3674 Halsey Ln Unit Lt K Bremerton, WA 98310

Estimated Value: $475,581 - $628,000

3

Beds

3

Baths

1,880

Sq Ft

$275/Sq Ft

Est. Value

About This Home

This home is located at 3674 Halsey Ln Unit Lt K, Bremerton, WA 98310 and is currently estimated at $516,145, approximately $274 per square foot. 3674 Halsey Ln Unit Lt K is a home located in Kitsap County with nearby schools including Pinecrest Elementary School, Fairview Middle School, and Olympic High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 24, 2019

Sold by

Frydenlund Jon C and Enyeart Frydenlund Yuki

Bought by

Mercado Valerie and Mercado Manuel A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$342,202

Outstanding Balance

$299,799

Interest Rate

3.82%

Mortgage Type

VA

Estimated Equity

$216,346

Purchase Details

Closed on

Dec 16, 2016

Sold by

Tuttle Andrew R and Tuttle Miranda A

Bought by

Frydenlund Jon C and Enyeart Frydenlund Yuki

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,172

Interest Rate

3.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 9, 2015

Sold by

The Highmark Homes Llc

Bought by

Tuttle Andrew R and Tuttle Miranda A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,571

Interest Rate

3.57%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mercado Valerie | $335,000 | Fidelity National Title Co | |

| Frydenlund Jon C | $291,431 | Land Title | |

| Tuttle Andrew R | $214,950 | Pacific Northwest Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mercado Valerie | $342,202 | |

| Previous Owner | Frydenlund Jon C | $256,172 | |

| Previous Owner | Tuttle Andrew R | $219,571 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $3,546 | $413,430 | $86,270 | $327,160 |

| 2025 | $3,546 | $433,630 | $86,270 | $347,360 |

| 2024 | $3,447 | $433,630 | $86,270 | $347,360 |

| 2023 | $3,570 | $433,630 | $86,270 | $347,360 |

| 2022 | $3,451 | $375,750 | $71,890 | $303,860 |

| 2021 | $3,050 | $308,090 | $45,570 | $262,520 |

| 2020 | $2,926 | $288,790 | $42,490 | $246,300 |

| 2019 | $2,612 | $260,880 | $38,180 | $222,700 |

| 2018 | $3,097 | $231,950 | $32,410 | $199,540 |

| 2017 | $2,805 | $231,950 | $32,410 | $199,540 |

| 2016 | $2,674 | $203,640 | $28,430 | $175,210 |

| 2015 | $1,104 | $85,140 | $28,800 | $56,340 |

| 2014 | -- | $28,800 | $28,800 | $0 |

Source: Public Records

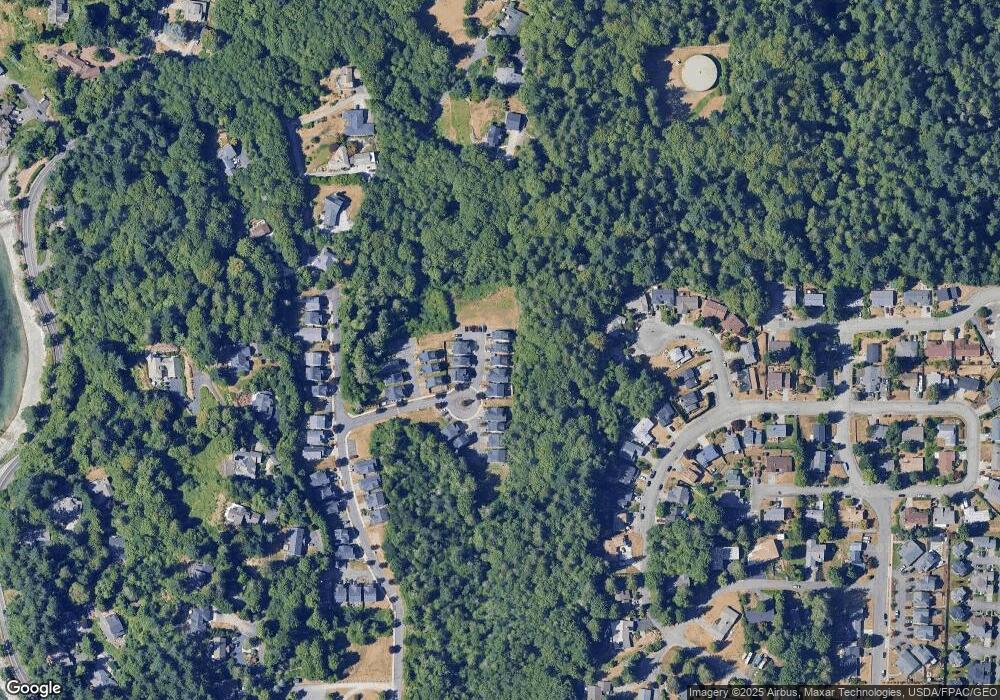

Map

Nearby Homes

- 3585 Sulphur Springs Ln

- 4 Sulphur Springs Ln

- 3573 Sulphur Springs Ln

- 0 XXX Tracyton Beach Rd NW

- 0 Tracyton Beach Rd NW

- 3347 Amak Ln

- 3560 Narrows View Ln NE Unit 5-201

- 3560 Narrows View Ln NE Unit 202

- 3400 Narrows View Ln NE Unit 204

- 3340 Narrows View Ln NE Unit 103

- 4224 Tracyton Beach Rd

- 3868 Pinecone Dr NE

- 3023 Pawnee Dr

- 3835 Earendale Ave

- 638 Shirehill St

- 414 E 31st St

- 3212 View Dr NW

- 802 Hanford Ave

- 654 E 31st St

- 754 NE Reeds Meadow Ln

- 3674 Halsey Ln

- 3674 Hasley Ln

- 3678 Halsey Ln

- 3678 Halsey Ln Unit Lt J

- 3670 Halsey Ln Unit Lt L

- 3670 Halsey Ln

- 3666 Halsey Ln Unit LT M

- 3666 Halsey Ln Unit M

- 3666 Halsey Ln

- 3675 Halsey Ln Unit Lt I

- 3675 Halsey Ln

- 3671 Halsey Ln Unit Lt H

- 3671 Halsey Ln

- 3662 Halsey Ln Unit Lt N

- 3662 Halsey Ln

- 3667 Halsey Ln Unit LT G

- 3667 Halsey Ln

- 3658 Nimitz Ln

- 3652 Nimitz Ln Unit Lt O

- 3652 Nimitz Ln