3813 Campanario Ave North Las Vegas, NV 89084

Aliante NeighborhoodEstimated Value: $735,835 - $844,000

4

Beds

4

Baths

4,391

Sq Ft

$175/Sq Ft

Est. Value

About This Home

This home is located at 3813 Campanario Ave, North Las Vegas, NV 89084 and is currently estimated at $767,459, approximately $174 per square foot. 3813 Campanario Ave is a home located in Clark County with nearby schools including Vincent L. Triggs Elementary School, Anthony Saville Middle School, and Shadow Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 12, 2023

Sold by

Savage Wilford

Bought by

Andshe Family Trust

Current Estimated Value

Purchase Details

Closed on

Jun 11, 2008

Sold by

Deutsch Bank

Bought by

Savage Wilford and Savage Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$316,800

Interest Rate

6.31%

Mortgage Type

Unknown

Purchase Details

Closed on

Feb 4, 2008

Sold by

Ochoa Efrain

Bought by

Deutsch Bank

Purchase Details

Closed on

May 25, 2006

Sold by

Ochoa Rosa

Bought by

Ochoa Efrain

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,950

Interest Rate

6.46%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Sep 27, 2005

Sold by

Acacia Credit Fund 9 & A Llc

Bought by

Us Home Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Andshe Family Trust | -- | None Listed On Document | |

| Savage Wilford | $396,000 | First American Title Howard | |

| Deutsch Bank | $480,250 | Fidelity National Title | |

| Ochoa Efrain | -- | North American Title Co | |

| Ochoa Efrain | $604,828 | North American Title Co | |

| Us Home Corp | $2,440,949 | First Amer Title Co Of Nv |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Savage Wilford | $316,800 | |

| Previous Owner | Ochoa Efrain | $120,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,946 | $227,904 | $57,365 | $170,539 |

| 2024 | $3,831 | $227,904 | $57,365 | $170,539 |

| 2023 | $3,831 | $239,832 | $54,285 | $185,547 |

| 2022 | $3,720 | $199,599 | $46,200 | $153,399 |

| 2021 | $3,612 | $170,199 | $42,350 | $127,849 |

| 2020 | $3,504 | $168,999 | $42,350 | $126,649 |

| 2019 | $3,402 | $159,205 | $34,650 | $124,555 |

| 2018 | $3,302 | $147,004 | $28,105 | $118,899 |

| 2017 | $4,787 | $142,697 | $22,750 | $119,947 |

| 2016 | $3,127 | $113,455 | $18,550 | $94,905 |

| 2015 | $3,121 | $98,258 | $16,800 | $81,458 |

| 2014 | $3,030 | $87,638 | $14,000 | $73,638 |

Source: Public Records

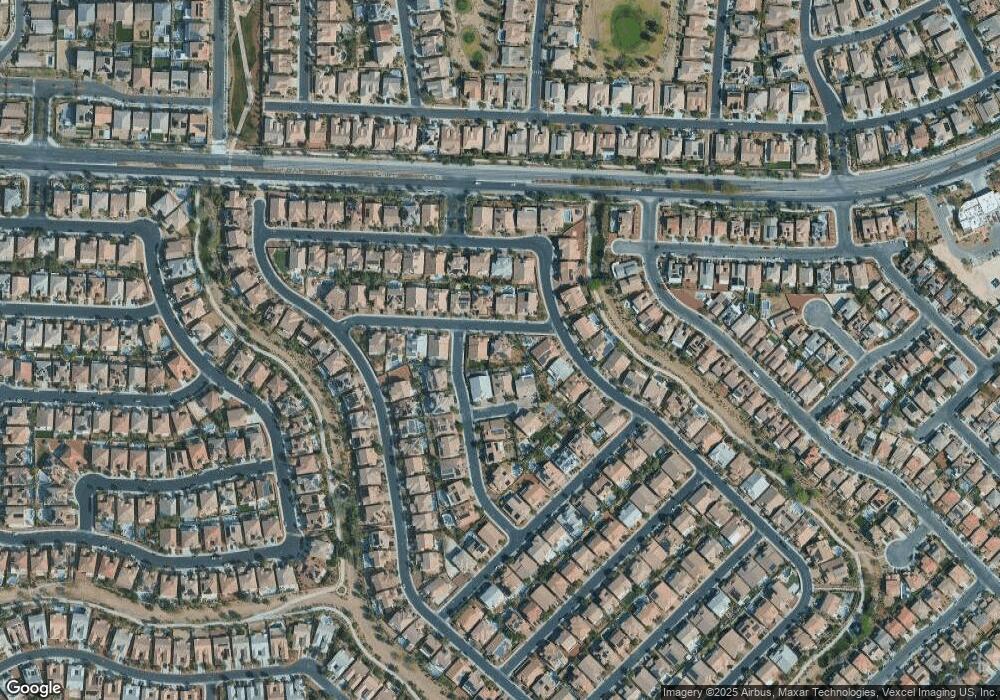

Map

Nearby Homes

- 7020 Villada St

- 7037 Puetollano Dr

- 7020 Puetollano Dr

- 3717 Fledgling Dr

- 7209 Millerbird St

- 4104 Fabulous Finches Ave

- 7140 Turkey Shoot Place

- 3425 Fledgling Dr

- 3721 Alcantara Ln

- 4116 Mantle Ave

- 3624 Pelican Brief Ln

- 7316 Bugler Swan Way

- 4208 Falcons Flight Ave

- 7312 Pinfeather Way

- 4212 Hawks Glide Ave

- 7381 Summer Duck Way

- 7264 Summer Duck Way

- 7073 Seabirds Place

- 4211 Klarissa Ave

- 7113 Bluebird Wing St

- 3817 Campanario Ave

- 3812 Ocelot Ct

- 7121 Manzanares Dr

- 3808 Ocelot Ct

- 3816 Ocelot Ct

- 3812 Campanario Ave

- 3808 Campanario Ave

- 3816 Campanario Ave

- 7117 Manzanares Dr

- 3905 Campanario Ave

- 3820 Campanario Ave

- 7113 Manzanares Dr

- 7041 Villada St

- 7028 Villada St

- 3807 Ocelot Ct

- 7120 Manzanares Dr

- 3813 San Esteban Ave

- 3809 San Esteban Ave

- 7037 Villada St

- 7124 Manzanares Dr