3845 Burgundy Bay Blvd E Medina, OH 44256

Estimated Value: $419,000 - $840,000

4

Beds

4

Baths

2,873

Sq Ft

$203/Sq Ft

Est. Value

About This Home

This home is located at 3845 Burgundy Bay Blvd E, Medina, OH 44256 and is currently estimated at $584,252, approximately $203 per square foot. 3845 Burgundy Bay Blvd E is a home located in Medina County with nearby schools including Sidney Fenn Elementary School, Claggett Middle School, and Medina High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 3, 2019

Sold by

Laneville Donald E and Laneville Debbra K

Bought by

Laneville Donald E and Laneville Debbra K

Current Estimated Value

Purchase Details

Closed on

May 4, 2001

Sold by

Joseph Perillo

Bought by

Laneville Donald E and Laneville Debra K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

7.18%

Purchase Details

Closed on

Nov 10, 1999

Sold by

Oconnor Daniel P and Oconnor Cynthia S

Bought by

Perillo Joseph and Perillo Claudia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,000

Interest Rate

7.72%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Laneville Donald E | -- | None Available | |

| Laneville Donald E | $381,900 | L T I C | |

| Perillo Joseph | $350,000 | L T I C |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Laneville Donald E | $250,000 | |

| Previous Owner | Perillo Joseph | $175,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,782 | $152,330 | $32,980 | $119,350 |

| 2023 | $7,782 | $152,330 | $32,980 | $119,350 |

| 2022 | $6,708 | $152,330 | $32,980 | $119,350 |

| 2021 | $6,415 | $122,850 | $26,600 | $96,250 |

| 2020 | $6,467 | $122,850 | $26,600 | $96,250 |

| 2019 | $6,480 | $122,850 | $26,600 | $96,250 |

| 2018 | $6,510 | $114,600 | $23,870 | $90,730 |

| 2017 | $6,598 | $114,600 | $23,870 | $90,730 |

| 2016 | $6,749 | $114,600 | $23,870 | $90,730 |

| 2015 | $6,621 | $107,100 | $22,310 | $84,790 |

| 2014 | $6,606 | $107,100 | $22,310 | $84,790 |

| 2013 | $6,614 | $107,100 | $22,310 | $84,790 |

Source: Public Records

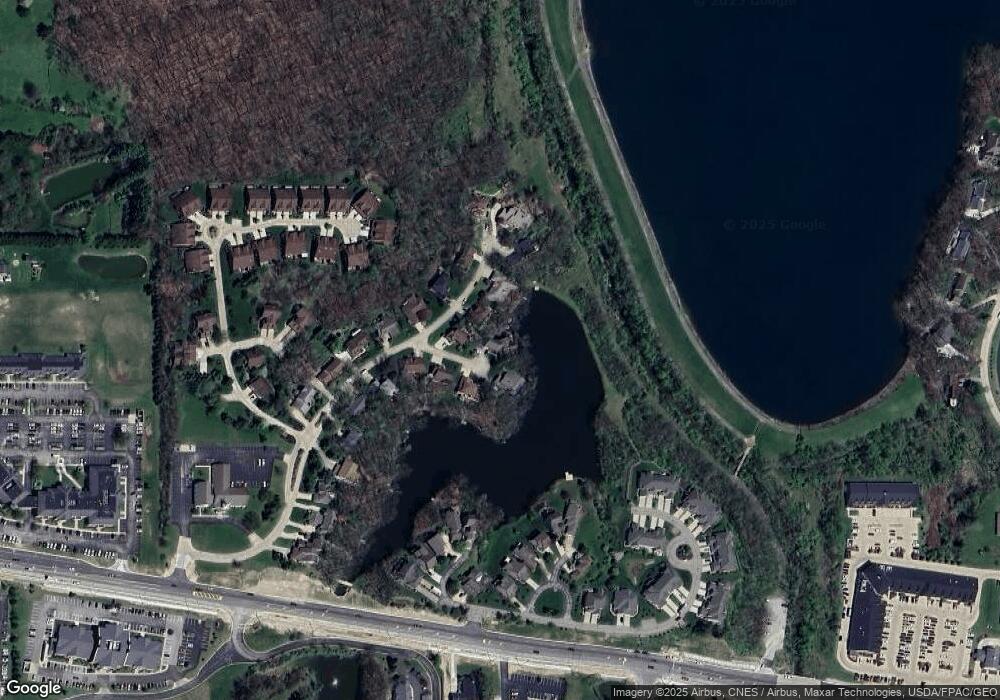

Map

Nearby Homes

- 0 Reserve Dr

- 3561 Old Hickory Ln

- 4138 Timber Trail

- 5249 Crown Pointe Dr

- SL #7 Falcon Ridge Dr

- SL #6 Falcon Ridge Dr

- 3465 Hunting Run Rd

- 3667 Eagle Point Ct

- 959 Sandy Ln

- 3966 Granger Rd

- 3621 Hidden Canyon Trail

- 1027 E Smith Rd

- 923 Sandy Ln

- 345 Roshon Dr

- 4550 Weymouth Rd

- 3276 Hardwood Hollow Rd

- 4992 Garden Lake Ct

- 895 Lancaster Dr

- 5532 Brook Run Dr

- 5226 Park Dr

- 4949 Burgundy Bay Blvd N

- 4953 Burgundy Bay Blvd N

- 3838 Burgundy Bay Blvd E

- 4953 Burgundy Bay Blvd E

- 4939 Burgundy Bay Blvd N

- 3856 Burgundy Bay Blvd E

- 3876 Burgundy Bay Blvd E

- 4959 Burgundy Bay Blvd N

- 4935 Burgundy Bay Blvd N

- 4944 Burgundy Bay Blvd N

- 4952 Burgundy Bay Blvd N

- 4936 Burgundy Bay Blvd N

- 4963 Burgundy Bay Blvd N

- 4956 Burgundy Bay Blvd N

- 4929 Burgundy Bay Blvd N

- 4930 Burgundy Bay Blvd N

- 4973 Burgundy Bay Blvd N

- 4962 Burgundy Bay Blvd N

- 3903 Burgundy Bay Blvd W

- 3901 Burgundy Bay Blvd W