357 Sycamore Ridge Way Unit 4th Columbus, OH 43230

Estimated Value: $331,327 - $365,000

3

Beds

4

Baths

1,567

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 357 Sycamore Ridge Way Unit 4th, Columbus, OH 43230 and is currently estimated at $348,332, approximately $222 per square foot. 357 Sycamore Ridge Way Unit 4th is a home located in Franklin County with nearby schools including Jefferson Elementary School, Gahanna East Middle School, and Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 17, 2018

Sold by

Welsh Scott

Bought by

Sunderman Pamela

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,500

Outstanding Balance

$149,315

Interest Rate

3.99%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$199,017

Purchase Details

Closed on

May 13, 2005

Sold by

Fannie Mae

Bought by

Welsh Scott

Purchase Details

Closed on

Jun 17, 2004

Sold by

Oberrath Curtis C

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Jul 30, 1999

Sold by

The Stonehenge Company

Bought by

Oberrath Curtis C and Lyons Nina L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,350

Interest Rate

7.68%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sunderman Pamela | $201,000 | World Class Title Agency Of | |

| Welsh Scott | $194,000 | Title First | |

| Federal National Mortgage Association | $140,000 | -- | |

| Oberrath Curtis C | $174,300 | Stewart Title Agency Of Colu |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sunderman Pamela | $175,500 | |

| Previous Owner | Oberrath Curtis C | $139,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,597 | $95,000 | $20,830 | $74,170 |

| 2023 | $5,526 | $94,990 | $20,825 | $74,165 |

| 2022 | $5,442 | $72,870 | $14,070 | $58,800 |

| 2021 | $5,263 | $72,870 | $14,070 | $58,800 |

| 2020 | $5,219 | $72,870 | $14,070 | $58,800 |

| 2019 | $4,359 | $60,730 | $11,730 | $49,000 |

| 2018 | $4,184 | $60,730 | $11,730 | $49,000 |

| 2017 | $4,019 | $60,730 | $11,730 | $49,000 |

| 2016 | $4,038 | $55,830 | $11,800 | $44,030 |

| 2015 | $4,041 | $55,830 | $11,800 | $44,030 |

| 2014 | $4,010 | $55,830 | $11,800 | $44,030 |

| 2013 | $1,991 | $55,825 | $11,795 | $44,030 |

Source: Public Records

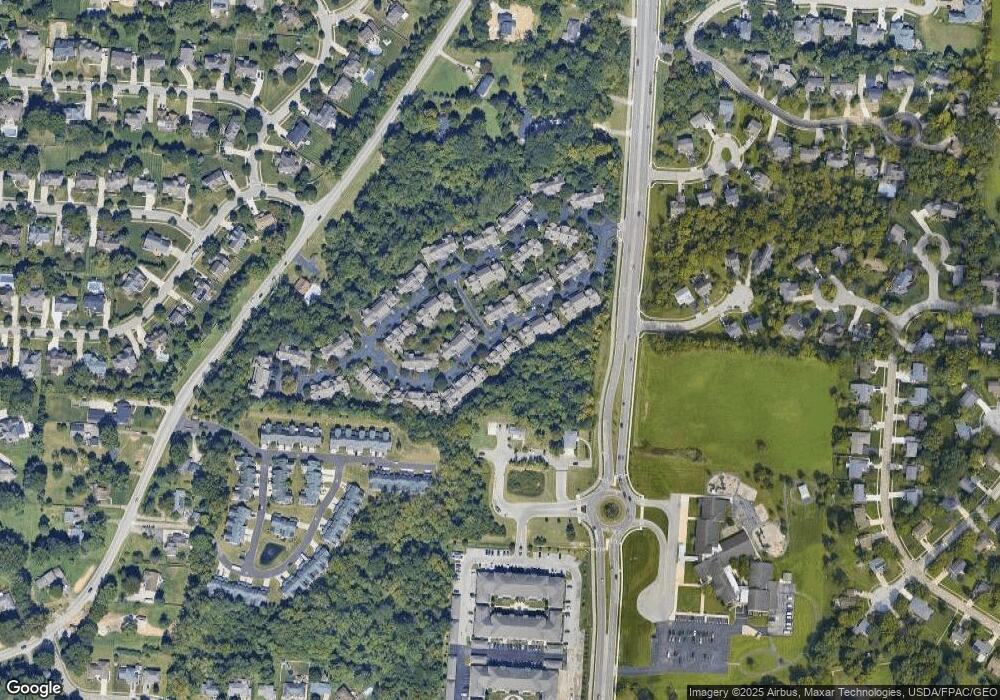

Map

Nearby Homes

- 365 Sycamore Woods Ln Unit 365

- 302 Zander Ln Unit 302

- 211 Crossing Creek N

- 641 Sycamore Mill Dr

- 657 Picadilly Ct

- 804 Riva Ridge Blvd

- 108 Walcreek Dr W

- 638 Churchill Dr

- 4220 E Johnstown Rd

- 219 N Hamilton Rd

- 206 Lintner St

- 111 Nob Hill Dr N

- 0 Beecher Crossing

- 488 Three Oaks Ct Unit 488

- 642 Ridenour Rd

- 777 Dark Star Ave

- 900 Old Pine Dr

- 4574 N Hamilton Rd

- 135 Serran Dr

- 148 Sierra Dr

- 357 Sycamore Ridge Way Unit 357

- 355 Sycamore Ridge Way Unit 355

- 359 Sycamore Ridge Way Unit 359

- 353 Sycamore Ridge Way Unit 353

- 362 Sycamore Ridge Way Unit 362

- 362 Sycamore Ridge Way Unit 4th

- 369 Sycamore Ridge Way Unit 369

- 346 Sycamore Ridge Way Unit 346

- 344 Sycamore Ridge Way Unit 344

- 360 Sycamore Ridge Way Unit 360

- 360 Sycamore Ridge Way Unit 4th

- 342 Sycamore Ridge Way Unit 342

- 371 Sycamore Ridge Way Unit 371

- 351 Sycamore Ridge Way Unit 351

- 351 Sycamore Ridge Way Unit 4th

- 364 Sycamore Ridge Way Unit 36423

- 373 Sycamore Ridge Way Unit 373

- 349 Sycamore Ridge Way Unit 349

- 340 Sycamore Ridge Way Unit 340

- 347 Sycamore Ridge Way Unit 347