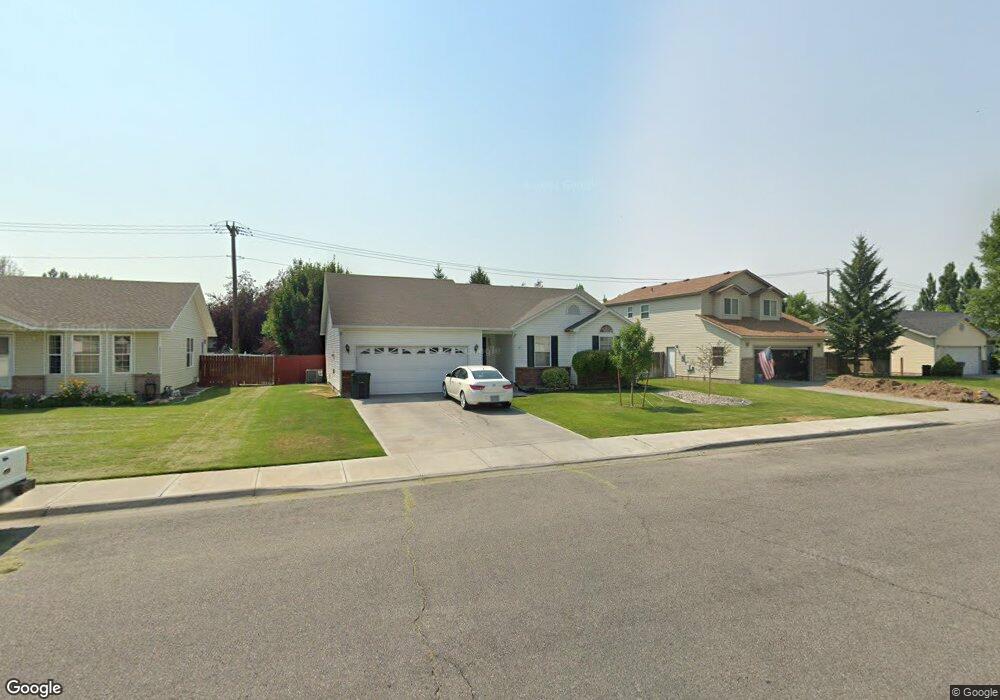

3548 Shadow Mountain Trail Idaho Falls, ID 83404

Estimated Value: $396,636 - $434,000

5

Beds

3

Baths

2,430

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 3548 Shadow Mountain Trail, Idaho Falls, ID 83404 and is currently estimated at $417,409, approximately $171 per square foot. 3548 Shadow Mountain Trail is a home located in Bonneville County with nearby schools including Edgemont Gardens Elementary School, Taylorview Middle School, and Idaho Falls Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2015

Sold by

Reyes Matthew D and Reyes Carly M

Bought by

Brentnall Terry

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,400

Outstanding Balance

$109,858

Interest Rate

3.64%

Mortgage Type

New Conventional

Estimated Equity

$307,551

Purchase Details

Closed on

Aug 19, 2011

Sold by

Blair Boyd F

Bought by

Reyes Mathew D and Reyes Carly M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,817

Interest Rate

4.4%

Mortgage Type

FHA

Purchase Details

Closed on

May 26, 2005

Sold by

Blair Boyd F

Bought by

Families Are Forever Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,400

Interest Rate

6.5%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brentnall Terry | -- | None Available | |

| Reyes Mathew D | -- | -- | |

| Families Are Forever Trust | -- | -- | |

| Blair Boyd F | -- | None Available | |

| Blair Boyd F | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brentnall Terry | $142,400 | |

| Previous Owner | Reyes Mathew D | $160,817 | |

| Previous Owner | Blair Boyd F | $110,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,281 | $402,020 | $53,365 | $348,655 |

| 2024 | $3,281 | $386,690 | $44,460 | $342,230 |

| 2023 | $3,089 | $327,880 | $44,460 | $283,420 |

| 2022 | $3,560 | $295,015 | $38,675 | $256,340 |

| 2021 | $2,837 | $208,485 | $38,675 | $169,810 |

| 2019 | $1,579 | $182,550 | $34,120 | $148,430 |

| 2018 | $1,552 | $175,042 | $25,302 | $149,740 |

| 2017 | $1,390 | $163,482 | $25,302 | $138,180 |

| 2016 | $1,460 | $147,615 | $19,295 | $128,320 |

| 2015 | $1,424 | $150,875 | $18,405 | $132,470 |

| 2014 | $47,767 | $150,875 | $18,405 | $132,470 |

| 2013 | -- | $142,765 | $18,405 | $124,360 |

Source: Public Records

Map

Nearby Homes

- 3508 Chimney Peak

- 802 E Sunnyside Rd Unit 303

- 802 E Sunnyside Rd Unit 203

- 802 E Sunnyside Rd Unit 301

- 802 E Sunnyside Rd Unit 103

- 802 E Sunnyside Rd Unit 201

- 802 E Sunnyside Rd Unit 101

- 3471 Spring Creek Dr

- 794 E Sunnyside Rd Unit 3

- 804 E Sunnyside Rd Unit 1

- 804 E Sunnyside Rd Unit 3

- 3079 Sandstone Dr

- 1427 Elk Creek Dr

- 3244 Chaparral Dr

- 706 Thicket Way

- 2962 Tipperary Ln

- 3131 Escalante Ave

- 3453 Sun Cir

- 5622 Glass Mountain Blvd

- 2921 Disney Dr

- 3548 Shadow Mountain Trail

- 3564 Shadow Mountain Trail

- 15 Sand Creek St

- 3524 Shadow Mountain Trail

- 3551 Dairy Ln

- 3506 Shadow Mountain Trail

- 3541 Shadow Mountain Trail

- 3583 Dairy Ln

- 1095 Wheatstone Dr

- 3563 Shadow Mountain Trail

- 3525 Dairy Ln

- 3519 Shadow Mountain Trail

- 3501 Shadow Mountain Trail

- 3484 Shadow Mountain Trail

- 0 Dairy Ln

- 0 Dairy Ln

- 1081 Wheatstone Dr

- 3475 Shadow Mountain Trail

- 3516 Chimney Peak

- 3466 Shadow Mountain Trail