Estimated Value: $476,000 - $543,000

2

Beds

3

Baths

1,300

Sq Ft

$386/Sq Ft

Est. Value

About This Home

This home is located at 3521 N Fox Run Unit 804, Eden, UT 84310 and is currently estimated at $501,656, approximately $385 per square foot. 3521 N Fox Run Unit 804 is a home located in Weber County with nearby schools including Valley Elementary School, Snowcrest Junior High School, and Weber High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2018

Sold by

Lowe Nicky

Bought by

Sparks Brian and Sparks Kristin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,000

Outstanding Balance

$186,742

Interest Rate

4.6%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$314,914

Purchase Details

Closed on

Jul 28, 2010

Sold by

Williams Lawrence Frederick and Bootcheck Monica Ann

Bought by

Rodes Oscar D and Rodes Patricia K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

4.04%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 11, 2005

Sold by

Lewis Homes Inc

Bought by

Williams Lawrence Frederick and Bootcheck Monica Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,000

Interest Rate

7.75%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sparks Brian | -- | None Available | |

| Rodes Oscar D | -- | Metro National Title | |

| Williams Lawrence Frederick | -- | Metro National Title Ogden |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sparks Brian | $215,000 | |

| Previous Owner | Rodes Oscar D | $120,000 | |

| Previous Owner | Williams Lawrence Frederick | $212,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,448 | $456,153 | $170,000 | $286,153 |

| 2024 | $2,478 | $471,000 | $170,000 | $301,000 |

| 2023 | $2,473 | $464,000 | $150,000 | $314,000 |

| 2022 | $2,387 | $456,000 | $150,000 | $306,000 |

| 2021 | $1,856 | $328,000 | $100,000 | $228,000 |

| 2020 | $1,721 | $279,000 | $70,000 | $209,000 |

| 2019 | $2,935 | $252,000 | $65,000 | $187,000 |

| 2018 | $2,649 | $218,000 | $65,000 | $153,000 |

| 2017 | $2,171 | $174,000 | $60,000 | $114,000 |

| 2016 | $1,919 | $151,429 | $60,000 | $91,429 |

| 2015 | $1,876 | $146,429 | $55,000 | $91,429 |

| 2014 | $1,919 | $146,429 | $55,000 | $91,429 |

Source: Public Records

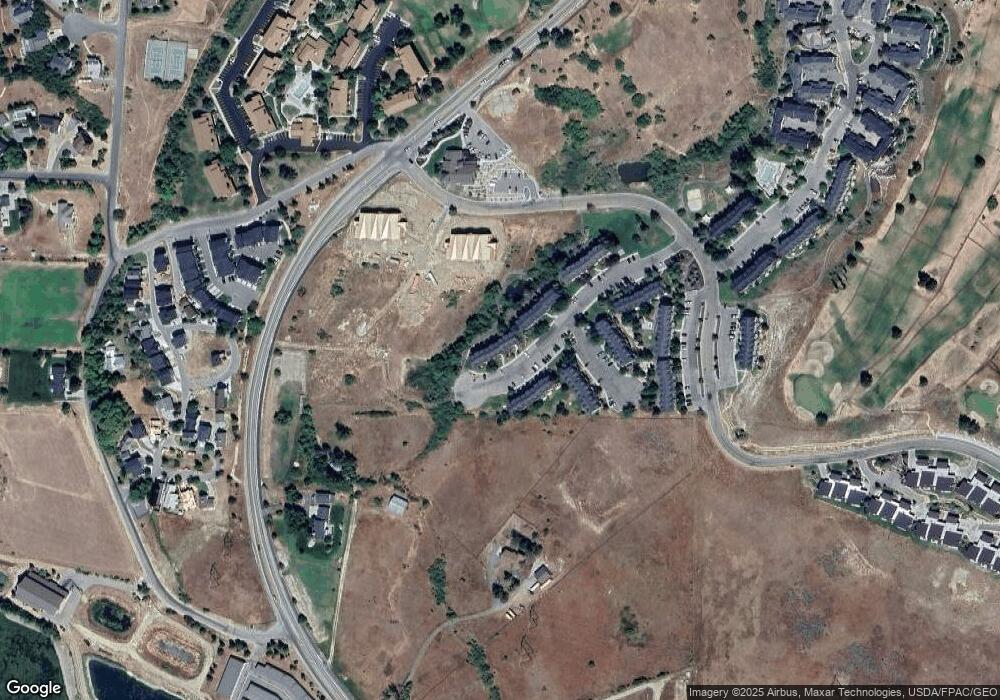

Map

Nearby Homes

- 3521 N Fox Run Dr Unit 806

- 3521 N Fox Run Dr Unit 803

- 3521 N Fox Run Unit 812

- 3521 N Fox Run Unit 811

- 5060 Lakeview Dr Unit 1105

- 3562 N Fox Run Dr Unit 403

- 3562 N Fox Run Dr Unit 406

- 5060 E Lakeview Dr Unit 1109

- 5060 E Lakeview Dr Unit 1108

- 3521 N Moosehollow Dr Unit 1202

- 3615 N Wolf Creek Dr Unit 709

- 3615 N Wolf Lodge Dr Unit 211

- 3615 N Wolf Lodge Dr Unit 402

- 3615 N Wolf Lodge Dr Unit 103

- 3615 N Wolf Dr Unit 309

- 3615 N Wolf Lodge Dr Unit 805

- 3615 N Wolf Dr Unit 804

- 3518 Moosehollow Dr

- 3518 Moosehollow Dr Unit 1406

- 3480 N 5100 E

- 3521 N Fox Run Unit 803

- 3521 N Fox Run Unit 805

- 3521 N Fox Run Unit 808

- 3521 N Fox Run Unit 810

- 3521 N Fox Run Unit 802

- 3521 N Fox Run Dr

- 3537 N Fox Run Unit 703

- 3537 N Fox Run Unit 701

- 3537 N Fox Run Unit 704

- 3537 N Fox Run Unit 710

- 3537 N Fox Run Unit 702

- 3537 N Fox Run Unit 707

- 3537 N Fox Run Unit 712

- 3537 N Fox Run Unit 711

- 3537 N Fox Run Unit 705

- 3537 N Fox Run Unit 708

- 3537 N Fox Run Unit 709

- 3537 N Fox Run Unit 706

- 3521 N Fox Run

- 3521 N Fox Run Unit 802