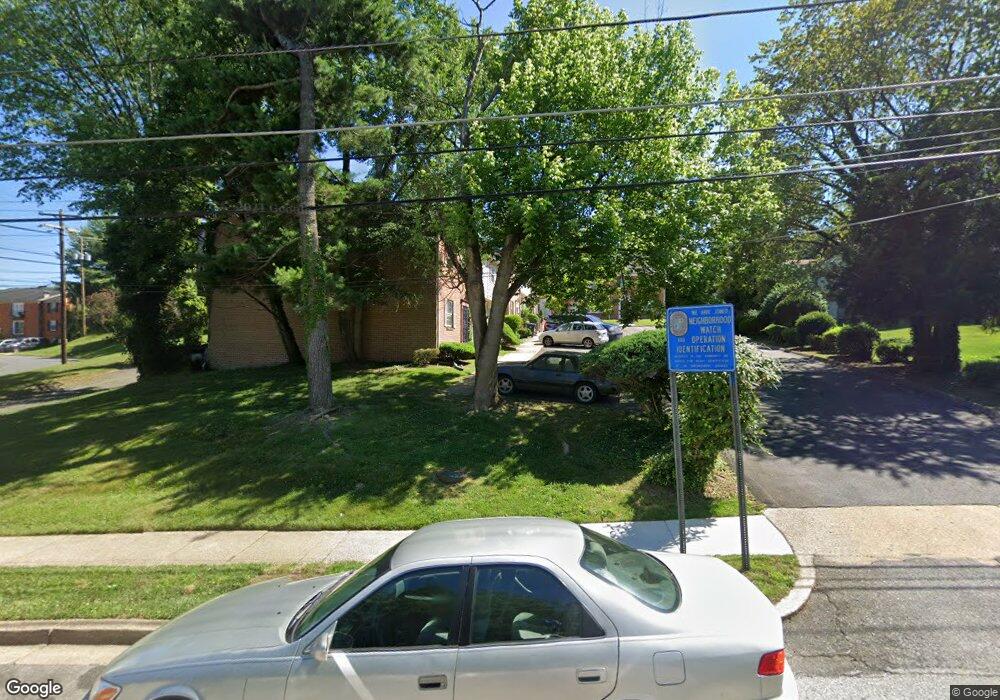

3733 Swann Rd Suitland, MD 20746

Estimated Value: $268,000 - $345,000

--

Bed

--

Bath

2,140

Sq Ft

$146/Sq Ft

Est. Value

About This Home

This home is located at 3733 Swann Rd, Suitland, MD 20746 and is currently estimated at $312,444, approximately $146 per square foot. 3733 Swann Rd is a home located in Prince George's County with nearby schools including William Beanes Elementary School, Drew Freeman Middle School, and Suitland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 10, 2018

Sold by

Kusansuka Robert L

Bought by

Smith Kia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,700

Outstanding Balance

$177,273

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$135,171

Purchase Details

Closed on

Sep 19, 2014

Sold by

Wood Christiana I and Thomas Raimond

Bought by

Kusansuka Robert L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,400

Interest Rate

4.11%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 7, 2012

Sold by

Wood Christiana and Thomas Ursula A

Bought by

Wood Christiana I and Thomas Raimond

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Kia | $210,000 | None Available | |

| Kusansuka Robert L | $93,000 | First American Title Ins Co | |

| Wood Christiana I | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Smith Kia | $203,700 | |

| Previous Owner | Kusansuka Robert L | $74,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,633 | $234,067 | -- | -- |

| 2024 | $3,633 | $218,033 | $0 | $0 |

| 2023 | $3,393 | $202,000 | $60,600 | $141,400 |

| 2022 | $3,267 | $193,500 | $0 | $0 |

| 2021 | $3,141 | $185,000 | $0 | $0 |

| 2020 | $6,029 | $176,500 | $52,900 | $123,600 |

| 2019 | $2,127 | $148,500 | $0 | $0 |

| 2018 | $1,803 | $120,500 | $0 | $0 |

| 2017 | $1,766 | $92,500 | $0 | $0 |

| 2016 | -- | $92,500 | $0 | $0 |

| 2015 | $347 | $92,500 | $0 | $0 |

| 2014 | $347 | $96,500 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 3807 Swann Rd Unit T1

- 3815 Swann Rd Unit 103

- 3805 Swann Rd Unit T-2

- 3811 Swann Rd Unit T-3

- 3811 Swann Rd Unit T-1

- 3811 Swann Rd Unit 103

- 3817 Swann Rd Unit 302

- 3809 Walnut Ln

- 3728 Dianna Rd

- 3612 Swann Rd

- 3409 Wood Creek Dr

- 5318 Stoney Meadows Dr

- 4334 Talmadge Cir

- 5211 Stoney Meadows Dr

- 4321 Talmadge Cir

- 5420 Hartfield Ave

- 5412 Lanier Ave

- 5504 Capital Gateway Dr Unit 415

- 5548 Capital Gateway Dr Unit 393

- 3721 Monacco Ct