38689 Palm Meadow Dr Unit 52-206 Clinton Township, MI 48036

Estimated Value: $221,000 - $245,000

2

Beds

2

Baths

1,530

Sq Ft

$153/Sq Ft

Est. Value

About This Home

This home is located at 38689 Palm Meadow Dr Unit 52-206, Clinton Township, MI 48036 and is currently estimated at $233,505, approximately $152 per square foot. 38689 Palm Meadow Dr Unit 52-206 is a home located in Macomb County with nearby schools including Ottawa Elementary School, Algonquin Middle School, and Chippewa Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 20, 2022

Sold by

Tyzo Edward

Bought by

Malone Janet

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,000

Outstanding Balance

$157,794

Interest Rate

6.02%

Mortgage Type

Balloon

Estimated Equity

$75,711

Purchase Details

Closed on

Oct 17, 2022

Sold by

Walczyk Agnes

Bought by

Malone Janet and Tyzo Edward

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,000

Outstanding Balance

$157,794

Interest Rate

6.02%

Mortgage Type

Balloon

Estimated Equity

$75,711

Purchase Details

Closed on

Jun 9, 2021

Sold by

Walczyk Agnes

Bought by

Walczyk Agnes and Walczyk Robert

Purchase Details

Closed on

Jul 19, 2018

Sold by

Knuth Judith A and Judith A Knuth Revocable Trust

Bought by

Walczyk Agnes

Purchase Details

Closed on

Dec 13, 2010

Sold by

Krausmann Mary L and Krausmann John P

Bought by

The Judith A Knuth Revocable Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Malone Janet | -- | -- | |

| Malone Janet | $205,000 | Ata National Title | |

| Walczyk Agnes | -- | None Available | |

| Walczyk Agnes | $147,000 | First American Title Insuran | |

| The Judith A Knuth Revocable Trust | $77,500 | Capital Title Insurance Agen |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Malone Janet | $164,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,127 | $103,500 | $0 | $0 |

| 2024 | $2,459 | $99,100 | $0 | $0 |

| 2023 | $2,332 | $93,300 | $0 | $0 |

| 2022 | $2,982 | $81,200 | $0 | $0 |

| 2021 | $2,901 | $78,200 | $0 | $0 |

| 2020 | $1,707 | $74,100 | $0 | $0 |

| 2019 | $2,702 | $66,400 | $0 | $0 |

| 2018 | $1,761 | $63,200 | $0 | $0 |

| 2017 | $1,740 | $58,200 | $15,000 | $43,200 |

| 2016 | $1,729 | $58,200 | $0 | $0 |

| 2015 | -- | $53,200 | $0 | $0 |

| 2014 | -- | $43,900 | $0 | $0 |

| 2011 | -- | $41,800 | $0 | $41,800 |

Source: Public Records

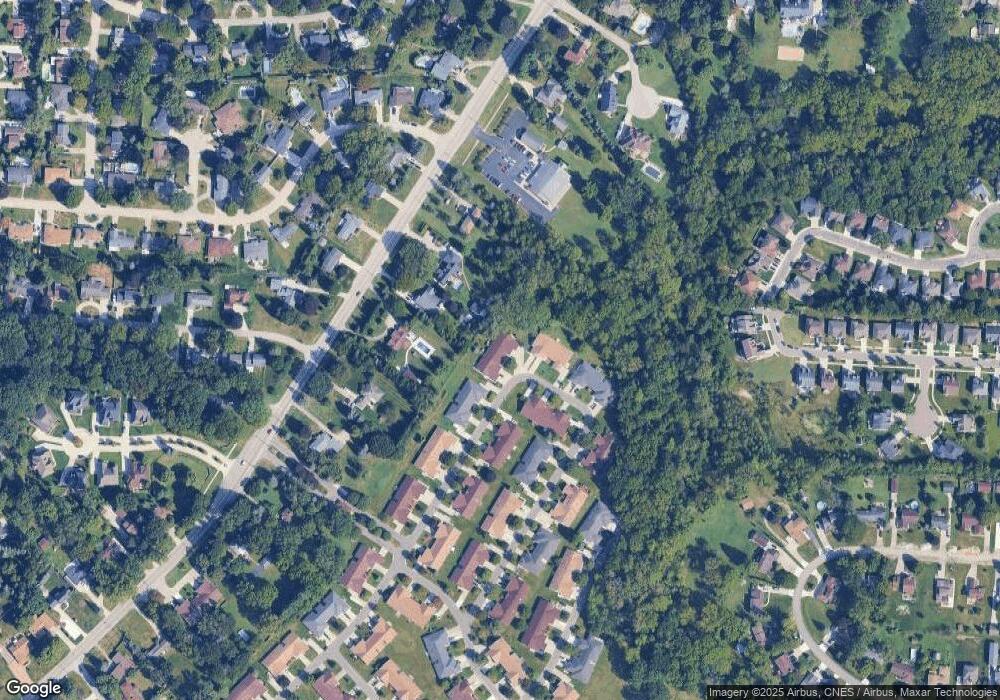

Map

Nearby Homes

- 20455 Palms Dr

- 0 Harrington St Unit 20251011459

- 20902 Oak Ridge Dr Unit 45

- 20706 Gaslight Dr

- 20543 Glenallen Dr

- 20810 Gaslight Dr

- 21130 Parkplace Ln Unit 11

- 20403 Robinway Dr

- 37840 Culver Dr

- 20463 Harmony Dr

- 37743 Rosedale Dr

- 20080 Rhapsody Dr

- 21272 Belleview St

- 40448 Emerald Ln W

- VL Moravian Dr

- 21361 Ulrich St

- 19915 Emerald Ln N

- 37619 Charter Oaks Blvd Unit 222

- 37682 Charter Oaks Blvd

- 37439 Charter Oaks Blvd Unit 114

- 38677 Palm Meadow

- 38677 Palm Meadow Dr Unit 208

- 38683 Palm Meadow Dr Unit 207

- 38689 Palm Meadow Dr Unit 206

- 38695 Palm Meadow Dr Unit 205

- 38677 Palm Meadow Dr Unit 52-208

- 38689 Palm Meadow

- 38766 Moravian Dr

- 20335 Palms Dr

- 20375 Palms Dr

- 20395 Palms Dr

- 38788 Moravian Dr

- 38659 Palm Meadow

- 38653 Palm Meadow Dr

- 38659 Palm Meadow Dr

- 38665 Palm Meadow Dr

- 38671 Palm Meadow Dr

- 38653 Palm Meadow Dr Unit 212

- 38659 Palm Meadow Dr Unit 53-211

- 38653 Palm Meadow Dr Unit 53-212