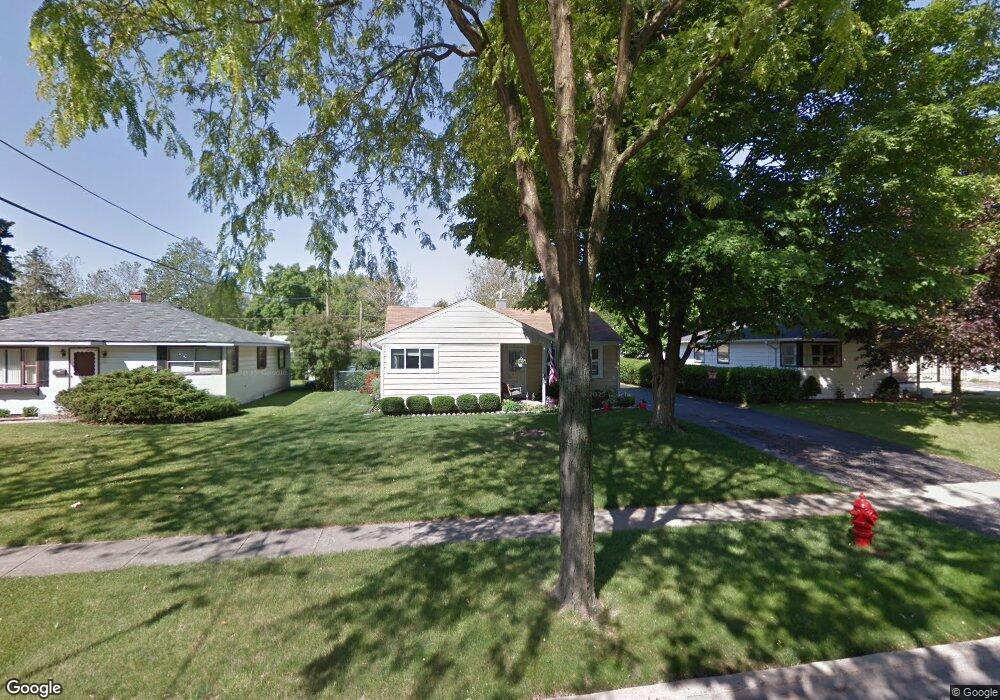

3603 Jay Ln Rolling Meadows, IL 60008

Estimated Value: $322,838 - $337,000

3

Beds

1

Bath

1,055

Sq Ft

$315/Sq Ft

Est. Value

About This Home

This home is located at 3603 Jay Ln, Rolling Meadows, IL 60008 and is currently estimated at $332,210, approximately $314 per square foot. 3603 Jay Ln is a home located in Cook County with nearby schools including Kimball Hill Elementary School, Carl Sandburg Junior High School, and Rolling Meadows High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 17, 2021

Sold by

Groh Armande H and Groh Nicole Marie

Bought by

Groh Armande H and Groh Marie

Current Estimated Value

Purchase Details

Closed on

Feb 12, 2007

Sold by

Groh Ronald L and Groh Armande H

Bought by

Groh Ronald L and Groh Armande H

Purchase Details

Closed on

Apr 26, 2006

Sold by

Bremer James J and Bremer Sharon S

Bought by

Groh Ronald L and Groh Armande H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,000

Outstanding Balance

$75,418

Interest Rate

6.42%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$256,792

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Groh Armande H | -- | None Available | |

| Groh Ronald L | -- | None Available | |

| Groh Ronald L | $266,000 | Multiple |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Groh Ronald L | $133,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,033 | $28,000 | $5,070 | $22,930 |

| 2024 | $6,033 | $23,000 | $4,290 | $18,710 |

| 2023 | $5,747 | $23,000 | $4,290 | $18,710 |

| 2022 | $5,747 | $23,000 | $4,290 | $18,710 |

| 2021 | $5,454 | $19,798 | $2,535 | $17,263 |

| 2020 | $5,399 | $19,798 | $2,535 | $17,263 |

| 2019 | $5,438 | $22,121 | $2,535 | $19,586 |

| 2018 | $5,135 | $19,289 | $2,340 | $16,949 |

| 2017 | $5,050 | $19,289 | $2,340 | $16,949 |

| 2016 | $4,964 | $19,289 | $2,340 | $16,949 |

| 2015 | $4,149 | $15,799 | $2,145 | $13,654 |

| 2014 | $4,066 | $15,799 | $2,145 | $13,654 |

| 2013 | $3,950 | $15,799 | $2,145 | $13,654 |

Source: Public Records

Map

Nearby Homes

- 3710 Meadow Dr

- 3712 Jay Ln

- 3605 Oriole Ln

- 2709 Lily Ln

- 3209 Trillium Cir

- 3306 Trillium Cir Unit 3001

- 3200 Thrush Ln

- 2201 Kingfisher Ln

- 2302 Fulle St

- 3100 Town Square Dr Unit 308

- 3100 Town Square Dr Unit 204

- 3135 Town Square Dr Unit 401

- 2705 Park St

- 3265 Kirchoff Rd Unit 116

- 3345 Kirchoff Rd Unit 5C

- 2830 Northampton Dr Unit A1

- 1107 S Old Wilke Rd Unit 103

- 1117 S Old Wilke Rd Unit 206

- 399 Knollwood Ct

- 1126 S New Wilke Rd Unit 307

Your Personal Tour Guide

Ask me questions while you tour the home.