3553 Sylvan Pines Cir Unit 32 Bremerton, WA 98310

Estimated Value: $334,000 - $393,000

3

Beds

2

Baths

1,480

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 3553 Sylvan Pines Cir Unit 32, Bremerton, WA 98310 and is currently estimated at $367,886, approximately $248 per square foot. 3553 Sylvan Pines Cir Unit 32 is a home located in Kitsap County with nearby schools including Armin Jahr Elementary School, Mountain View Middle School, and Bremerton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 9, 2018

Sold by

Olson I Su

Bought by

Alexander Lorene

Current Estimated Value

Purchase Details

Closed on

Oct 5, 2018

Sold by

Olson I Su

Bought by

Alexander Lorene

Purchase Details

Closed on

Jul 14, 2014

Sold by

Judd Ralph

Bought by

Olson I Su and Olson John W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

4.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 1, 2009

Sold by

Williams Judith M and Grose Ronald

Bought by

Judd Ralph and Judd Sarah

Purchase Details

Closed on

Mar 25, 1999

Sold by

Housing Authority Of City Of Bremerton

Bought by

Grose Martha I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,000

Interest Rate

6.73%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alexander Lorene | $120,000 | Land Title | |

| Alexander Lorene | $120,000 | Land Title | |

| Olson I Su | $155,280 | Pacific Northwest Title | |

| Judd Ralph | $188,280 | Pacific Nw Title | |

| Grose Martha I | -- | Transnation Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Olson I Su | $100,000 | |

| Previous Owner | Grose Martha I | $45,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $2,542 | $293,750 | $91,040 | $202,710 |

| 2025 | $2,542 | $293,750 | $91,040 | $202,710 |

| 2024 | $2,452 | $293,750 | $91,040 | $202,710 |

| 2023 | $2,535 | $293,750 | $91,040 | $202,710 |

| 2022 | $2,349 | $244,980 | $75,870 | $169,110 |

| 2021 | $2,078 | $198,410 | $48,230 | $150,180 |

| 2020 | $1,940 | $185,380 | $44,970 | $140,410 |

| 2019 | $1,682 | $166,940 | $40,410 | $126,530 |

| 2018 | $2,060 | $158,200 | $34,300 | $123,900 |

| 2017 | $2,023 | $158,200 | $34,300 | $123,900 |

| 2016 | $1,877 | $139,050 | $30,090 | $108,960 |

| 2015 | $1,284 | $94,630 | $30,470 | $64,160 |

| 2014 | -- | $91,160 | $30,470 | $60,690 |

| 2013 | -- | $97,350 | $32,610 | $64,740 |

Source: Public Records

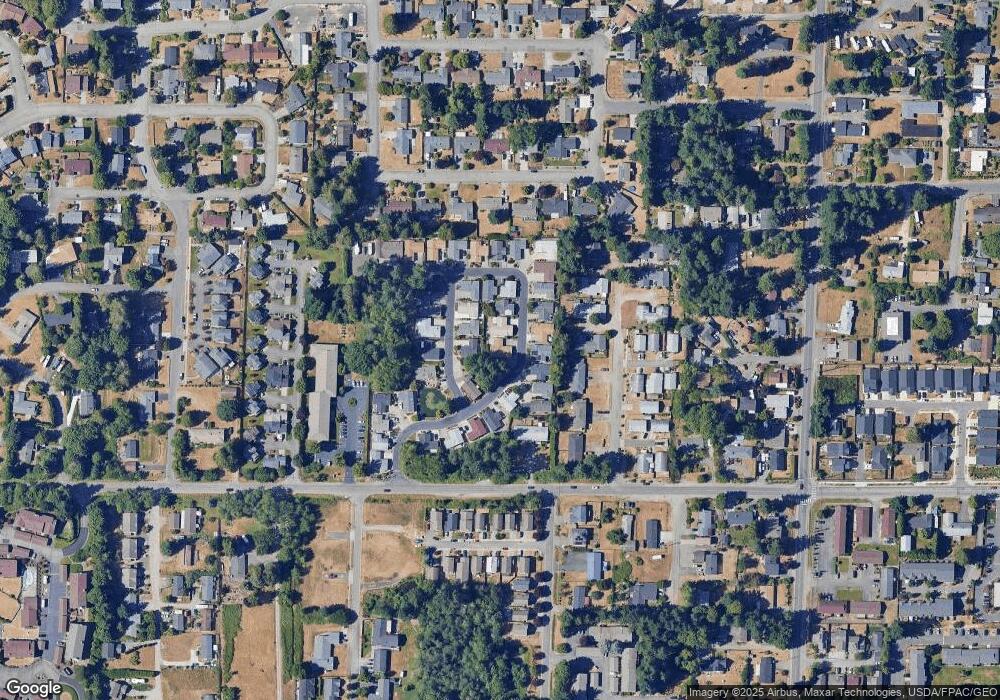

Map

Nearby Homes

- 223 Alnus Way

- 3400 Narrows View Ln NE Unit 204

- 3868 Pinecone Dr NE

- 3560 Narrows View Ln NE Unit 5-201

- 3560 Narrows View Ln NE Unit 202

- 3835 Earendale Ave

- 3340 Narrows View Ln NE Unit 103

- 3340 Narrows View Ln NE Unit 203

- 414 E 31st St

- 638 Shirehill St

- 654 E 31st St

- 3023 Pawnee Dr

- 3347 Amak Ln

- 802 Hanford Ave

- 4 Sulphur Springs Ln

- 937 Pearl St

- 3585 Sulphur Springs Ln

- 3573 Sulphur Springs Ln

- 0 XXX Tracyton Beach Rd NW

- 0 Tracyton Beach Rd NW

- 3557 Sylvan Pines Cir

- 3554 Sylvan Pines Ln Unit 40

- 3559 Sylvan Pines Cir

- 3558 Sylvan Pines Ln Unit 39

- 3561 Sylvan Pines Cir

- 3548 Sylvan Pines Cir

- 3556 Sylvan Pines Cir Unit 15

- 3538 Sylvan Pines Ln Unit 31

- 3560 Sylvan Pines Cir

- 3544 Sylvan Pines Cir

- 3580 Sylvan Pines Cir

- 3565 Sylvan Pines Cir

- 3566 Sylvan Pines Ln Unit 37

- 3540 Sylvan Pines Cir Unit 11

- 3532 Sylvan Pines Cir Unit 9

- 3551 Sylvan Pines Ln Unit 30

- 3564 Sylvan Pines Cir

- 3555 Sylvan Pines Ln

- 3559 Sylvan Pines Ln Unit 28

- 3528 Sylvan Pines Cir Unit 8