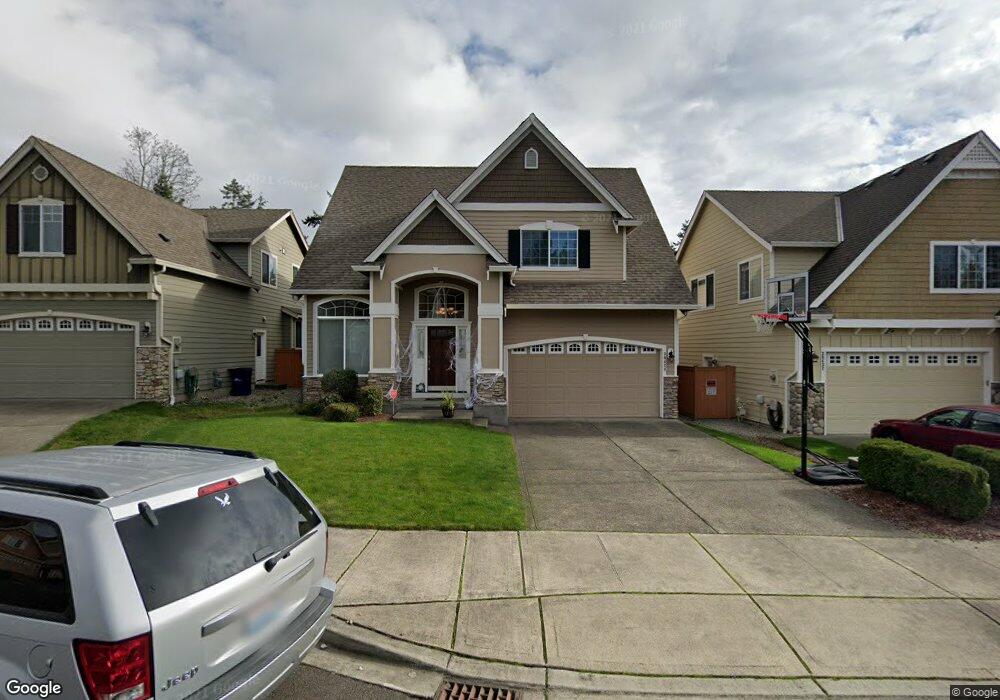

36428 10th Ct SW Federal Way, WA 98023

Estimated Value: $783,193 - $1,025,000

4

Beds

3

Baths

3,210

Sq Ft

$275/Sq Ft

Est. Value

About This Home

This home is located at 36428 10th Ct SW, Federal Way, WA 98023 and is currently estimated at $881,298, approximately $274 per square foot. 36428 10th Ct SW is a home located in King County with nearby schools including Enterprise Elementary School, Illahee Middle School, and Todd Beamer High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 12, 2013

Sold by

Felizardo Jeffrey David and Felizardo Rachel Ann Campos

Bought by

Felizardo Jeffrey David and Felizardo Rachel Ann Campos

Current Estimated Value

Purchase Details

Closed on

Jan 13, 2010

Sold by

Brighton Ming Limited Liability Company

Bought by

Felizardo Rachel A Campos and Felizardo Jeffrey D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$402,116

Outstanding Balance

$260,371

Interest Rate

4.68%

Mortgage Type

FHA

Estimated Equity

$620,927

Purchase Details

Closed on

Jun 30, 2009

Sold by

Norris Homes Inc

Bought by

Brighton Ming Limited Liability Company

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Felizardo Jeffrey David | -- | None Available | |

| Felizardo Rachel A Campos | $409,950 | Stewart Title | |

| Brighton Ming Limited Liability Company | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Felizardo Rachel A Campos | $402,116 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,132 | $721,000 | $198,000 | $523,000 |

| 2023 | $6,884 | $652,000 | $165,000 | $487,000 |

| 2022 | $6,349 | $704,000 | $183,000 | $521,000 |

| 2021 | $5,889 | $563,000 | $160,000 | $403,000 |

| 2020 | $5,744 | $490,000 | $113,000 | $377,000 |

| 2018 | $6,516 | $463,000 | $113,000 | $350,000 |

| 2017 | $6,357 | $460,000 | $103,000 | $357,000 |

| 2016 | $6,168 | $449,000 | $94,000 | $355,000 |

| 2015 | $5,720 | $417,000 | $90,000 | $327,000 |

| 2014 | -- | $396,000 | $90,000 | $306,000 |

| 2013 | -- | $276,000 | $81,000 | $195,000 |

Source: Public Records

Map

Nearby Homes

- 36607 9th Ave SW

- 541 SW 366th St Unit 1

- 1406 60th Ave NE

- 1316 60th Ave NE

- 1328 60th Ave NE

- 1414 60th Ave NE

- 1418 60th Ave NE

- 1422 60th Ave NE

- 1327 60th Ave NE

- 35851 12th Ave SW

- 1307 60th Ave NE

- 316 SW 365th St Unit 6

- 35814 11th Ave SW

- Sapporo B Plan at Montevista

- Osaka A Plan at Montevista

- Osaka B Plan at Montevista

- 36520 3rd Ave SW Unit 1

- 36508 3rd Ave SW Unit 2

- 36922 6th Ave SW

- 37301 2nd Ave SW

- 36424 10th Ct SW

- 36432 10th Ct SW

- 36422 10th Ct SW

- 36420 10th Ct SW

- 36418 10th Ct SW

- 36444 10th Ct SW

- 910 SW 365th Place

- 36415 10th Ct SW

- 36433 10th Ct SW

- 36427 10th Ct SW

- 36437 10th Ct SW

- 904 SW 365th Place

- 902 SW 365th Place

- 36425 10th Ct SW

- 839 SW 364th Place

- 837 SW 364th Place

- 36443 10th Ct SW

- 36417 10th Ct SW

- 833 SW 364th Place

- 36447 10th Ct SW