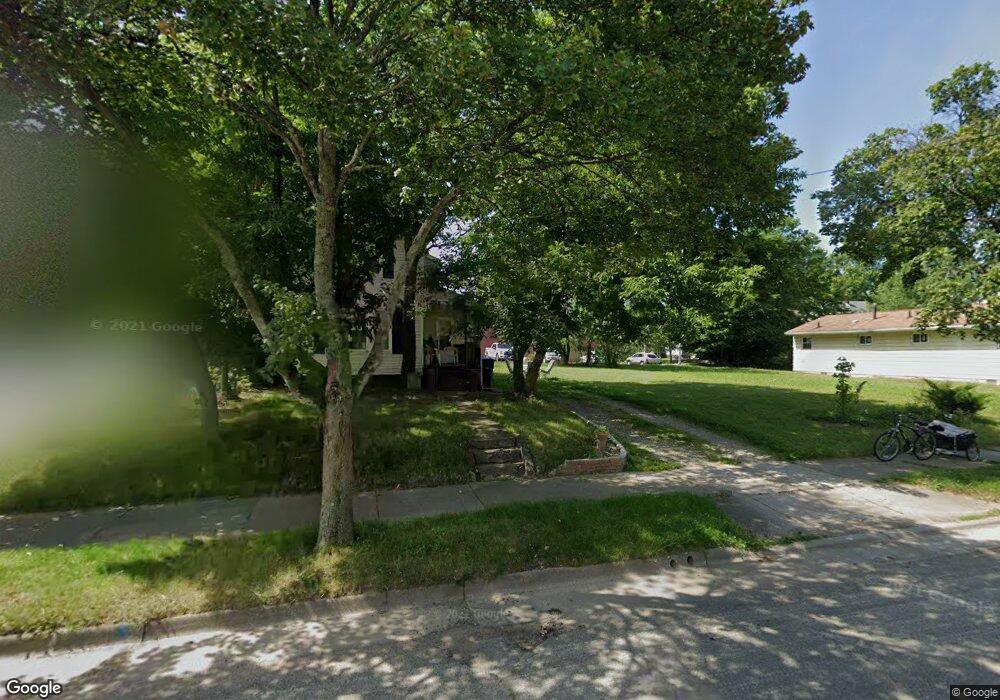

362 Stanton Ave Akron, OH 44301

South Akron NeighborhoodEstimated Value: $84,000 - $128,000

2

Beds

1

Bath

616

Sq Ft

$162/Sq Ft

Est. Value

About This Home

This home is located at 362 Stanton Ave, Akron, OH 44301 and is currently estimated at $100,020, approximately $162 per square foot. 362 Stanton Ave is a home located in Summit County with nearby schools including McEbright Elementary School, Kenmore Garfield Community Learning Center, and Main Preparatory Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 4, 2021

Sold by

Summit Cnty Land Reutilization Coporatio

Bought by

Johnson Johnnie

Current Estimated Value

Purchase Details

Closed on

Jun 23, 2015

Sold by

Westfall Mitchell Ray and Scalise Kristen M

Bought by

The Summit County Land Reutilization Cor

Purchase Details

Closed on

Feb 27, 2007

Sold by

Westfall Mitchell and Westfall Deborah L

Bought by

Westfall Mitchell Ray and Westfall Deborah L

Purchase Details

Closed on

Sep 30, 1998

Sold by

Lombardi Dino L

Bought by

Westfall Mitchell

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$32,000

Interest Rate

10.63%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnson Johnnie | -- | None Available | |

| The Summit County Land Reutilization Cor | -- | None Available | |

| Westfall Mitchell Ray | -- | None Available | |

| Westfall Mitchell | $40,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Westfall Mitchell | $32,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $251 | $3,574 | $3,574 | -- |

| 2024 | $251 | $3,574 | $3,574 | -- |

| 2023 | $251 | $3,574 | $3,574 | $0 |

| 2022 | $218 | $2,307 | $2,307 | $0 |

| 2021 | $64 | $2,307 | $2,307 | $0 |

| 2020 | $64 | $2,310 | $2,310 | $0 |

| 2019 | $64 | $3,490 | $3,490 | $0 |

| 2018 | $64 | $3,490 | $3,490 | $0 |

| 2017 | $794 | $3,490 | $3,490 | $0 |

| 2016 | $64 | $3,490 | $3,490 | $0 |

| 2015 | $794 | $10,940 | $3,490 | $7,450 |

| 2014 | $1,485 | $10,940 | $3,490 | $7,450 |

| 2013 | $1,781 | $10,970 | $3,490 | $7,480 |

Source: Public Records

Map

Nearby Homes

- 1133 Bellows St

- 1203 Atwood Ave

- 436 Cole Ave

- 1208 Bellows St Unit 1210

- 1236 Grant St

- 1231 Bellows St

- 1235 Bellows St

- 1241 Wilbur Ave

- 1051 Brown St

- 1094 Dietz Ave

- 1212 Tulip St

- 888 Beardsley St

- 568 Stanton Ave

- 0 Beardsley St

- 559 Morgan Ave

- 147 Brighton Dr

- 543 Corice St

- 1033 Herberich Ave

- 1345 Bellows St

- 555 Corice St

- 360 Stanton Ave

- 364 Stanton Ave

- 1115 Sherman St Unit 1117

- 372 Stanton Ave

- 1117 Sherman St

- 378 Stanton Ave

- 1116 Sherman St

- 1122 Sherman St

- 1128 Sherman St

- 386 Stanton Ave

- 0 Corner Stanton Herb

- 1134 Sherman St

- 1138 Sherman St

- 390 Stanton Ave

- 338 Stanton Ave

- 1140 Sherman St

- 394 Stanton Ave

- 1121 Hinman Ct

- 1142 Sherman St

- 332 Stanton Ave