3815 Oreana Ct Spring, TX 77386

Benders Landing NeighborhoodEstimated Value: $802,000 - $911,000

3

Beds

5

Baths

3,554

Sq Ft

$245/Sq Ft

Est. Value

About This Home

This home is located at 3815 Oreana Ct, Spring, TX 77386 and is currently estimated at $871,207, approximately $245 per square foot. 3815 Oreana Ct is a home located in Montgomery County with nearby schools including Snyder Elementary School, York J High School, and Grand Oaks High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 16, 2015

Sold by

Raymond Daniel and Raymond Kristina

Bought by

Mcphie Craig W and Mcphie Roberta R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$445,500

Outstanding Balance

$287,420

Interest Rate

1.75%

Mortgage Type

New Conventional

Estimated Equity

$583,787

Purchase Details

Closed on

Nov 21, 2012

Sold by

Lgi Land Llc

Bought by

Obryant Jeffrey A

Purchase Details

Closed on

Mar 28, 2012

Sold by

Schwartzenburg Sean and Schwartzenburg Stephanie

Bought by

First Texas Homes Inc

Purchase Details

Closed on

May 14, 2007

Sold by

Liang Youngwu and Xu Min

Bought by

Raymond Daniel and Raymond Kristina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$368,000

Interest Rate

6.16%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 16, 2002

Sold by

Houston Lipar Ltd

Bought by

Mcphie Craig W and Mcphie Roberta

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcphie Craig W | -- | Startex Title Company | |

| Obryant Jeffrey A | -- | Texas American Title Company | |

| First Texas Homes Inc | -- | Capital Title | |

| Raymond Daniel | -- | None Available | |

| Mcphie Craig W | -- | -- | |

| Liang Youngwu | -- | American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcphie Craig W | $445,500 | |

| Previous Owner | Raymond Daniel | $368,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,755 | $850,000 | $346,410 | $503,590 |

| 2024 | $7,831 | $865,815 | -- | -- |

| 2023 | $7,831 | $787,110 | $214,550 | $582,480 |

| 2022 | $12,416 | $715,550 | $194,260 | $577,030 |

| 2021 | $12,026 | $650,500 | $118,450 | $532,050 |

| 2020 | $11,691 | $601,350 | $118,450 | $482,900 |

| 2019 | $11,009 | $546,510 | $126,000 | $420,510 |

| 2018 | $9,616 | $523,500 | $126,000 | $397,500 |

| 2017 | $10,531 | $523,500 | $126,000 | $397,500 |

| 2016 | $10,531 | $523,500 | $126,000 | $397,500 |

| 2015 | $10,341 | $553,930 | $126,000 | $427,930 |

| 2014 | $10,341 | $508,930 | $81,000 | $427,930 |

Source: Public Records

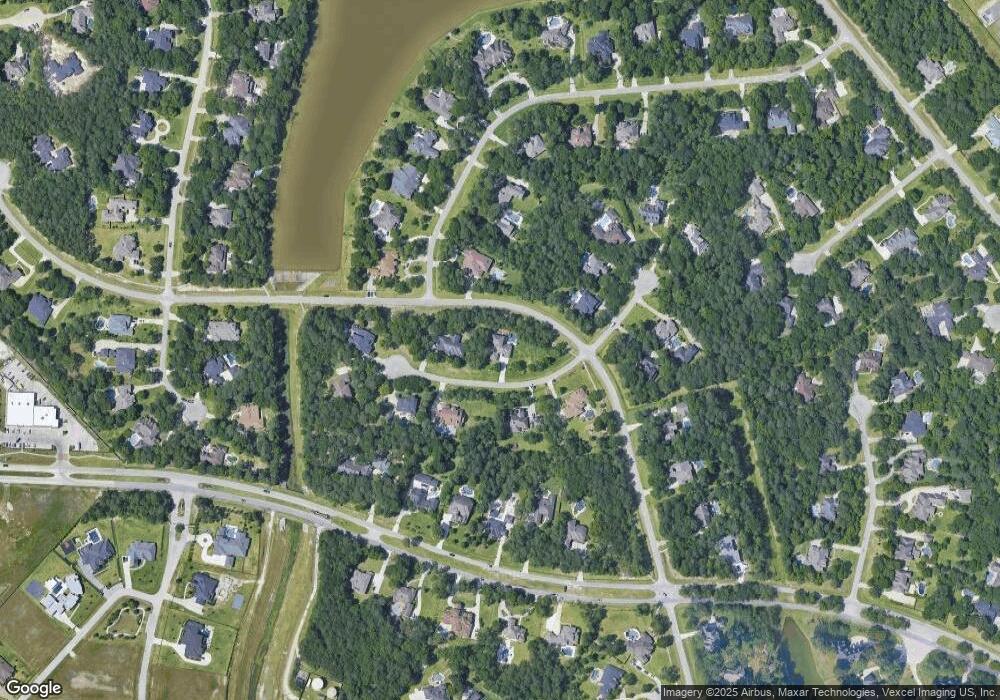

Map

Nearby Homes

- 3811 Rayford Rd

- 4028 Blenheim Terrace Ln

- TBD Old Riley Fuzzel Rd

- 3207 W Benders Landing Blvd

- 28210 & 28214 E Benders Landing Blvd

- 28019 E Benders Landing Blvd

- 27946 Emory Cove Dr

- 3823 Fleetwood Falls Ln

- 4527 Silver Moon Dr

- 4582 Silver Moon Dr

- 4345 Victoria Pine Dr

- 4349 Victoria Pine Dr

- 3814 Trophy Ridge Dr

- 4226 Davis Oak Dr

- 3834 Trophy Ridge Dr

- 4603 Silver Moon Dr

- 27911 Seger Bend Trail

- 3866 Everly Bend Dr

- 4300 Silver Oak Place

- 28210 Wooded Mist Dr

- 3811 Oreana Ct

- 3814 Oreana Ct

- 3810 Oreana Ct

- 3902 Boden Ln

- 27703 Braydon Ct

- 3806 Oreana Ct

- 27707 Braydon Ct

- 3910 Boden Ln

- 3803 Oreana Ct

- 3903 Boden Ln

- 3807 Rayford Rd

- 27702 Braydon Ct

- 27711 Braydon Ct

- 3815 Rayford Rd

- 27706 Braydon Ct

- 3802 Oreana Ct

- 3907 Boden Ln

- 3819 Rayford Rd

- 3803 Rayford Rd

- 3911 Boden Ln