359 Crippled Oak Trail Unit 240 Jasper, GA 30143

Estimated Value: $437,981 - $518,000

3

Beds

2

Baths

2,257

Sq Ft

$216/Sq Ft

Est. Value

About This Home

This home is located at 359 Crippled Oak Trail Unit 240, Jasper, GA 30143 and is currently estimated at $488,245, approximately $216 per square foot. 359 Crippled Oak Trail Unit 240 is a home located in Pickens County with nearby schools including Tate Elementary School, Pickens County Middle School, and Pickens County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 14, 2017

Sold by

Osbelt Gary R

Bought by

George Ross Bryan and George Dickie Marie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$214,400

Outstanding Balance

$178,228

Interest Rate

3.91%

Mortgage Type

New Conventional

Estimated Equity

$310,017

Purchase Details

Closed on

Nov 18, 2013

Sold by

Kistler James William

Bought by

Osbelt Gary R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,734

Interest Rate

4.31%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 20, 2012

Sold by

Kistler John Edward

Bought by

Kistler Steele Family Revocable Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| George Ross Bryan | $268,000 | -- | |

| Osbelt Gary R | $117,200 | -- | |

| Osbelt Gary R | $117,168 | -- | |

| Kistler Steele Family Revocable Trust | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | George Ross Bryan | $214,400 | |

| Previous Owner | Osbelt Gary R | $93,734 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,448 | $123,712 | $26,000 | $97,712 |

| 2023 | $2,475 | $121,712 | $24,000 | $97,712 |

| 2022 | $2,475 | $121,712 | $24,000 | $97,712 |

| 2021 | $2,333 | $107,055 | $24,000 | $83,055 |

| 2020 | $2,403 | $107,055 | $24,000 | $83,055 |

| 2019 | $2,458 | $107,055 | $24,000 | $83,055 |

| 2018 | $2,481 | $107,055 | $24,000 | $83,055 |

| 2017 | $2,359 | $100,147 | $24,000 | $76,147 |

| 2016 | $2,382 | $99,525 | $24,000 | $75,525 |

| 2015 | $2,097 | $89,712 | $24,000 | $65,712 |

| 2014 | $2,101 | $89,712 | $24,000 | $65,712 |

| 2013 | -- | $89,711 | $24,000 | $65,711 |

Source: Public Records

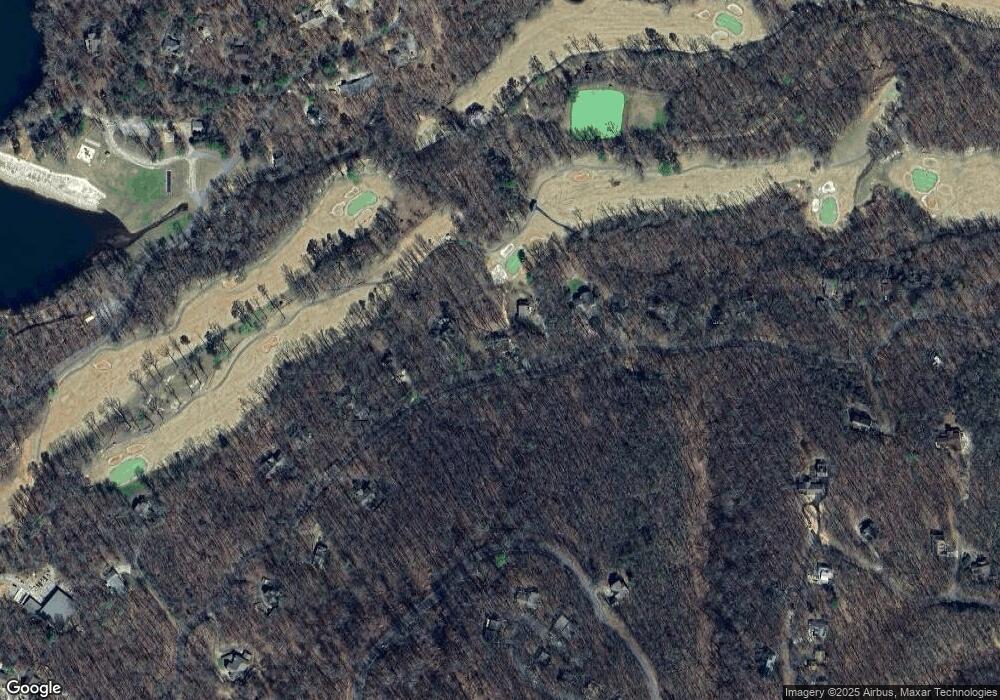

Map

Nearby Homes

- 617 Crippled Oak Trail

- 70 Fox Den Cir

- LT3150 Crippled Oak Trail

- 3364 Crippled Oak Trail

- 200 Villa Rd Unit 103

- 3183 Crippled Oak Trail

- 3501 Crippled Oak Trail

- 0 Oak Ct Unit 7679013

- 0 Oak Ct Unit 10640652

- 3366 Crippled Oak Trail

- 220 Fox Den Cir

- 0 Crippled Oak Trail Unit 7483547

- 0 Crippled Oak Trail Unit 10409950

- 264 Fox Den Cir

- 0 Oak Ridge Ct Unit 7614137

- 3238 Coffee Cove Dr

- 297 Fox Den Cir

- 455 Tamarack Dr

- 30 Villa Rd Unit 2

- 64 Villa Rd

- 359 Crippled Oak Trail

- 331 Crippled Oak Trail Unit 20134

- 1.1AC Crippled Oak Trail

- 295 Crippled Oak Trail

- 423 Crippled Oak Trail

- 263 Crippled Oak Trail

- 433 Crippled Oak Trail

- 262 Crippled Oak Trail

- 449 Crippled Oak Trail

- LT246 Crippled Oak Trail

- 236 Crippled Oak Trail

- 231 Crippled Oak Trail

- 226 Crippled Oak Trail Unit A

- 225 Crippled Oak Trail

- 495 Crippled Oak Trail

- 219 Crippled Oak Trail

- 212 Crippled Oak Trail

- 509 Crippled Oak Trail Unit 20742

- 509 Crippled Oak Trail

- 856 Tamarack Dr