth forests and city views by hiking or biking the trails of the Terwilliger Parkway and Marquam Nature Park. Entertain friends and family on your private 384 square foot deck with one of the best views in the city. The open floor plan with lots of windows allows you to fully immerse yourself in this spectacular setting. This unit has fresh paint, new carpeting, and a stacking washer/dryer unit that provides much-needed convenience. The kitchen features slate flooring, a built-in Subzero refrigerator, a Miele dishwasher and a stainless-steel range. Play your favorite beats on the Bose speakers in the ceiling and an additional speaker on the deck. The complex has recently undergone a complete exterior renovation including new siding, exterior paint, vinyl windows and doors. The HOA is currently in the process of replacing the decks and awnings and this unit is on the replacement list. This condo includes an assigned parking spot and a storage unit. Fantastic location just minutes from OHSU, the South Waterfront, downtown, and quick access to I-5, 405, and highway 26. Walk score of 73 and bike score of 69.

Listing Agent

Premiere Property Group, LLC License #200701364 Listed on: 12/03/2025

Property Details

Home Type

- Condominium

Est. Annual Taxes

- $5,998

Year Built

- Built in 1978

Lot Details

- Bluff on Lot

- Sloped Lot

HOA Fees

- $581 Monthly HOA Fees

Property Views

- River

- City

- Mountain

Home Design

- Contemporary Architecture

- Flat Roof Shape

- Cement Siding

Interior Spaces

- 831 Sq Ft Home

- 1-Story Property

- Sound System

- Vinyl Clad Windows

- Sliding Doors

- Family Room

- Living Room

- Dining Room

Kitchen

- Free-Standing Range

- Built-In Refrigerator

- Dishwasher

- Stainless Steel Appliances

- Tile Countertops

- Disposal

Flooring

- Wall to Wall Carpet

- Laminate

- Tile

- Slate Flooring

Bedrooms and Bathrooms

- 2 Bedrooms

- 1 Full Bathroom

Laundry

- Laundry in unit

- Washer and Dryer

Parking

- Garage

- Off-Street Parking

- Deeded Parking

Outdoor Features

- Deck

Location

- Upper Level

- Property is near a bus stop

Schools

- Ainsworth Elementary School

- West Sylvan Middle School

- Lincoln High School

Utilities

- No Cooling

- Zoned Heating

- Electric Water Heater

- Municipal Trash

Listing and Financial Details

- Assessor Parcel Number R100364

Community Details

Overview

- 57 Units

- Abitare Homeowners Association, Phone Number (503) 241-4798

- Homestead Subdivision

- On-Site Maintenance

Amenities

- Community Deck or Porch

- Common Area

- Community Storage Space

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,998 | $222,800 | -- | $222,800 |

| 2024 | $5,782 | $216,320 | -- | $216,320 |

| 2023 | $5,560 | $210,020 | $0 | $210,020 |

| 2022 | $5,440 | $203,910 | $0 | $0 |

| 2021 | $5,348 | $197,980 | $0 | $0 |

| 2020 | $4,906 | $192,220 | $0 | $0 |

| 2019 | $4,726 | $186,630 | $0 | $0 |

| 2018 | $4,587 | $181,200 | $0 | $0 |

| 2017 | $4,396 | $175,930 | $0 | $0 |

| 2016 | $4,023 | $170,810 | $0 | $0 |

| 2015 | $3,918 | $165,840 | $0 | $0 |

| 2014 | $3,858 | $161,010 | $0 | $0 |

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 12/03/2025 12/03/25 | For Sale | $298,000 | -- | $359 / Sq Ft |

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Warranty Deed | $136,000 | Ticor Title | |

| Warranty Deed | $239,000 | First American | |

| Interfamily Deed Transfer | -- | Fidelity Natl Title Co Of Or | |

| Warranty Deed | $160,000 | Fidelity National Title Co |

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Previous Owner | $35,850 | Credit Line Revolving | |

| Previous Owner | $191,200 | Fannie Mae Freddie Mac | |

| Previous Owner | $156,600 | Unknown | |

| Previous Owner | $152,000 | No Value Available |

Source: Regional Multiple Listing Service (RMLS)

MLS Number: 190705068

APN: R100364

- 3515 SW Barbur Blvd Unit P1

- 3515 SW Barbur Blvd Unit N3

- 3515 SW Barbur Blvd Unit S2

- 3515 SW Barbur Blvd Unit Y2

- 3516 SW 1st Ave

- 25 SW Abernethy St

- 3907 SW View Point Terrace

- 3312 SW 1st Ave

- 3328 SW Barbur Blvd Unit 5

- 3840 S Water Ave

- 3614 S Corbett Ave

- 114 S Abernethy St

- 15 S Gibbs St

- 3312 S Corbett Ave

- 0 SW Condor Ave

- 3727 S Hood Ave

- 3906 S Kelly Ave

- 4219 SW Condor Ave

- 4145 S Corbett Ave

- 3204 S Kelly Ave

- 3405 SW Barbur Blvd Unit B

- 3610 S Kelly Ave

- 3029 S Water Ave Unit ID1309888P

- 2926 SW 4th Ave

- 3883 S Moody Ave

- 650 S Gaines St

- 3833 SW Bond Ave

- 3155 S Moody Ave

- 677 S Lowell St

- 3720 SW Bond Ave

- 3601 S River Pkwy Unit 1606

- 3601 S River Pkwy Unit 433

- 3850 S Bond Ave

- 3440 SW Us Veterans Hospital Rd

- 3323 SW US Veterans Hospital Rd Unit 3323

- 3570 S River Pkwy

- 3736 SW 10th Ave Unit 1

- 3750 S River Pkwy

- 3820 S River Pkwy

- 3521-1019 SW 10th Ave Unit 1013