386 S 100 E Unit 5 Mantua, UT 84324

Estimated Value: $819,000 - $972,000

Studio

--

Bath

--

Sq Ft

0.5

Acres

About This Home

This home is located at 386 S 100 E Unit 5, Mantua, UT 84324 and is currently estimated at $881,379. 386 S 100 E Unit 5 is a home located in Box Elder County with nearby schools including Golden Spike Elementary, Box Elder Middle School, and Adele C. Young Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 2020

Sold by

Hansen Steven and Hansen Heather

Bought by

Hansen Steven Carey and Hansen Heather Jo

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$341,750

Outstanding Balance

$301,321

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$580,058

Purchase Details

Closed on

Apr 12, 2016

Sold by

Robb Miles Construction Inc

Bought by

Hansen Steven and Hansen Heather

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$330,900

Interest Rate

3.64%

Mortgage Type

Construction

Purchase Details

Closed on

Sep 25, 2015

Sold by

Huise Johnny G

Bought by

Robb Miles Construction Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hansen Steven Carey | -- | Integrated Ttl Ins Svcs Llc | |

| Hansen Steven | -- | Hickman Land Title Company | |

| Robb Miles Construction Inc | -- | Mountain View Title Ogden |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hansen Steven Carey | $341,750 | |

| Closed | Hansen Steven | $330,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,597 | $769,558 | $200,080 | $569,478 |

| 2024 | $4,018 | $750,104 | $175,080 | $575,024 |

| 2023 | $4,356 | $836,937 | $175,080 | $661,857 |

| 2022 | $3,725 | $354,824 | $49,517 | $305,307 |

| 2021 | $3,355 | $501,730 | $90,030 | $411,700 |

| 2020 | $3,492 | $501,730 | $90,030 | $411,700 |

| 2019 | $3,285 | $249,902 | $49,517 | $200,385 |

| 2018 | $2,844 | $204,886 | $44,000 | $160,886 |

| 2017 | $2,928 | $372,520 | $44,000 | $292,520 |

| 2016 | $1,176 | $80,000 | $80,000 | $0 |

| 2015 | -- | $62,500 | $62,500 | $0 |

Source: Public Records

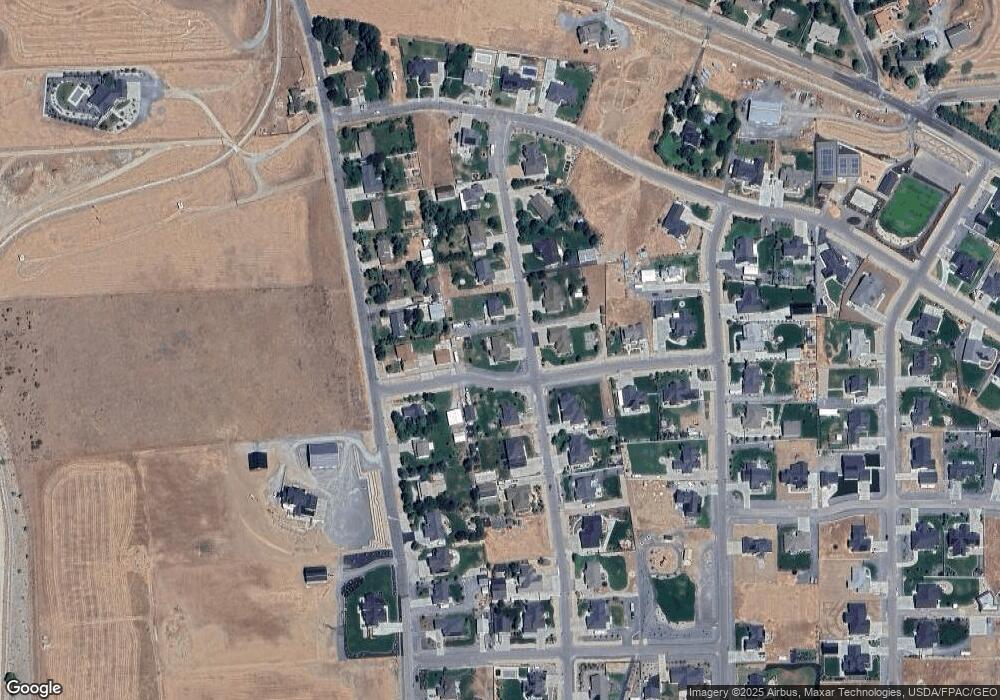

Map

Nearby Homes

- 553 S Lake View Dr

- 655 Willard Peak Rd

- 263 E Fish Hatchery Rd

- 669 S 150 E

- 1623 Willard Peak Rd Unit 1

- 1705 Willard Peak Rd Unit 2

- 534 E Fish Hatchery Rd

- 67 E Center St

- 214 W Center St

- 91 U S 89

- 1329 E Kaylynne Cir

- 64 N Bywater Way

- 644 S 900 E

- 1228 Sheri Cir

- 637 E 950 S Unit 20

- 1066 Beecher Ave

- 867 S Arapaho Ct

- 520 E 500 S

- 801 S 425 E

- 165 E 1550 S

- 386 S 100 E

- 368 S 100 E

- 412 S 100 E

- 387 S 100 E Unit 1

- 618 E Fish Hatchery Rd

- 618 E Fish Hatchery Rd Unit 83

- 617 S Lake View Dr

- 617 S Lake View Dr Unit 80

- 601 S Lake View Dr Unit 81

- 373 S 100 E

- 371 Willard Peak Rd

- 415 S 100 E

- 363 Willard Peak Rd

- 405 Willard Peak Rd

- 349 Willard Peak Rd

- 426 S 100 E

- 330 S 100 E

- 417 Willard Peak Rd

- 355 S 100 E

- 611 Willard Peak Rd

Your Personal Tour Guide

Ask me questions while you tour the home.