3831 Josephine Heights Colorado Springs, CO 80906

Stratmoor Hills NeighborhoodEstimated Value: $311,000 - $324,000

2

Beds

3

Baths

1,374

Sq Ft

$230/Sq Ft

Est. Value

About This Home

This home is located at 3831 Josephine Heights, Colorado Springs, CO 80906 and is currently estimated at $316,333, approximately $230 per square foot. 3831 Josephine Heights is a home located in El Paso County with nearby schools including Otero Elementary School, Fox Meadow Middle School, and Harrison High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 15, 2024

Sold by

Lobanova Elena

Bought by

Lobanov Dimitry and Lobanova Tetiana

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,387

Outstanding Balance

$257,891

Interest Rate

6.32%

Mortgage Type

VA

Estimated Equity

$58,442

Purchase Details

Closed on

Oct 14, 2017

Sold by

Oimitvy Labanov

Bought by

Lobanova Elena

Purchase Details

Closed on

Sep 1, 2017

Sold by

Kronebushc Eric A

Bought by

Lobanov Dimiitry

Purchase Details

Closed on

Aug 5, 2016

Sold by

Lloyd Thomas F

Bought by

Kronebusch Eric A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$186,658

Interest Rate

3.41%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 1, 2004

Sold by

St Andrews Homes Ltd

Bought by

Lloyd Thomas F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,800

Interest Rate

6.26%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lobanov Dimitry | $305,000 | Stewart Title | |

| Lobanov Dimitry | $305,000 | Stewart Title | |

| Lobanova Elena | -- | None Available | |

| Lobanov Dimiitry | $183,422 | Heritage Title Co | |

| Kronebusch Eric A | $190,000 | North American Title | |

| Lloyd Thomas F | $178,500 | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lobanov Dimitry | $260,387 | |

| Closed | Lobanov Dimitry | $260,387 | |

| Previous Owner | Kronebusch Eric A | $186,658 | |

| Previous Owner | Lloyd Thomas F | $142,800 | |

| Closed | Lloyd Thomas F | $35,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,198 | $24,680 | -- | -- |

| 2024 | $930 | $24,410 | $4,960 | $19,450 |

| 2023 | $930 | $24,410 | $4,960 | $19,450 |

| 2022 | $948 | $17,570 | $3,160 | $14,410 |

| 2021 | $1,012 | $18,080 | $3,250 | $14,830 |

| 2020 | $954 | $14,640 | $2,290 | $12,350 |

| 2019 | $925 | $14,640 | $2,290 | $12,350 |

| 2018 | $886 | $13,500 | $1,980 | $11,520 |

| 2017 | $677 | $13,500 | $1,980 | $11,520 |

| 2016 | $693 | $12,980 | $1,910 | $11,070 |

| 2015 | $693 | $12,980 | $1,910 | $11,070 |

| 2014 | $692 | $12,820 | $1,750 | $11,070 |

Source: Public Records

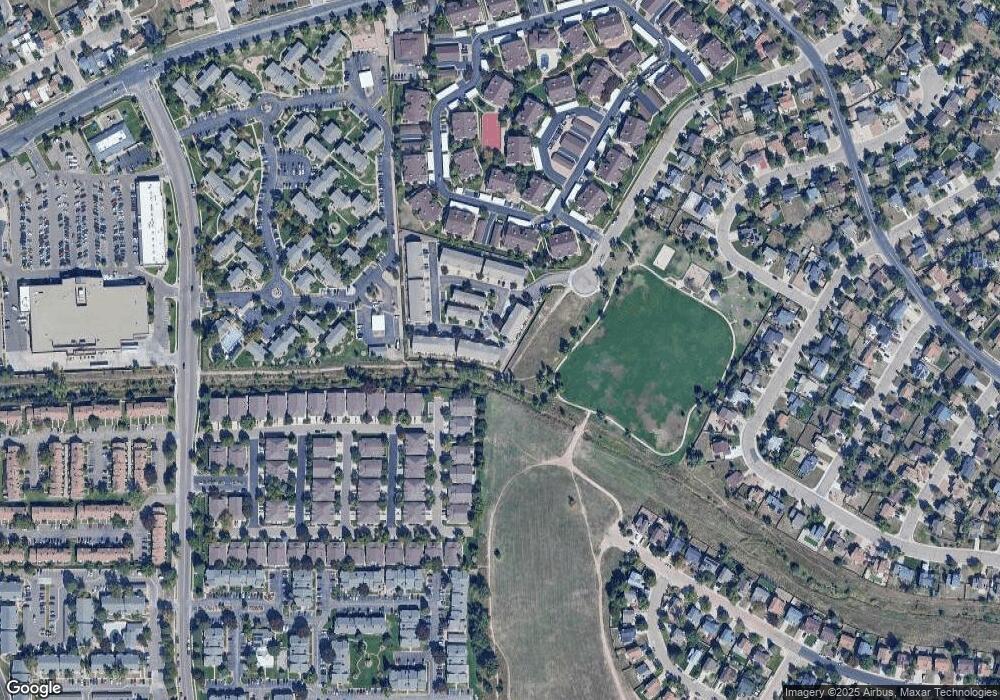

Map

Nearby Homes

- 3884 Packers Point

- 1025 Cheyenne Villas Point

- 3914 Leah Heights Unit 108

- 3930 Leah Heights Unit 16

- 1244 Samuel Point Unit 1

- 3630 Strawberry Field Grove Unit G

- 3916 Red Cedar Dr

- 938 London Green Way

- 865 San Antonio Place

- 3640 San Pedro Ct

- 906 London Green Way

- 1250 Cheyenne Meadows Rd

- 825 San Gabriel Place

- 1565 Charmwood Dr

- 794 Crosstrail Dr

- 3865 Rosemere St

- 720 Crown Point Dr

- 785 Bayfield Dr

- 780 Bayfield Dr

- 4573 Prestige Point

- 3835 Josephine Heights

- 3839 Josephine Heights

- 3843 Josephine Heights

- 3847 Josephine Heights

- 3819 Josephine Heights

- 3851 Josephine Heights

- 3815 Josephine Heights

- 3840 Josephine Heights

- 3811 Josephine Heights

- 3844 Josephine Heights

- 3863 Josephine Heights

- 3848 Josephine Heights

- 3807 Josephine Heights

- 3867 Josephine Heights

- 1037 Cheyenne Villas Point

- 3803 Josephine Heights

- 3852 Josephine Heights

- 1031 Cheyenne Villas Point

- 3871 Josephine Heights

- 1012 Samuel Point Unit 70