3568 Shadetree Dr Unit 3568 Dayton, OH 45431

Estimated Value: $221,983 - $232,000

3

Beds

3

Baths

1,453

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 3568 Shadetree Dr Unit 3568, Dayton, OH 45431 and is currently estimated at $227,496, approximately $156 per square foot. 3568 Shadetree Dr Unit 3568 is a home located in Greene County with nearby schools including Shaw Elementary School, Jacob Coy Middle School, and Beavercreek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 23, 2015

Sold by

Medina Moises Z

Bought by

Stubbs Cameron and Stubbs Milagross

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,010

Outstanding Balance

$111,198

Interest Rate

3.86%

Mortgage Type

VA

Estimated Equity

$116,298

Purchase Details

Closed on

Jan 25, 2006

Sold by

Turinetti Joel and Turinetti Robin

Bought by

Medina Moises Z

Purchase Details

Closed on

Feb 25, 2003

Sold by

Charles V Simms Development Corp

Bought by

Turinetti Joel and Turinetti Robin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,357

Interest Rate

6%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stubbs Cameron | $140,000 | Attorney | |

| Medina Moises Z | $140,000 | None Available | |

| Turinetti Joel | $152,800 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stubbs Cameron | $143,010 | |

| Previous Owner | Turinetti Joel | $149,357 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,341 | $65,190 | $7,000 | $58,190 |

| 2023 | $4,341 | $65,190 | $7,000 | $58,190 |

| 2022 | $3,778 | $50,080 | $7,000 | $43,080 |

| 2021 | $3,703 | $50,080 | $7,000 | $43,080 |

| 2020 | $3,731 | $50,080 | $7,000 | $43,080 |

| 2019 | $3,225 | $39,520 | $7,000 | $32,520 |

| 2018 | $2,854 | $39,520 | $7,000 | $32,520 |

| 2017 | $2,807 | $39,520 | $7,000 | $32,520 |

| 2016 | $3,167 | $42,470 | $7,000 | $35,470 |

| 2015 | $2,442 | $42,470 | $7,000 | $35,470 |

| 2014 | $2,405 | $42,470 | $7,000 | $35,470 |

Source: Public Records

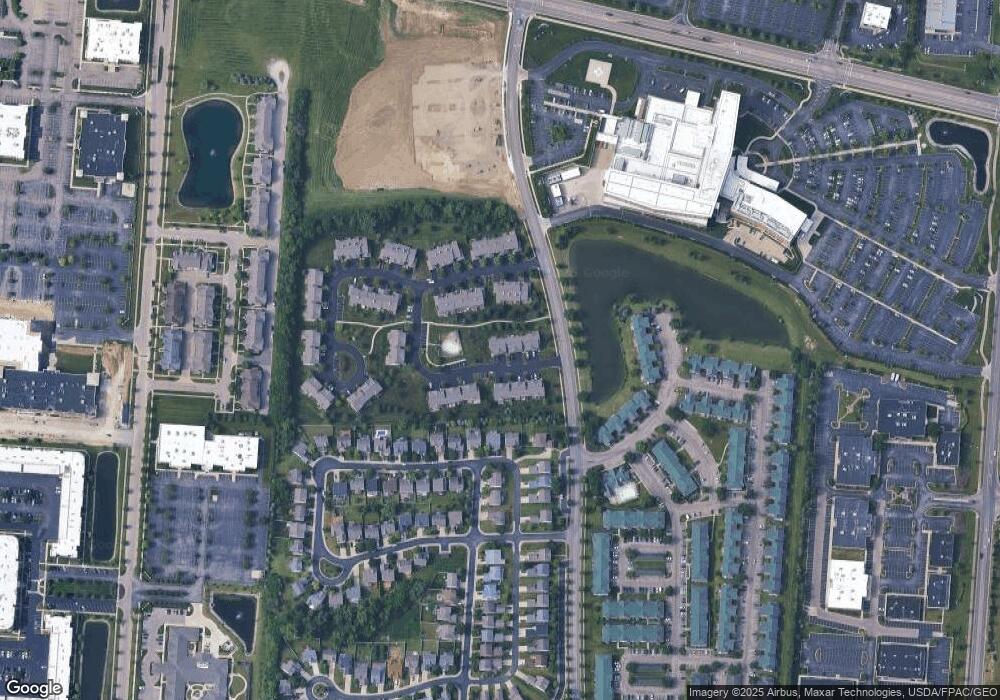

Map

Nearby Homes

- 2690 Gardenia Ave Unit 6

- 3752 Grant Ave Unit P

- 3611 King Edward Way

- 3602 Queen Victoria Ct

- 2745 Golden Leaf Dr Unit 18-303

- 2699 Golden Leaf Dr Unit 19-203

- 2402 Spicer Dr

- 2341 S Old Oaks Dr

- 2340 Fieldstone Cir

- 3976 Graham Dr

- 3951 La Bonne Rd

- 3125 Crestmont Ln Unit 101

- 2998 Warner Dr

- 4124 Rosehill Dr

- 4116 Rushton Dr

- 2548 Hillsdale Dr

- 2629 Morning Sun Dr

- 3331 Home Acres Ave

- 2982 Idaho Falls Dr

- 3653 Knollwood Dr

- 3566 Shadetree Dr Unit 3560

- 3564 Shadetree Dr Unit 3560

- 3562 Shadetree Dr Unit 3560

- 3560 Shadetree Dr Unit 3560

- 3569 Shadetree Dr Unit 63569

- 3567 Shadetree Dr Unit 3567

- 3558 Shadetree Dr Unit 53558

- 3565 Shadetree Dr Unit 63565

- 3563 Shadetree Dr Unit 3563

- 3577 Shadetree Dr Unit 73577

- 3579 Shadetree Dr Unit 73579

- 3561 Shadetree Dr Unit 63561

- 3559 Shadetree Dr Unit 3559

- 3583 Shadetree Dr Unit 73583

- 3583 Shadetree Dr

- 3573 Sequoia Dr Unit 3573

- 3571 Sequoia Dr Unit 3571

- 3575 Sequoia Dr Unit 3575

- 3563 Sequoia Dr Unit 3563

- 3581 Shadetree Dr Unit 73581