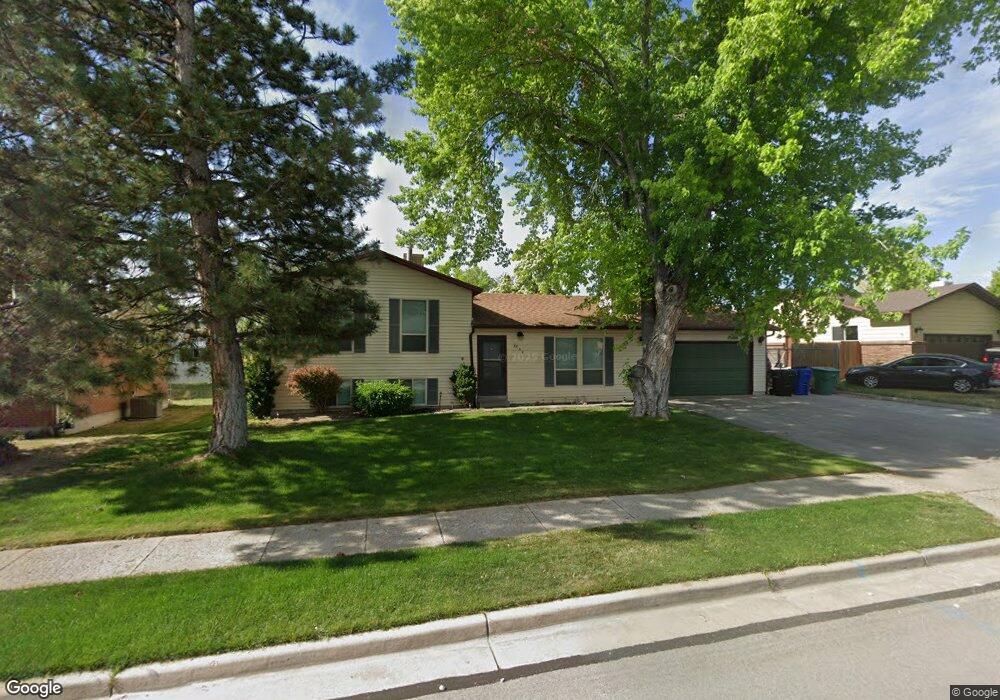

3853 W Deborah Dr West Jordan, UT 84088

Jordan Oaks NeighborhoodEstimated Value: $512,723 - $576,000

4

Beds

3

Baths

1,734

Sq Ft

$305/Sq Ft

Est. Value

About This Home

This home is located at 3853 W Deborah Dr, West Jordan, UT 84088 and is currently estimated at $529,681, approximately $305 per square foot. 3853 W Deborah Dr is a home located in Salt Lake County with nearby schools including Terra Linda Elementary School, Elk Ridge Middle School, and West Jordan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 10, 2021

Sold by

Miller Bruce W and Miller Natalie J

Bought by

Fox Jeremy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$408,500

Outstanding Balance

$374,424

Interest Rate

3.01%

Mortgage Type

New Conventional

Estimated Equity

$155,257

Purchase Details

Closed on

Dec 17, 2018

Sold by

Miller Bruce W

Bought by

Utah West Jordan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,000

Interest Rate

4.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 30, 2008

Sold by

Miller Bruce W and Miller Natalie J

Bought by

Miller Bruce W and Miller Natalie J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fox Jeremy | -- | Vanguard Title Union Park | |

| Utah West Jordan | -- | Accommodation | |

| Utah West Jordan | -- | Titleone | |

| Miller Bruce W | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fox Jeremy | $408,500 | |

| Previous Owner | Utah West Jordan | $192,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,580 | $497,300 | $152,400 | $344,900 |

| 2024 | $2,580 | $496,300 | $150,900 | $345,400 |

| 2023 | $2,533 | $459,300 | $147,900 | $311,400 |

| 2022 | $2,631 | $469,400 | $145,000 | $324,400 |

| 2021 | $2,065 | $335,300 | $100,000 | $235,300 |

| 2020 | $1,795 | $273,600 | $82,000 | $191,600 |

| 2019 | $1,795 | $268,200 | $82,000 | $186,200 |

| 2018 | $1,666 | $246,900 | $79,800 | $167,100 |

| 2017 | $1,564 | $230,800 | $79,800 | $151,000 |

| 2016 | $1,505 | $208,700 | $79,800 | $128,900 |

| 2015 | $1,430 | $193,300 | $81,300 | $112,000 |

| 2014 | $1,369 | $182,200 | $77,500 | $104,700 |

Source: Public Records

Map

Nearby Homes

- 3702 W Angus Dr

- 3750 W Bingham Creek Dr

- 9375 S Laurel Ridge Cir

- 9441 S Newkirk St

- 9526 Ember Glow Ct Unit C

- 9566 Ember Glow Ct Unit C

- 8983 S 3860 W

- 9353 S 4460 W

- 9941 Birnam Woods Way

- 3931 W Dansere Cir

- 8941 S Sun Leaf Dr

- 3256 Star Fire Rd

- 4424 W Skye Dr

- 3888 W 8700 S

- 9029 S Ripple Dr

- 4565 Lennox Dr

- 9851 S Birdie Way

- 3928 W Kilt St

- 4058 W Ascot Downs Dr

- 4072 W Ascot Downs Dr

- 3853 Deborah Dr

- 3861 Deborah Dr

- 3861 W Deborah Dr

- 3845 Deborah Dr

- 3854 Westland Dr

- 3854 Westland Dr Unit 14A

- 3862 Westland Dr

- 3846 Westland Dr

- 3869 Deborah Dr

- 9352 S 3825 W

- 3854 Deborah Dr

- 3854 W Deborah Dr

- 3846 Deborah Dr

- 3862 Deborah Dr

- 3870 Westland Dr

- 9370 S 3825 W

- 9326 S 3825 W

- 3877 W Deborah Dr

- 3877 Deborah Dr

- 9325 Janet Way