38415 North Ln Willoughby, OH 44094

Estimated Value: $109,000 - $140,000

3

Beds

1

Bath

1,011

Sq Ft

$117/Sq Ft

Est. Value

About This Home

This home is located at 38415 North Ln, Willoughby, OH 44094 and is currently estimated at $118,061, approximately $116 per square foot. 38415 North Ln is a home located in Lake County with nearby schools including Grant Elementary School, Willoughby Middle School, and South High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 10, 2019

Sold by

App William

Bought by

Onna App William and Onna Breale Blade Bri

Current Estimated Value

Purchase Details

Closed on

Dec 2, 2015

Sold by

Filipovic Perica

Bought by

App William

Purchase Details

Closed on

Jan 29, 2015

Sold by

Filipovic Gordana

Bought by

Filipovic Perica

Purchase Details

Closed on

May 22, 2001

Sold by

Mikonsky Dennis P and Mikonsky Lori

Bought by

Filipovic Perica and Filipovic Gordana

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,400

Interest Rate

7.07%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 30, 1992

Bought by

Mikonsky Dennis P

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Onna App William | -- | None Available | |

| App William | $50,000 | Newman Title | |

| Filipovic Perica | -- | Ohio Real Title | |

| Filipovic Perica | $65,500 | Executive Title Agency Corp | |

| Mikonsky Dennis P | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Filipovic Perica | $52,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $24,060 | $2,270 | $21,790 |

| 2024 | -- | $24,060 | $2,270 | $21,790 |

| 2023 | $1,795 | $18,960 | $1,810 | $17,150 |

| 2022 | $1,195 | $18,960 | $1,810 | $17,150 |

| 2021 | $1,200 | $18,960 | $1,810 | $17,150 |

| 2020 | $1,171 | $16,490 | $1,580 | $14,910 |

| 2019 | $1,089 | $16,490 | $1,580 | $14,910 |

| 2018 | $1,081 | $15,750 | $1,240 | $14,510 |

| 2017 | $1,089 | $15,750 | $1,240 | $14,510 |

| 2016 | $1,085 | $15,750 | $1,240 | $14,510 |

| 2015 | $1,024 | $15,750 | $1,240 | $14,510 |

| 2014 | $972 | $15,750 | $1,240 | $14,510 |

| 2013 | $973 | $15,750 | $1,240 | $14,510 |

Source: Public Records

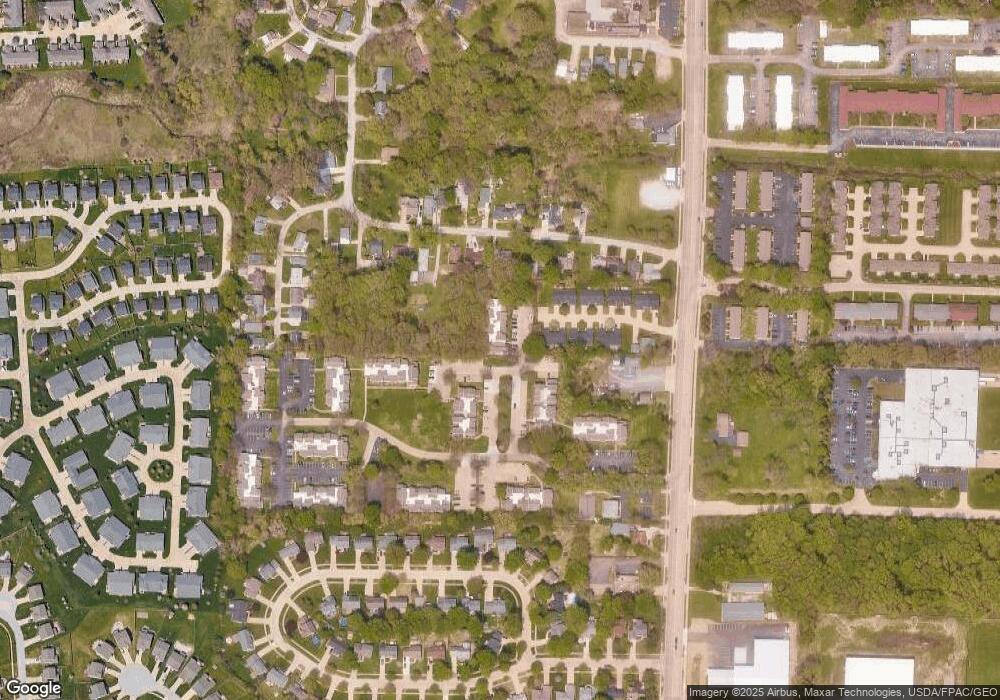

Map

Nearby Homes

- VL#1 Oak St

- VL#2 Oak St

- 38462 S Beachview Rd

- 1395 E Cross Creek Dr Unit 32

- 38256 Lake Shore Blvd

- 1187 Brookline Place Unit A

- 1263 Lost Nation Rd Unit 22A

- 38606 Granite Dr Unit 28

- 1053 Peach Blvd

- 0 V L Lake Shore Blvd Unit 5070796

- 992 Peach Blvd

- 213 Paxton Rd

- 845 Shadowrow Ave

- 130 Traymore Blvd

- 126 Plymouth Rd

- 871 Birchwood Dr

- 132 Shelton Blvd

- 6399 Seminole Trail

- 753 Birchwood Dr

- 766 Cherokee Trail

- 38415 North Ln

- 38415 North Ln

- 38415 North Ln

- 38415 North Ln

- 38415 North Ln

- 38415 North Ln Unit D109

- 38415 North Ln Unit D108

- 38415 North Ln

- 38415 North Ln Unit D106

- 38415 North Ln

- 38415 North Ln

- 38415 North Ln

- 38415 North Ln Unit D102

- 38415 North Ln Unit 210 D

- 38415 North Ln Unit D210

- 38415 North Ln Unit D-202

- 38415 North Ln Unit D206

- 38415 N Lane D-201

- 38415 North Ln Unit D105

- 38415 North Ln Unit D201