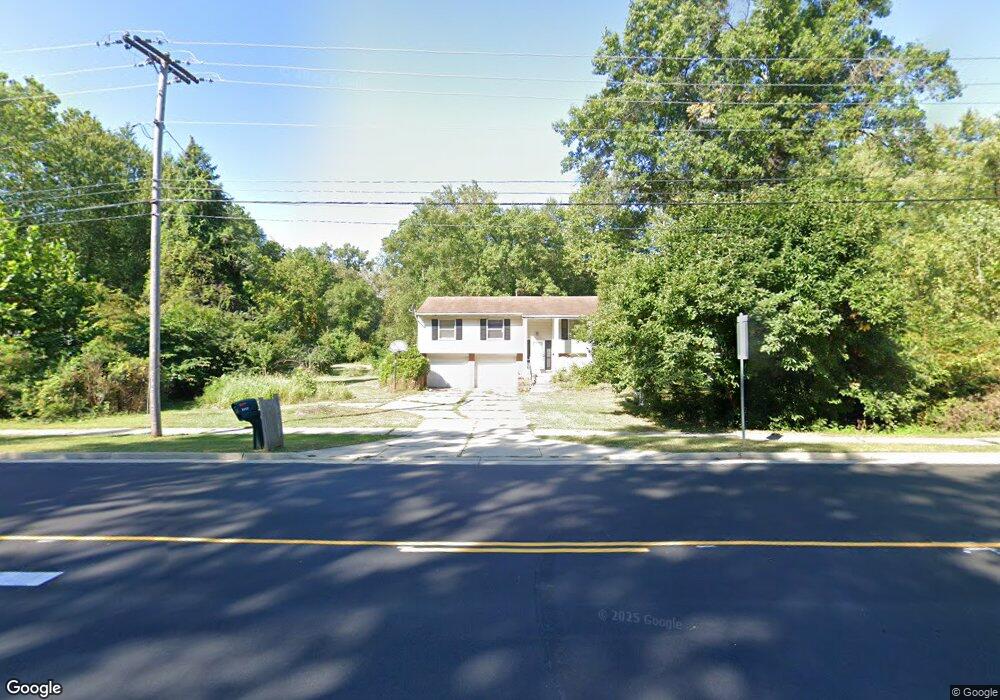

3527 N Mccord Rd Toledo, OH 43617

Estimated Value: $230,000 - $283,841

3

Beds

2

Baths

1,634

Sq Ft

$160/Sq Ft

Est. Value

About This Home

This home is located at 3527 N Mccord Rd, Toledo, OH 43617 and is currently estimated at $261,710, approximately $160 per square foot. 3527 N Mccord Rd is a home located in Lucas County with nearby schools including Stranahan Elementary School, Sylvania Timberstone Junior High School, and Sylvania Southview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 1, 2025

Sold by

Glover Wanda M and Glover Albert

Bought by

Crosby James and Gombash Mary

Current Estimated Value

Purchase Details

Closed on

Mar 27, 2023

Sold by

Glover Wanda M

Bought by

Glover Wanda M and Glover Ceana M

Purchase Details

Closed on

Mar 25, 2009

Sold by

Glover Wanda and Glover Albert L

Bought by

Board Of Lucas County Ohio Commissioners

Purchase Details

Closed on

Dec 18, 2007

Sold by

Peabody Karen and Glover Wanda

Bought by

Peabody Karen and Glover Wanda

Purchase Details

Closed on

Oct 9, 2007

Sold by

Estate Of Lester G Peabody

Bought by

Glover Wanda and Peabody Karen M

Purchase Details

Closed on

Dec 7, 2004

Sold by

Estate Of Pauline Peabody

Bought by

Peabody Lester G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Crosby James | $188,000 | Liberty Title | |

| Glover Wanda M | -- | None Listed On Document | |

| Board Of Lucas County Ohio Commissioners | $2,924 | None Available | |

| Board Of Lucas County Ohio Commissioners | $2,924 | None Available | |

| Peabody Karen | -- | Attorney | |

| Glover Wanda | -- | None Available | |

| Peabody Lester G | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,578 | $79,800 | $27,405 | $52,395 |

| 2023 | $3,567 | $56,280 | $24,500 | $31,780 |

| 2022 | $3,597 | $56,280 | $24,500 | $31,780 |

| 2021 | $4,347 | $56,280 | $24,500 | $31,780 |

| 2020 | $4,754 | $54,565 | $23,730 | $30,835 |

| 2019 | $4,580 | $54,565 | $23,730 | $30,835 |

| 2018 | $4,983 | $54,565 | $23,730 | $30,835 |

| 2017 | $5,832 | $63,420 | $29,855 | $33,565 |

| 2016 | $5,720 | $181,200 | $85,300 | $95,900 |

| 2015 | $5,395 | $181,200 | $85,300 | $95,900 |

| 2014 | $5,134 | $60,970 | $28,700 | $32,270 |

| 2013 | $5,134 | $60,970 | $28,700 | $32,270 |

Source: Public Records

Map

Nearby Homes

- 6606 Blossman Rd

- 3507 Indian Oaks Ln

- 3302 Zone Ave

- 3757 N Mccord Rd

- 3330 Wilford Dr

- 3655 Woodspring Rd

- 3800 Harrowsfield Rd

- 6243 Bonsels Pkwy

- 6537 Woodhall Dr Unit 8

- 4022 Stonehenge Dr Unit 4022

- 2822 Page Lindsay Ln

- 6657 Margate Blvd Unit 3

- 21 Shenandoah Cir

- 22 Shenandoah Cir

- 6537 Abbey Run Unit D5

- 6830 Carrietowne Ln Unit 6830

- 6554 Abbey Run Unit 5

- 6718 5th Ave Unit F

- 6636 Kingsbridge Dr Unit 4

- 6626 Kingsbridge Dr Unit 4

- 3501 N Mccord Rd

- 3541 N Mccord Rd

- 3516 N Mccord Rd

- 3504 N Mccord Rd

- 3540 N Mccord Rd

- 3452 N Mccord Rd

- 6648 Blossman Rd

- 3521 Zone Ave

- 3527 Zone Ave

- 3509 Zone Ave

- 3503 Zone Ave

- 3451 Zone Ave

- 3434 N Mccord Rd

- 6642 Blossman Rd

- 3611 Swallow Tail Ln

- 3608 Swallow Tail Ln

- 3439 Zone Ave

- 3621 N Mccord Rd

- 3427 N Mccord Rd

- 3433 Zone Ave