37B Hc 1 Kresgeville, PA 18333

Estimated Value: $507,139 - $717,000

3

Beds

3

Baths

3,280

Sq Ft

$188/Sq Ft

Est. Value

About This Home

This home is located at 37B Hc 1, Kresgeville, PA 18333 and is currently estimated at $618,035, approximately $188 per square foot. 37B Hc 1 is a home located in Monroe County with nearby schools including Pleasant Valley Elementary School, Pleasant Valley Intermediate School, and Pleasant Valley Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 25, 2010

Sold by

Un Capital Llc

Bought by

Ogburn William L and Ogburn Delilah

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$315,000

Outstanding Balance

$207,641

Interest Rate

4.95%

Mortgage Type

VA

Estimated Equity

$410,394

Purchase Details

Closed on

Jun 19, 2008

Sold by

Meadow View Enterprises Llc

Bought by

Un Capital Llc

Purchase Details

Closed on

Apr 28, 2005

Sold by

Meadow View Development Llc

Bought by

Meadow View Enterprises Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,450,000

Interest Rate

6.05%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ogburn William L | $315,000 | None Available | |

| Un Capital Llc | $10,768 | None Available | |

| Meadow View Enterprises Llc | $328,853 | Pocono Property Abstract |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ogburn William L | $315,000 | |

| Previous Owner | Meadow View Enterprises Llc | $1,450,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,633 | $252,530 | $49,110 | $203,420 |

| 2024 | $1,161 | $252,530 | $49,110 | $203,420 |

| 2023 | $7,193 | $252,530 | $49,110 | $203,420 |

| 2022 | $6,985 | $252,530 | $49,110 | $203,420 |

| 2021 | $6,826 | $252,530 | $49,110 | $203,420 |

| 2020 | $6,985 | $252,530 | $49,110 | $203,420 |

| 2019 | $7,157 | $40,820 | $2,650 | $38,170 |

| 2018 | $7,075 | $40,820 | $2,650 | $38,170 |

| 2017 | $7,075 | $40,820 | $2,650 | $38,170 |

| 2016 | $1,043 | $40,820 | $2,650 | $38,170 |

| 2015 | -- | $40,820 | $2,650 | $38,170 |

| 2014 | -- | $40,820 | $2,650 | $38,170 |

Source: Public Records

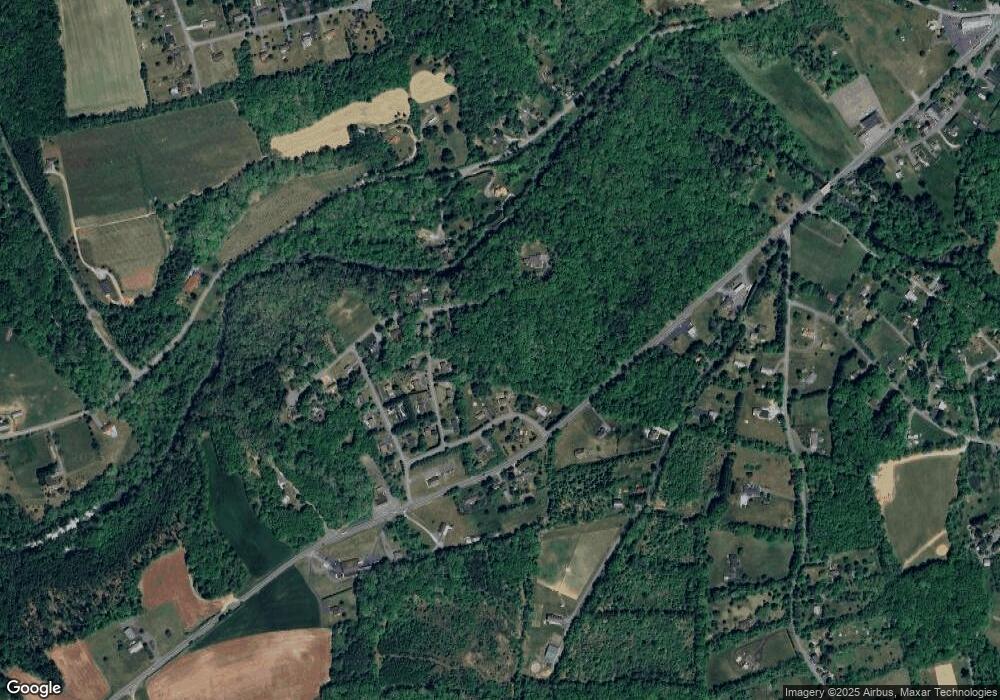

Map

Nearby Homes

- 1149 Red Fox Ct

- 1101 Red Fox Ct Unit Ct 9

- 0 T425

- 208 Bryan Dr

- 2107 Pohopoco Dr N

- 117 Streamside St

- 157 Viewtop Rd

- 969 Hideaway Hill Rd

- 209 Floyd Dr

- Lot 31 Greenview Ct

- Lot 32 Greenview Ct

- 119 Rolling View Rd

- 229 Deer Path

- 119 Rolling View Dr

- 207 Scenic Dr

- 1322 Par Dr

- 90 Halina Way

- 125 Hillview Rd

- 150 Red Oak Dr

- 0 Victoria Arms Cir Unit PM-133039