3750 SE Doubleton Dr Unit x Stuart, FL 34997

Willoughby NeighborhoodEstimated Value: $1,036,731 - $1,158,000

3

Beds

4

Baths

3,467

Sq Ft

$313/Sq Ft

Est. Value

About This Home

This home is located at 3750 SE Doubleton Dr Unit x, Stuart, FL 34997 and is currently estimated at $1,085,433, approximately $313 per square foot. 3750 SE Doubleton Dr Unit x is a home located in Martin County with nearby schools including Pinewood Elementary School, Dr. David L. Anderson Middle School, and Martin County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 11, 2010

Sold by

Philpott Joy D and Philpott Robert W

Bought by

Whalen Steve and Whalen Alayne

Current Estimated Value

Purchase Details

Closed on

May 23, 2008

Sold by

Philpott Robert W and Philpott Joy Davis

Bought by

Philpott Robert W

Purchase Details

Closed on

Jul 15, 2002

Sold by

Rupp Herbert E

Bought by

Philpott Robert W and Philpott Joy Davis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$379,169

Interest Rate

6.75%

Purchase Details

Closed on

Oct 22, 1998

Sold by

Owens Brent D and Owens Diane L

Bought by

Rupp Ii Herbert H

Purchase Details

Closed on

Jun 21, 1994

Sold by

Willoughby Assoc

Bought by

Owens D Brent and Owens Diane L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Whalen Steve | $660,000 | Attorney | |

| Philpott Robert W | -- | Attorney | |

| Philpott Joy D | -- | Attorney | |

| Philpott Robert W | $585,000 | -- | |

| Rupp Ii Herbert H | $530,000 | -- | |

| Owens D Brent | $130,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Philpott Robert W | $379,169 |

Source: Public Records

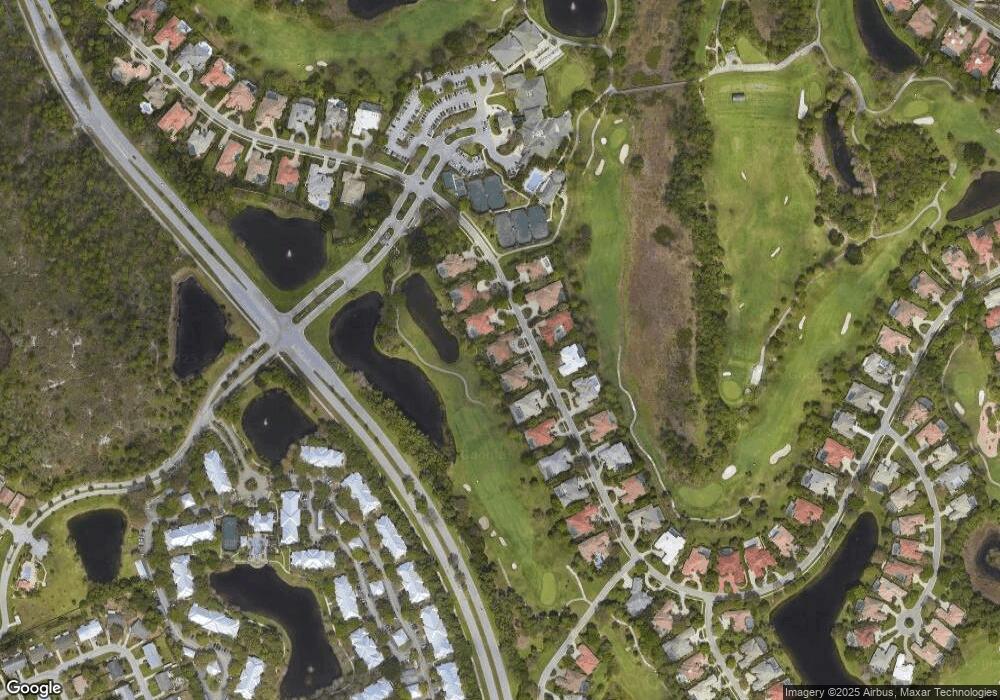

Map

Nearby Homes

- 4201 SE Frazier Ct

- 1226 SE Brewster Place

- 1589 SE Tidewater Place

- 3487 SE Doubleton Dr

- 3500 SE Doubleton Dr

- 1465 SE Brewster Place

- 4179 SE Henley Ln

- 871 SE Westminster Place

- 926 SE Westminster Place

- 3501 SE Putnam Ct

- 938 SE Westminster Place

- 937 SE Westminster Place

- 1572 SE Cypress Glen Way

- 960 SE Willoughby Trace Unit 960

- 3435 SE Putnam Ct

- 3390 SE Putnam Ct

- 1129 SE Westminster Place

- 1039 SE Westminster Place

- 1651 SE Pomeroy St

- 1680 SE Cypress Glen Way

- 3750 SE Doubleton Dr

- 3756 SE Doubleton Dr

- 3744 SE Doubleton Dr

- 3745 SE Doubleton Dr

- 3762 SE Doubleton Dr

- 3738 SE Doubleton Dr

- 3751 SE Doubleton Dr

- 3739 SE Doubleton Dr

- 3733 SE Doubleton Dr

- 3768 SE Doubleton Dr

- 3732 SE Doubleton Dr

- 3727 SE Doubleton Dr

- 3721 SE Doubleton Dr

- 3720 SE Doubleton Dr

- 3714 SE Doubleton Dr

- 3715 SE Doubleton Dr

- 3709 SE Doubleton Dr Unit 505

- 3709 SE Doubleton Dr

- 3708 SE Doubleton Dr

- 3012 SE Doubleton Dr