3827 Sweet Bottom Dr Unit 1 Duluth, GA 30096

Estimated Value: $1,826,000 - $2,224,000

4

Beds

6

Baths

8,831

Sq Ft

$227/Sq Ft

Est. Value

About This Home

This home is located at 3827 Sweet Bottom Dr Unit 1, Duluth, GA 30096 and is currently estimated at $2,005,707, approximately $227 per square foot. 3827 Sweet Bottom Dr Unit 1 is a home located in Gwinnett County with nearby schools including Chattahoochee Elementary School, Coleman Middle School, and Duluth High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2021

Sold by

Martin Robert A

Bought by

Martin Robert A and Martin Nancy M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$547,600

Outstanding Balance

$456,193

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$1,549,514

Purchase Details

Closed on

Jun 25, 2012

Sold by

Crm Central Properties Llc

Bought by

Stinchcomb Matt

Purchase Details

Closed on

Jul 7, 1994

Sold by

Patridge Greene Inc

Bought by

Phears H Wayne Linda A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Martin Robert A | -- | -- | |

| Stinchcomb Matt | $247,500 | -- | |

| Phears H Wayne Linda A | $75,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Martin Robert A | $547,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $17,684 | $628,800 | $110,880 | $517,920 |

| 2023 | $17,684 | $653,600 | $110,880 | $542,720 |

| 2022 | $15,997 | $640,080 | $110,880 | $529,200 |

| 2021 | $17,096 | $577,800 | $107,360 | $470,440 |

| 2020 | $15,225 | $484,480 | $97,760 | $386,720 |

| 2019 | $18,682 | $484,480 | $97,760 | $386,720 |

| 2018 | $15,258 | $484,480 | $97,760 | $386,720 |

| 2016 | $14,060 | $430,840 | $97,760 | $333,080 |

| 2015 | $16,914 | $430,840 | $97,760 | $333,080 |

| 2014 | -- | $430,840 | $97,760 | $333,080 |

Source: Public Records

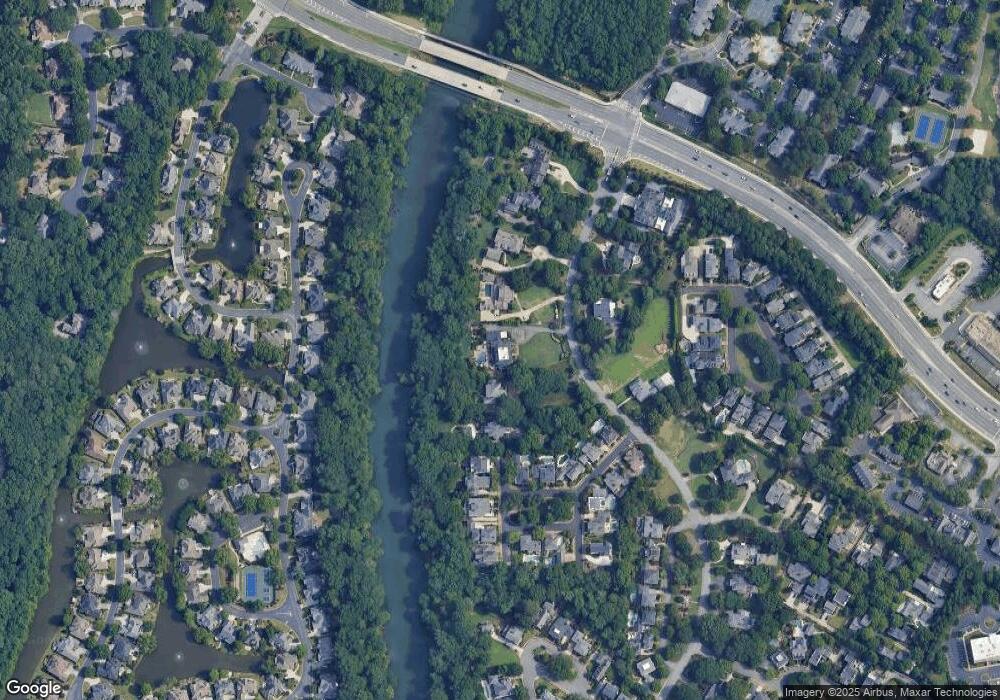

Map

Nearby Homes

- 5890 Hershinger Close

- 3869 Saint Elisabeth Square

- 3786 Turnberry Ct

- 3959 Saint Elisabeth Square

- 721 Beaufort Cir

- 622 Bedfort Dr

- 4027 Wood Acres Ct

- 3533 Mulberry Way

- 509 Bedfort Dr

- 3865 Whitney Place

- 515 Bedfort Dr

- 4146 Paddington Dr

- 113 Brittany Ct

- 9450 Riverclub Pkwy

- 121 Brittany Ct

- 3476 Silver Maple Dr

- 3469 Silver Maple Dr Unit A

- 3692 Howell Wood Trail NW

- 3446 Courtenay Ct

- 3837 Sweet Bottom Dr

- 3817 Sweet Bottom Dr

- 3807 Sweet Bottom Dr

- 3915 the Battery

- 3891 the Battery

- 3838 Sweet Bottom Dr

- 3881 the Battery

- 3861 the Battery Unit 2

- 3851 the Battery

- 3871 the Battery Unit 10

- 3871 the Battery

- 3911 the Battery Unit 4

- 3858 Sweet Bottom Dr

- 3868 Sweet Bottom Dr

- 3797 Sweet Bottom Dr Unit 1

- 3921 the Battery

- 0 the Battery Unit 8583198

- 0 the Battery Unit 7014510

- 0 the Battery Unit 8813143

- 0 the Battery Unit 3093568