370 Harrington Dr Unit 88 London, OH 43140

Estimated Value: $238,000 - $271,000

2

Beds

2

Baths

1,502

Sq Ft

$168/Sq Ft

Est. Value

About This Home

This home is located at 370 Harrington Dr Unit 88, London, OH 43140 and is currently estimated at $252,521, approximately $168 per square foot. 370 Harrington Dr Unit 88 is a home located in Madison County with nearby schools including London Elementary School, London Middle School, and London High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 19, 2019

Sold by

Rowe William R and Kelley Rowe Teresa M

Bought by

Newberry Richard L and Newberry Janet M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$165,300

Outstanding Balance

$144,790

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$107,731

Purchase Details

Closed on

Jun 13, 2014

Sold by

Palmer Carole A and Mccune Connie

Bought by

Rowe William R and Kelley Rowe Teresa M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

4.2%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 29, 2007

Sold by

Smith Thomas A

Bought by

Palmer Mary O

Purchase Details

Closed on

Sep 21, 2001

Sold by

John J Bland Inc

Bought by

Smith Thomas A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,000

Interest Rate

7.06%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Newberry Richard L | $174,000 | Midland Title | |

| Rowe William R | $120,000 | Midland Title | |

| Palmer Mary O | $135,500 | Midland Title | |

| Smith Thomas A | $107,210 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Newberry Richard L | $165,300 | |

| Previous Owner | Rowe William R | $90,000 | |

| Previous Owner | Smith Thomas A | $70,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,810 | $68,960 | $8,800 | $60,160 |

| 2023 | $1,810 | $68,960 | $8,800 | $60,160 |

| 2022 | $1,395 | $50,440 | $7,000 | $43,440 |

| 2021 | $1,389 | $50,440 | $7,000 | $43,440 |

| 2020 | $1,725 | $50,440 | $7,000 | $43,440 |

| 2019 | $1,459 | $42,230 | $7,000 | $35,230 |

| 2018 | $1,545 | $42,230 | $7,000 | $35,230 |

| 2017 | $1,519 | $42,230 | $7,000 | $35,230 |

| 2016 | $1,479 | $41,820 | $7,000 | $34,820 |

| 2015 | $1,470 | $41,820 | $7,000 | $34,820 |

| 2014 | $1,340 | $41,820 | $7,000 | $34,820 |

| 2013 | -- | $40,820 | $7,000 | $33,820 |

Source: Public Records

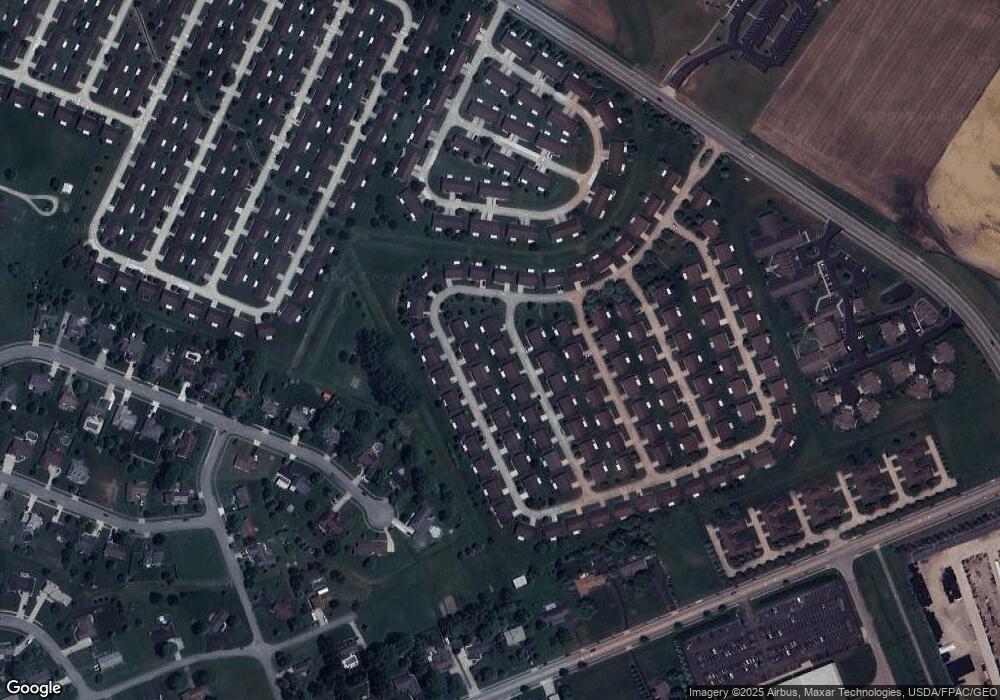

Map

Nearby Homes

- 473 Samantha Cir Unit 53

- 438 Samantha Cir Unit 3

- 610 Circle Dr

- 103 Andrew Ct E

- 1039 Amherst Blvd

- 0 Keny Blvd Unit 225008830

- 1070 Wilshire Ct

- 1063 Hartford Ln

- 1084 Wesley Dr

- 205 Lafayette St

- 1052 E Margate Cir

- 1043 Edinburgh Cove

- 1095 Hartford Ln

- 1099 Hartford Ln

- Lyndhurst Plan at Johnson's Creek

- Stamford Plan at Johnson's Creek

- Bellamy Plan at Johnson's Creek

- Chatham Plan at Johnson's Creek

- Pendleton Plan at Johnson's Creek

- Harmony Plan at Johnson's Creek

- 372 Harrington Dr

- 371 Bishop Dr Unit 5

- 369 Bishop Dr

- 369 Harrington Dr

- 373 Bishop Dr

- 367 Bishop Dr

- 367 Harrington Dr Unit 85

- 366 Harrington Dr

- 365 Harrington Dr

- 370 Victoria Dr

- 372 Bishop Dr Unit 30

- 368 Bishop Dr Unit 28

- 384 Bishop Dr Unit 36

- 368 Victoria Dr

- 386 Bishop Dr Unit 37

- 382 Bishop Dr Unit 35

- 374 Bishop Dr Unit 31

- 366 Bishop Dr Unit 27

- 366 Victoria Dr Unit 75

- 363 Harrington Dr