3876 Cherrybridge Ln Unit 293 Dublin, OH 43016

Shannon Heights NeighborhoodEstimated Value: $265,000 - $288,000

2

Beds

2

Baths

1,344

Sq Ft

$206/Sq Ft

Est. Value

About This Home

This home is located at 3876 Cherrybridge Ln Unit 293, Dublin, OH 43016 and is currently estimated at $277,115, approximately $206 per square foot. 3876 Cherrybridge Ln Unit 293 is a home located in Franklin County with nearby schools including Thomas Elementary School, John Sells Middle School, and Dublin Coffman High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 23, 2023

Sold by

Sheets Lois J

Bought by

Sahin Ali and Sahin Hanife

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$239,590

Outstanding Balance

$233,638

Interest Rate

6.79%

Mortgage Type

Credit Line Revolving

Estimated Equity

$43,477

Purchase Details

Closed on

Oct 11, 2000

Sold by

Heinlen Adam H and Zak Christina

Bought by

Sheets Rose Lois J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,000

Interest Rate

7.9%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 30, 1996

Sold by

Macklin Sara E

Bought by

Heinlen Adam H and Zak Christina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,500

Interest Rate

6.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 19, 1994

Purchase Details

Closed on

Nov 27, 1991

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sahin Ali | $252,000 | Northwest Select Title | |

| Sheets Rose Lois J | $116,500 | Chicago Title | |

| Heinlen Adam H | $93,600 | -- | |

| -- | $87,800 | -- | |

| -- | $87,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sahin Ali | $239,590 | |

| Previous Owner | Sheets Rose Lois J | $93,000 | |

| Previous Owner | Heinlen Adam H | $79,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,537 | $75,010 | $15,400 | $59,610 |

| 2023 | $3,776 | $72,490 | $15,400 | $57,090 |

| 2022 | $3,216 | $58,870 | $10,710 | $48,160 |

| 2021 | $3,268 | $58,870 | $10,710 | $48,160 |

| 2020 | $3,248 | $58,870 | $10,710 | $48,160 |

| 2019 | $2,809 | $47,120 | $8,580 | $38,540 |

| 2018 | $2,499 | $47,120 | $8,580 | $38,540 |

| 2017 | $2,379 | $47,120 | $8,580 | $38,540 |

| 2016 | $2,164 | $38,820 | $7,810 | $31,010 |

| 2015 | $2,177 | $38,820 | $7,810 | $31,010 |

| 2014 | $2,179 | $38,820 | $7,810 | $31,010 |

| 2013 | $1,265 | $43,120 | $8,680 | $34,440 |

Source: Public Records

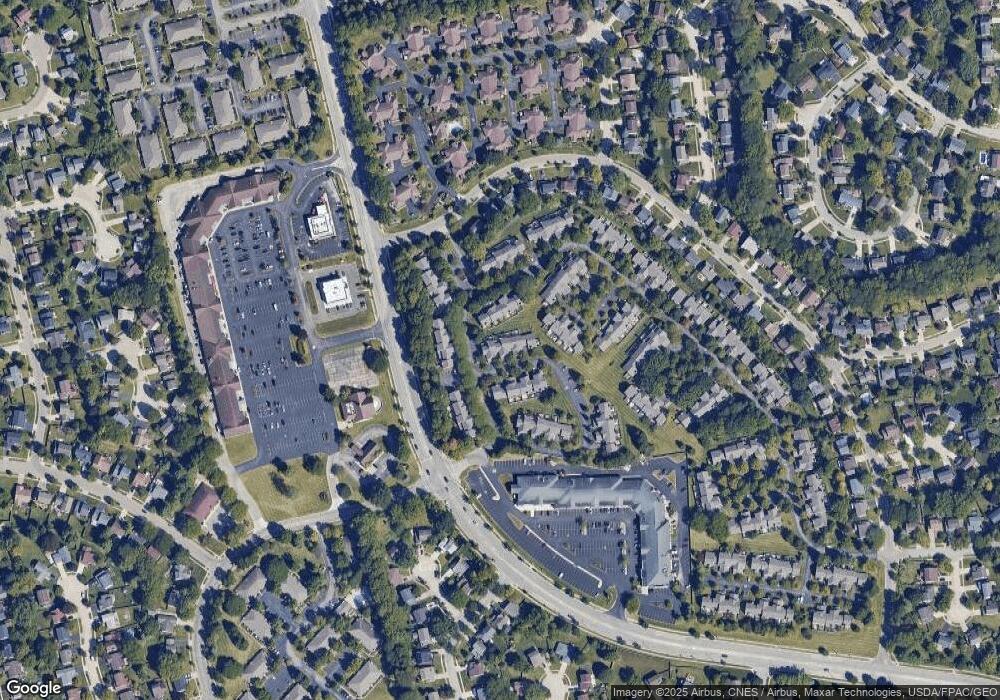

Map

Nearby Homes

- 3873 Oakbridge Ln Unit 262

- 3741 Baybridge Ln

- 4044 Dumfries Ct

- 5500 Saddlebrook Dr

- 5506 Shannon Heights Blvd

- 5500 Shannon Heights Blvd

- 3660 Rivervail Dr

- 5850 Chatterfield Dr

- 4222 Bradhurst Dr Unit 15

- 5735 Newbank Cir Unit 303

- 5753 Newgate Rd Unit 5753

- 3761 Carnforth Dr

- 3158 Kingsmead Trace Unit 3158

- 5622 Riverside Dr

- 5830 Settlers Place

- 6241 Buck Ridge Rd

- 6040 Thatcher Dr

- 3263 Scioto Ridge Rd

- 3873 Tweedsmuir Dr

- 3552 Mountshannon Rd

- 3874 Cherrybridge Ln

- 3874 Cherrybridge Ln Unit 29-4

- 3878 Cherrybridge Ln Unit 292

- 3878 Cherrybridge Ln Unit 2

- 3872 Cherrybridge Ln

- 3872 Cherrybridge Ln Unit 29-5

- 3880 Cherrybridge Ln

- 3880 Cherrybridge Ln Unit 29-1

- 3870 Cherrybridge Ln Unit 296

- 3868 Cherrybridge Ln

- 3875 Cherrybridge Ln Unit 306

- 3875 Cherrybridge Ln Unit 6

- 3873 Cherrybridge Ln Unit 305

- 3881 Oakbridge Ln

- 3871 Cherrybridge Ln

- 3879 Oakbridge Ln

- 3879 Oakbridge Ln Unit 26-5

- 3877 Cherrybridge Ln Unit 307

- 3869 Cherrybridge Ln Unit 303

- 3877 Oakbridge Ln