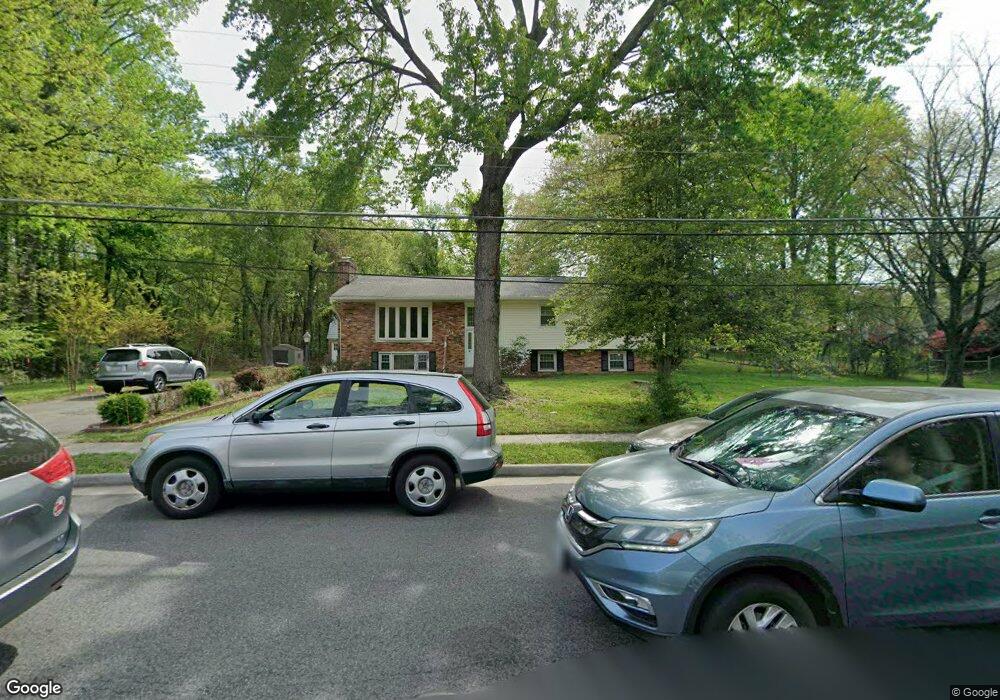

3704 Crest Dr Annandale, VA 22003

Estimated Value: $811,000 - $941,930

5

Beds

4

Baths

1,920

Sq Ft

$460/Sq Ft

Est. Value

About This Home

This home is located at 3704 Crest Dr, Annandale, VA 22003 and is currently estimated at $883,233, approximately $460 per square foot. 3704 Crest Dr is a home located in Fairfax County with nearby schools including Mason Crest Elementary School, Poe Middle School, and Falls Church High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2016

Sold by

Acquah Albert and Acquah Phyllis Victoria

Bought by

Acquah Family Trust Dated July 19 2016

Current Estimated Value

Purchase Details

Closed on

Feb 29, 2016

Sold by

Asafo Boakye Bemjamin

Bought by

Acquah Albert and Acquah Phyllis Victoria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$594,041

Interest Rate

4.12%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 23, 2007

Sold by

Acguah Albert

Bought by

Asafo-Boakye Benjamin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

6.39%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 24, 2003

Sold by

Scott Edward

Bought by

Acquah Albert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$385,000

Interest Rate

6.15%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Acquah Family Trust Dated July 19 2016 | -- | None Available | |

| Acquah Albert | $605,000 | Assure Title Llc | |

| Asafo-Boakye Benjamin | $640,000 | -- | |

| Acquah Albert | $440,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Acquah Albert | $594,041 | |

| Previous Owner | Asafo-Boakye Benjamin | $417,000 | |

| Previous Owner | Acquah Albert | $385,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,538 | $890,600 | $297,000 | $593,600 |

| 2024 | $10,538 | $847,770 | $277,000 | $570,770 |

| 2023 | $10,045 | $837,770 | $267,000 | $570,770 |

| 2022 | $9,609 | $790,460 | $252,000 | $538,460 |

| 2021 | $8,613 | $692,770 | $212,000 | $480,770 |

| 2020 | $8,535 | $683,010 | $207,000 | $476,010 |

| 2019 | $8,148 | $649,340 | $196,000 | $453,340 |

| 2018 | $7,421 | $645,340 | $192,000 | $453,340 |

| 2017 | $7,769 | $632,340 | $179,000 | $453,340 |

| 2016 | $7,683 | $625,340 | $172,000 | $453,340 |

| 2015 | $7,327 | $617,340 | $164,000 | $453,340 |

| 2014 | $6,577 | $552,210 | $158,000 | $394,210 |

Source: Public Records

Map

Nearby Homes

- 3716 Krysia Ct

- 7406 Masonville Dr

- 3805 Oliver Ave

- 3539 Marvin St

- 7551 Marshall Dr

- 3540 Ewell St

- 7103 Valleycrest Blvd

- 7204 Quiet Cove

- 7508 Masonville Dr

- 3905 Hummer Rd

- 3422 Charleson St

- 7530 Royce Ct

- 3418 Arnold Ln

- 7011 Murray Ln

- 7504 Walnut Hill Ln

- 3405 Silver Maple Place

- 3416 Arnold Ln

- 4025 Travis Pkwy

- 4015 Woodland Rd

- 4017 Woodland Rd

- 3702 Crest Dr

- 7360 Annandale Ct

- 3706 Crest Dr

- 7361 Annandale Ct

- 3703 Crest Dr

- 7362 Annandale Ct

- 7315 Wayne Dr

- 7363 Annandale Ct

- 7317 Wayne Dr

- 7364 Annandale Ct

- 7319 Wayne Dr

- 7309 Wayne Dr

- 7365 Annandale Ct

- 7313 Wayne Dr

- 3811 Gallows Rd

- 7321 Wayne Dr

- 7307 Wayne Dr

- 7366 Annandale Ct

- 7314 Wayne Dr

- 3801 Gallows Rd