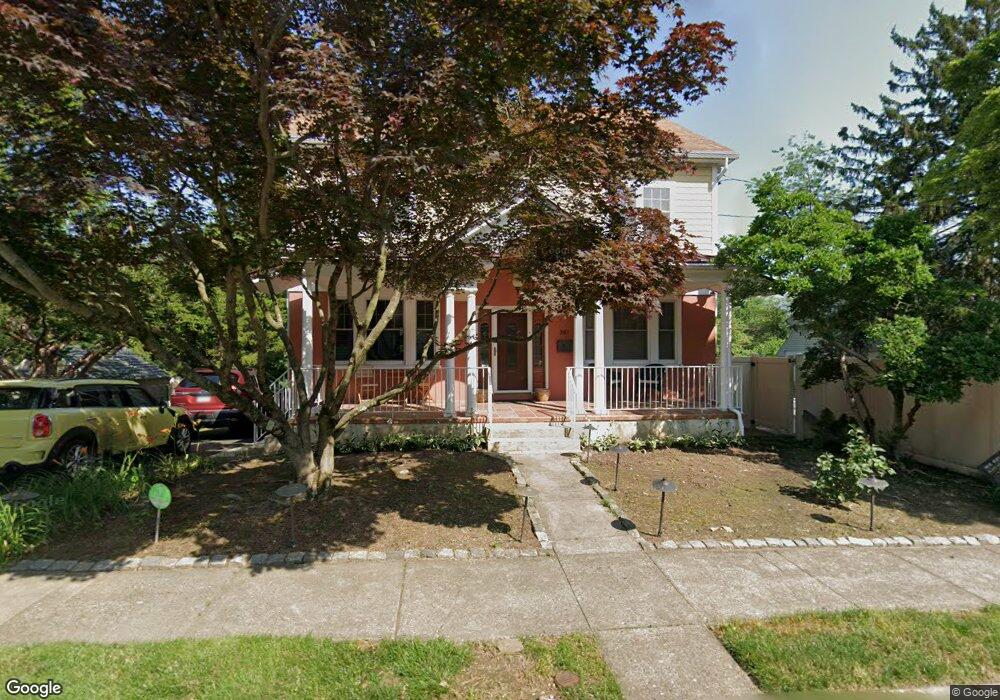

361 Union St Doylestown, PA 18901

Estimated Value: $891,000 - $1,438,000

4

Beds

4

Baths

3,754

Sq Ft

$321/Sq Ft

Est. Value

About This Home

This home is located at 361 Union St, Doylestown, PA 18901 and is currently estimated at $1,206,189, approximately $321 per square foot. 361 Union St is a home located in Bucks County with nearby schools including Doyle El School, Lenape Middle School, and Central Bucks High School-West.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 7, 2000

Sold by

Fish Lynda

Bought by

May Charles W and May Elizabeth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

11.5%

Purchase Details

Closed on

Nov 28, 2000

Sold by

Rowe Elizabeth L and Pellegrino Elizabeth L

Bought by

Rowe William A and Rowe Elizabeth L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

11.5%

Purchase Details

Closed on

Apr 23, 1996

Sold by

Pellegrino Robert M and Pellegrino Elizabeth L

Bought by

Pellegrino Elizabeth L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| May Charles W | $140,500 | -- | |

| Rowe William A | -- | -- | |

| Pellegrino Elizabeth L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | May Charles W | $80,000 | |

| Previous Owner | Rowe William A | $160,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,755 | $48,600 | $8,760 | $39,840 |

| 2024 | $8,755 | $48,600 | $8,760 | $39,840 |

| 2023 | $8,341 | $48,600 | $8,760 | $39,840 |

| 2022 | $8,226 | $48,600 | $8,760 | $39,840 |

| 2021 | $8,135 | $48,600 | $8,760 | $39,840 |

| 2020 | $8,046 | $48,600 | $8,760 | $39,840 |

| 2019 | $7,957 | $48,600 | $8,760 | $39,840 |

| 2018 | $7,860 | $48,600 | $8,760 | $39,840 |

| 2017 | $7,777 | $48,600 | $8,760 | $39,840 |

| 2016 | $6,980 | $26,400 | $8,760 | $17,640 |

| 2015 | -- | $26,400 | $8,760 | $17,640 |

| 2014 | -- | $26,400 | $8,760 | $17,640 |

Source: Public Records

Map

Nearby Homes

- 190 Decatur St

- 215 N Franklin St

- 195 Lafayette St

- 69 E Oakland Ave

- 169 N Main St

- 11-13 Aspen Way Unit 1113

- 9 Mill Creek Dr

- 102 Clear Springs Ct

- 110 E Ashland St

- 150 Selner Ln

- 146 E Court St

- 2401 Lower State Rd Unit 102

- 236 Green St

- 45 Latham Ct Unit 45

- 163 Progress Dr

- 6 Edison Ln Unit 1

- 225 Chestnut Valley Dr

- 807 N Broad St

- 33 Hibiscus Ct Unit 33

- 1 Steeplechase Dr

Your Personal Tour Guide

Ask me questions while you tour the home.