3847 Mossy Rock Dr Unit 203 Highlands Ranch, CO 80126

Northridge NeighborhoodEstimated Value: $350,000 - $371,021

2

Beds

2

Baths

1,077

Sq Ft

$334/Sq Ft

Est. Value

About This Home

This home is located at 3847 Mossy Rock Dr Unit 203, Highlands Ranch, CO 80126 and is currently estimated at $359,255, approximately $333 per square foot. 3847 Mossy Rock Dr Unit 203 is a home located in Douglas County with nearby schools including Cougar Run Elementary School, Cresthill Middle School, and Highlands Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2023

Sold by

Burnette Carolyn Sue

Bought by

Bullard Benjamin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$384,408

Outstanding Balance

$373,719

Interest Rate

6.39%

Mortgage Type

FHA

Estimated Equity

-$14,464

Purchase Details

Closed on

Oct 28, 2022

Sold by

Burnette Carolyn S and Burnette Casey G

Bought by

Burnette Carolyn S and Burnette Casey G

Purchase Details

Closed on

Oct 16, 2000

Sold by

Garr Frank J

Bought by

Burnette Carolyn Sue

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

7.89%

Purchase Details

Closed on

Jan 30, 1997

Sold by

Canyon Ranch Condominiums Ltd

Bought by

Garr Frank J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,400

Interest Rate

7.73%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bullard Benjamin | $391,500 | First Alliance Title | |

| Burnette Carolyn S | -- | None Listed On Document | |

| Burnette Carolyn Sue | $150,000 | -- | |

| Garr Frank J | $106,006 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bullard Benjamin | $384,408 | |

| Previous Owner | Burnette Carolyn Sue | $100,000 | |

| Previous Owner | Garr Frank J | $95,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,093 | $25,890 | -- | $25,890 |

| 2023 | $1,459 | $25,890 | $0 | $25,890 |

| 2022 | $1,060 | $18,550 | $0 | $18,550 |

| 2021 | $1,103 | $18,550 | $0 | $18,550 |

| 2020 | $1,065 | $18,630 | $1,070 | $17,560 |

| 2019 | $1,069 | $18,630 | $1,070 | $17,560 |

| 2018 | $744 | $15,080 | $1,080 | $14,000 |

| 2017 | $677 | $15,080 | $1,080 | $14,000 |

| 2016 | $553 | $12,600 | $1,190 | $11,410 |

| 2015 | $283 | $12,600 | $1,190 | $11,410 |

| 2014 | $984 | $10,140 | $1,190 | $8,950 |

Source: Public Records

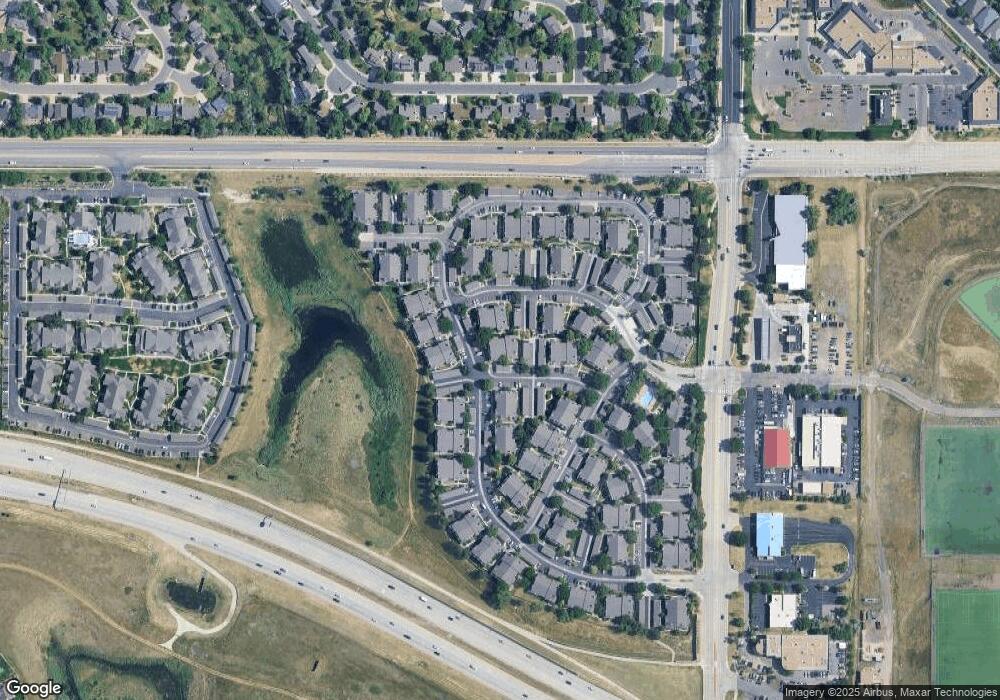

Map

Nearby Homes

- 3825 Canyon Ranch Rd Unit 203

- 8415 Pebble Creek Way Unit 203

- 8437 Thunder Ridge Way Unit 202

- 3855 Canyon Ranch Rd Unit 104

- 8425 Pebble Creek Way Unit 101

- 3727 Cactus Creek Ct Unit 104

- 3756 E Phillips Cir

- 8465 Pebble Creek Way Unit 102

- 8475 Pebble Creek Way Unit 204

- 8495 Pebble Creek Way Unit 102

- 3298 E Phillips Dr

- 8317 Stonybridge Cir

- 8391 Stonybridge Cir

- 8399 Stonybridge Cir

- 8586 Meadow Creek Dr

- 4179 E Phillips Place

- 3887 Mallard Ln

- 8103 S Harrison Cir

- 3480 Meadow Creek Way

- unkonwn Siskin Ave

- 3847 Mossy Rock Dr Unit 204

- 3847 Mossy Rock Dr Unit 101

- 3847 Mossy Rock Dr Unit 202

- 3847 Mossy Rock Dr Unit 201

- 3847 Mossy Rock Dr Unit 103

- 3847 Mossy Rock Dr Unit 102

- 3847 E Mossy Rock Dr Unit 203

- 3847 Mossy Rock Dr Unit 28103

- 3836 E Canyon Ranch Rd Unit 102

- 3836 Canyon Ranch Rd Unit 204

- 3836 Canyon Ranch Rd Unit 203

- 3836 Canyon Ranch Rd Unit 202

- 3836 Canyon Ranch Rd Unit 201

- 3836 Canyon Ranch Rd Unit 104

- 3836 Canyon Ranch Rd Unit 103

- 3836 Canyon Ranch Rd Unit 102

- 3836 Canyon Ranch Rd Unit 101

- 3836 Canyon Ranch Rd Unit 3836201

- 8389 Pebble Creek Way Unit 103

- 8389 Pebble Creek Way Unit 204