3822 Country Club Rd Unit 3822F Winston Salem, NC 27104

South Fork NeighborhoodEstimated Value: $70,000 - $103,000

1

Bed

1

Bath

662

Sq Ft

$127/Sq Ft

Est. Value

About This Home

This home is located at 3822 Country Club Rd Unit 3822F, Winston Salem, NC 27104 and is currently estimated at $83,833, approximately $126 per square foot. 3822 Country Club Rd Unit 3822F is a home located in Forsyth County with nearby schools including South Fork Elementary School, Wiley Magnet Middle School, and Reynolds High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2019

Sold by

Carter Carol

Bought by

Flinchum Timothy M

Current Estimated Value

Purchase Details

Closed on

May 19, 2008

Sold by

Kuhn Sue and Kuhn Raymond

Bought by

Carter Carol

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$44,000

Interest Rate

5.84%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 16, 2002

Sold by

Hill Margaret and Hill Danny

Bought by

Kuhn Raymond and Kuhn Sue

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$33,600

Interest Rate

5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 16, 2001

Sold by

Orren Anne B

Bought by

Hill Danny and Hill Margaret

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Flinchum Timothy M | $30,956 | None Available | |

| Carter Carol | $44,000 | None Available | |

| Kuhn Raymond | $42,000 | -- | |

| Hill Danny | $40,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Carter Carol | $44,000 | |

| Previous Owner | Kuhn Raymond | $33,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $586 | $88,500 | $14,500 | $74,000 |

| 2024 | $560 | $41,800 | $8,000 | $33,800 |

| 2023 | $560 | $41,800 | $8,000 | $33,800 |

| 2022 | $549 | $41,800 | $8,000 | $33,800 |

| 2021 | $539 | $41,800 | $8,000 | $33,800 |

| 2020 | $414 | $30,000 | $14,000 | $16,000 |

| 2019 | $417 | $30,000 | $14,000 | $16,000 |

| 2018 | $66 | $30,000 | $14,000 | $16,000 |

| 2016 | -- | $24,917 | $14,000 | $10,917 |

| 2015 | -- | $24,917 | $14,000 | $10,917 |

| 2014 | -- | $24,917 | $14,000 | $10,917 |

Source: Public Records

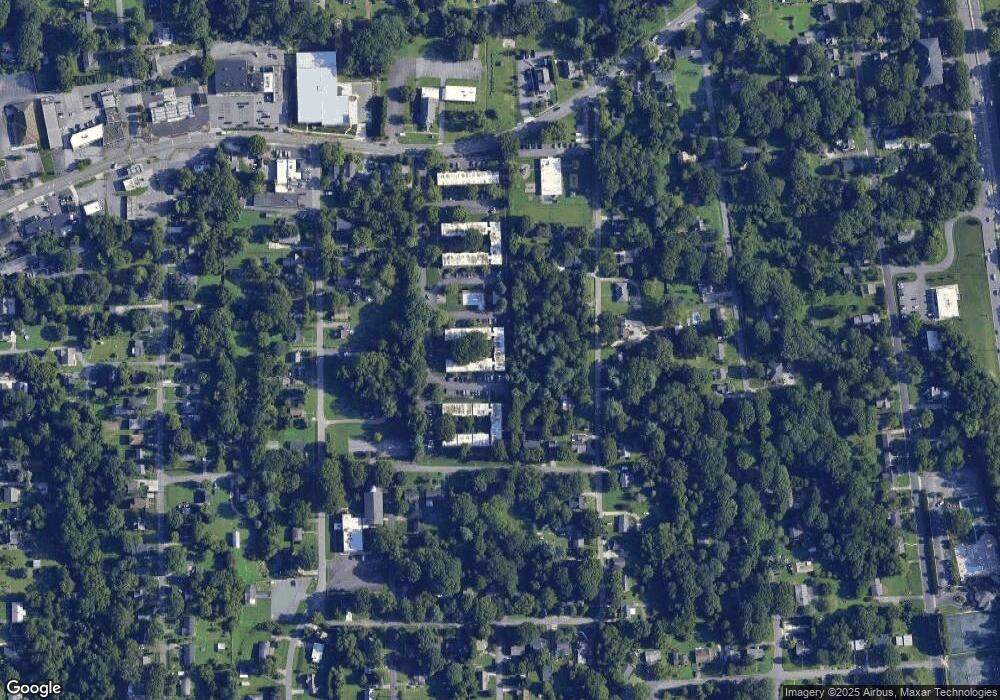

Map

Nearby Homes

- 3820 Country Club Rd Unit I

- 3812 Country Club Rd Unit D

- 3824 Country Club Rd Unit D

- 3830 Country Club Rd Unit L

- 406 S Cliffdale Dr

- 3618 Vandalia Dr

- 328 Keating Dr

- 4379 & 4391 Silas Creek Pkwy

- 185 Coventry Park Ln

- 181 Westhaven Cir

- 228 Longwood Dr NW

- 224 Longwood Dr NW

- 200 Coventry Park Ln

- 4205 Club Pointe Ct

- 4532 Fernhaven Cir Unit 9

- 310 Coventry Park Ln

- 3351 Emory Dr

- 104 Westhaven Cir

- 318 Anita Dr

- 204 Bradberry Ln

- 3822 Country Club Rd Unit 3822H

- 3822 Country Club Rd Unit 3822I

- 3822 Country Club Rd

- 3822 Country Club Rd Unit 3822D

- 3822 Country Club Rd Unit 3822C

- 3822 Country Club Rd

- 3822 Country Club Rd Unit B

- 3822 Country Club Rd Unit A

- 3822 Country Club Rd Unit J

- 3822 Country Club Rd Unit E

- 3822 Country Club Rd Unit 3822G

- 3822 Country Club Rd Unit L

- 3822 Country Club Rd Unit K

- 3822 Country Club Rd Unit D

- 3822 Country Club Rd

- 3822 Country Club Rd Unit Condo-i

- 3822 Country Club Rd

- 3822 Country Club Rd

- 3822-A Country Club Road - 3822-A

- 3820 Country Club Rd Unit 3820F