364 Chestnut St Geneva, OH 44041

Geneva NeighborhoodEstimated Value: $114,000 - $139,000

2

Beds

1

Bath

864

Sq Ft

$142/Sq Ft

Est. Value

About This Home

This home is located at 364 Chestnut St, Geneva, OH 44041 and is currently estimated at $122,622, approximately $141 per square foot. 364 Chestnut St is a home located in Ashtabula County with nearby schools including Geneva Middle School, Geneva High School, and Assumption School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 4, 2013

Sold by

Phillips Larry

Bought by

Phillips Heather

Current Estimated Value

Purchase Details

Closed on

May 21, 2010

Sold by

Deutsche Bank National Trust Company

Bought by

Phillips Larry

Purchase Details

Closed on

Apr 28, 2010

Sold by

Yankie James

Bought by

Deutsche Bank National Trust Company and Bankers Trust Company

Purchase Details

Closed on

Nov 4, 2004

Sold by

Atkinson Norman James and Atkinson Deborah

Bought by

Yankie James and Yankie Robin M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,475

Interest Rate

8.87%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 9, 2004

Sold by

Estate Of Blanche Pauline Atkinson

Bought by

Atkinson Norman James and Bond Bonita

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Phillips Heather | -- | None Available | |

| Phillips Larry | $16,500 | Fidelity Natl Title Group | |

| Deutsche Bank National Trust Company | $14,000 | None Available | |

| Yankie James | $60,500 | Chicago Title Insurance Co | |

| Atkinson Norman James | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Yankie James | $57,475 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,385 | $28,280 | $15,750 | $12,530 |

| 2023 | $1,371 | $28,280 | $15,750 | $12,530 |

| 2022 | $1,077 | $21,840 | $12,110 | $9,730 |

| 2021 | $1,137 | $21,840 | $12,110 | $9,730 |

| 2020 | $1,137 | $21,840 | $12,110 | $9,730 |

| 2019 | $1,171 | $21,880 | $11,940 | $9,940 |

| 2018 | $1,029 | $21,880 | $11,940 | $9,940 |

| 2017 | $480 | $21,880 | $11,940 | $9,940 |

| 2016 | $641 | $21,460 | $11,690 | $9,770 |

| 2015 | $637 | $21,460 | $11,690 | $9,770 |

| 2014 | $618 | $21,460 | $11,690 | $9,770 |

| 2013 | $576 | $21,010 | $9,980 | $11,030 |

Source: Public Records

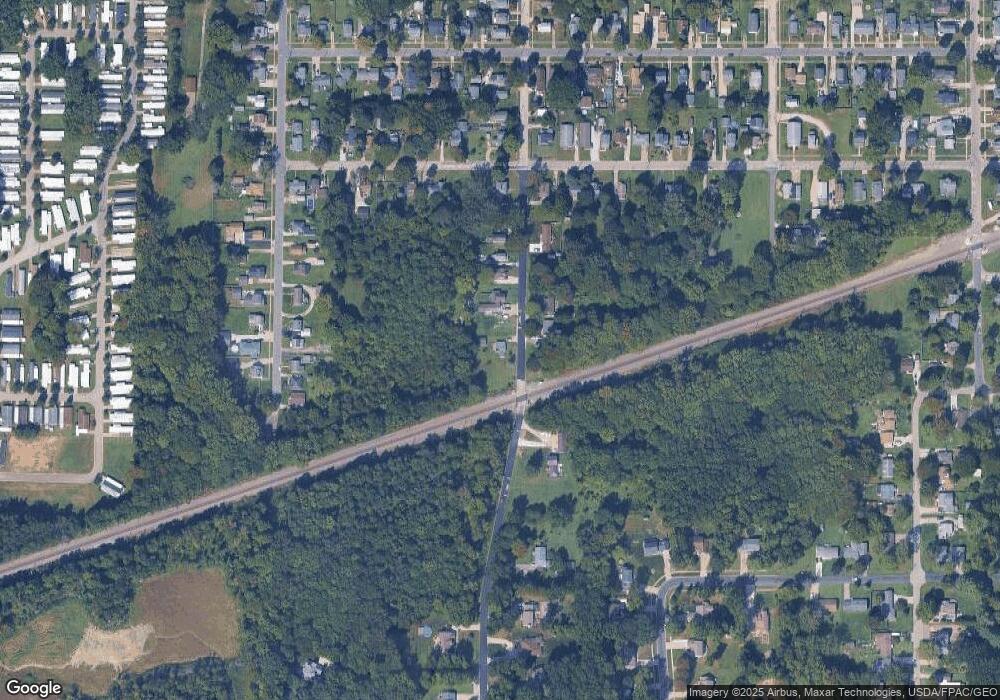

Map

Nearby Homes

- 165 S Eagle St

- 515 S Broadway

- 754 Chestnut St

- 613 Sherman St

- 0 S Ridge Rd E Unit 5176296

- 276 Beach St

- 234 Elm St

- 45 S Cedar St

- 465 Eastwood St

- 484 E Main St

- 1166 Sherman St

- 549 E Main St

- 815 S Nearing Cir

- 70 Crown Point

- VL N Crowell Ave

- 2302 Walter Main Rd

- 3410 N Broadway

- 1973 Lafevre Rd

- 1840 Alexander Ave

- 3581 Austin Rd Unit 51

- 327 Chestnut St

- 337 Chestnut St

- 328 Chestnut St

- 320 Chestnut St

- 441 Chestnut St

- 310 Chestnut St

- 305 Chestnut St

- 2792 Chestnut St

- 280 Chestnut St

- 281 Chestnut St

- 450 W Liberty St

- 344 W Liberty St

- 323 Lockwood St

- 311 Lockwood St

- 333 Lockwood St

- 301 Lockwood St

- 343 Lockwood St

- 352 W Liberty St

- 456 W Liberty St

- 285 Lockwood St