3845 Redcoat Way Alpharetta, GA 30022

Estimated Value: $1,158,000 - $1,314,000

4

Beds

5

Baths

4,606

Sq Ft

$270/Sq Ft

Est. Value

About This Home

This home is located at 3845 Redcoat Way, Alpharetta, GA 30022 and is currently estimated at $1,242,510, approximately $269 per square foot. 3845 Redcoat Way is a home located in Fulton County with nearby schools including Barnwell Elementary School, Autrey Mill Middle School, and Johns Creek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 7, 2005

Sold by

Sinervo Ken

Bought by

Sinervo Ken and Sinervo Cynthia A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$497,600

Outstanding Balance

$293,112

Interest Rate

7.5%

Mortgage Type

New Conventional

Estimated Equity

$949,398

Purchase Details

Closed on

Jul 14, 2000

Sold by

Stevens James A

Bought by

Pratt William A and Pratt Bonnie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

8.3%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sinervo Ken | -- | -- | |

| Sinervo Ken | $622,000 | -- | |

| Pratt William A | $432,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sinervo Ken | $497,600 | |

| Previous Owner | Pratt William A | $300,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,027 | $488,320 | $137,080 | $351,240 |

| 2023 | $11,693 | $414,280 | $117,480 | $296,800 |

| 2022 | $8,672 | $350,120 | $59,000 | $291,120 |

| 2021 | $8,601 | $310,680 | $66,120 | $244,560 |

| 2020 | $8,664 | $310,280 | $65,240 | $245,040 |

| 2019 | $1,094 | $304,800 | $64,080 | $240,720 |

| 2018 | $8,698 | $297,680 | $62,600 | $235,080 |

| 2017 | $8,589 | $277,800 | $56,360 | $221,440 |

| 2016 | $8,415 | $277,800 | $56,360 | $221,440 |

| 2015 | $8,509 | $277,800 | $56,360 | $221,440 |

| 2014 | $7,773 | $236,520 | $56,360 | $180,160 |

Source: Public Records

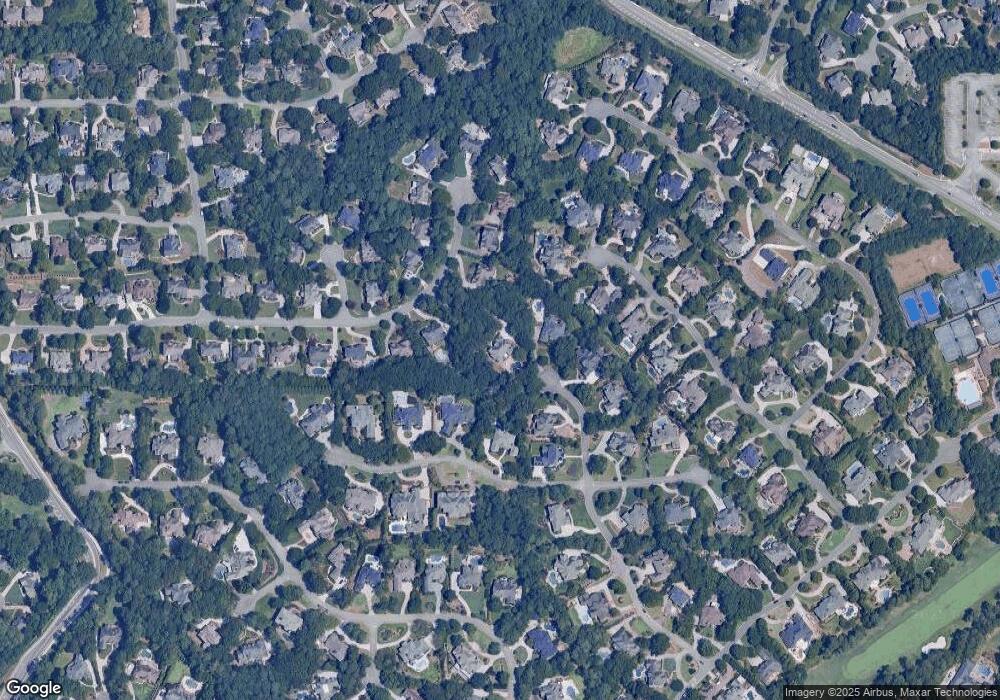

Map

Nearby Homes

- 3765 Redcoat Way

- 2001 Tavistock Ct

- 2005 Westbourne Way Unit 2

- 3815 Falls Landing Dr

- 515 Oak Bridge Trail

- 545 Oak Bridge Trail

- 9715 Almaviva Dr

- 595 Oak Alley Way

- 9695 Almaviva Dr

- 350 Waters Bend Way

- 9675 Almaviva Dr

- 2045 Northwick Pass Way

- 6092 Carlisle Ln

- 2100 Northwick Pass Way

- 5040 Harrington Rd

- 615 S Preston Ct

- 115 Thome Dr

- 7015 Carlisle Ln

- 180 Preston Oaks Dr

- 3835 Redcoat Way

- 3835 Redcoat Way

- 3855 Redcoat Way

- 2014 Tavistock Ct

- 3825 Redcoat Way

- 3865 Redcoat Way

- 3015 Kettering Ct

- 3840 Redcoat Way

- 2013 Tavistock Ct

- 2012 Tavistock Ct Unit 1

- 3013 Kettering Ct

- 1017 Tullamore Place

- 1015 Tullamore Place

- 205 Foxworth Chase Unit 3

- 3017 Kettering Ct Unit 7

- 3017 Kettering Ct

- 3850 Redcoat Way

- 3875 Redcoat Way

- 3815 Redcoat Way

- 0 Kettering Ct Unit 3229512